Economic Insights

Investor Memo Q4 2025: Fiscal Deficits, Corporate Profits, AI and the Future of Equity Returns

Download PDF Key Points S&P 500 returns (954.5%) following the 2008 Global Financial Crisis far exceeded expectations; driven by…

Investor Memo Q3 2025: Melt-up, Valuation and AI

The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which we have characterized as a…

Investor Memo Q2 2025: From Panic to Peak: Market Turmoil, Recovery

From Liberation Day Chaos to Cautious Recovery The second quarter of 2025 started with the April 2nd “Liberation Day” tariff…

Investor Memo Q1 2025: Trump Chaos or Valuation Coming Home to Roost?

Stock Price Performance in Review We postponed publication of our quarterly memo awaiting the statement from President Trump on tariffs…

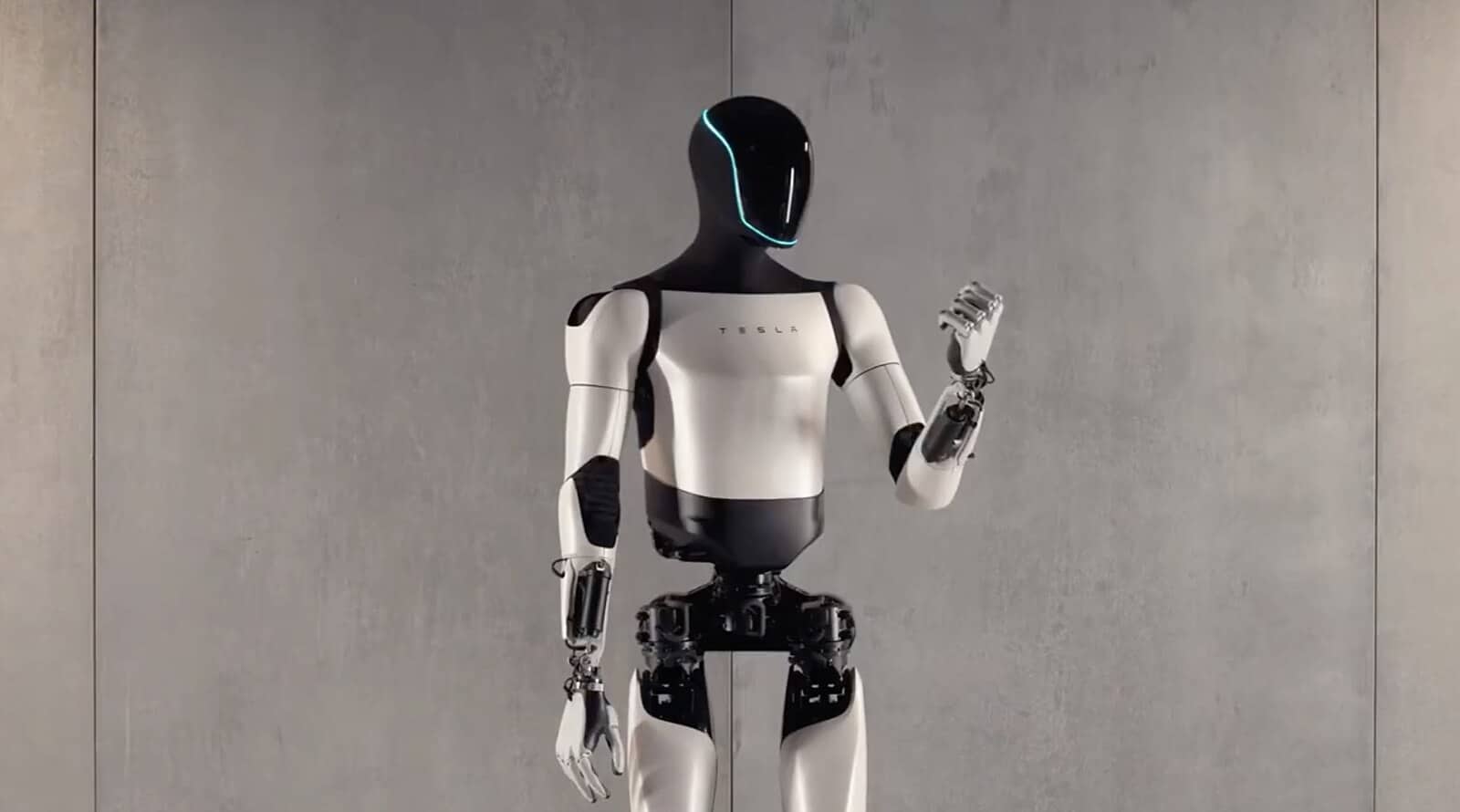

#65 Reflections on Investing: Tesla’s Fountain of Youth Revisited

The P/E for automobile manufacturers is normally very low. Ford, GM and Toyota currently trade at 7 times earnings. Tesla’s…

The EV Shakeout

By Rob Arnott, Bradford Cornell, Forrest Henslee, Thomas Verghese March 2025 Key Points Big market delusions (BMD) develop when investors anticipate that most…

#64 Reflections on Investing: Risk

Today, we’re going to talk about one of the most basic concepts of investing—risk. There’s overwhelming evidence that when it…

Investor Memo Q4 2024: Valuation, Momentum, and the Risk of a Market Correction

Stock Price Performance in ReviewThe year 2023 ended on a high note. During the year, the S&P 500 Index rose…

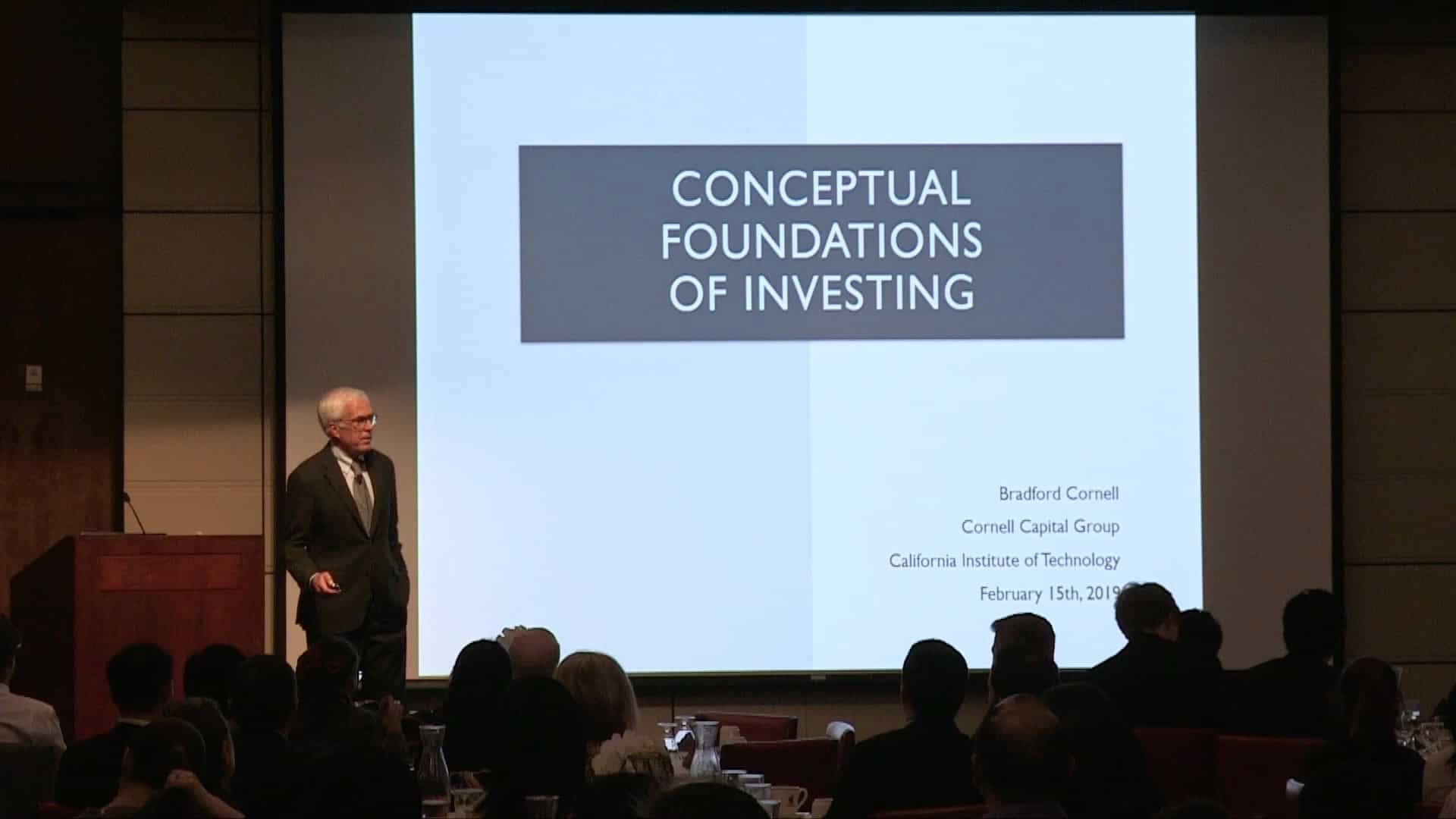

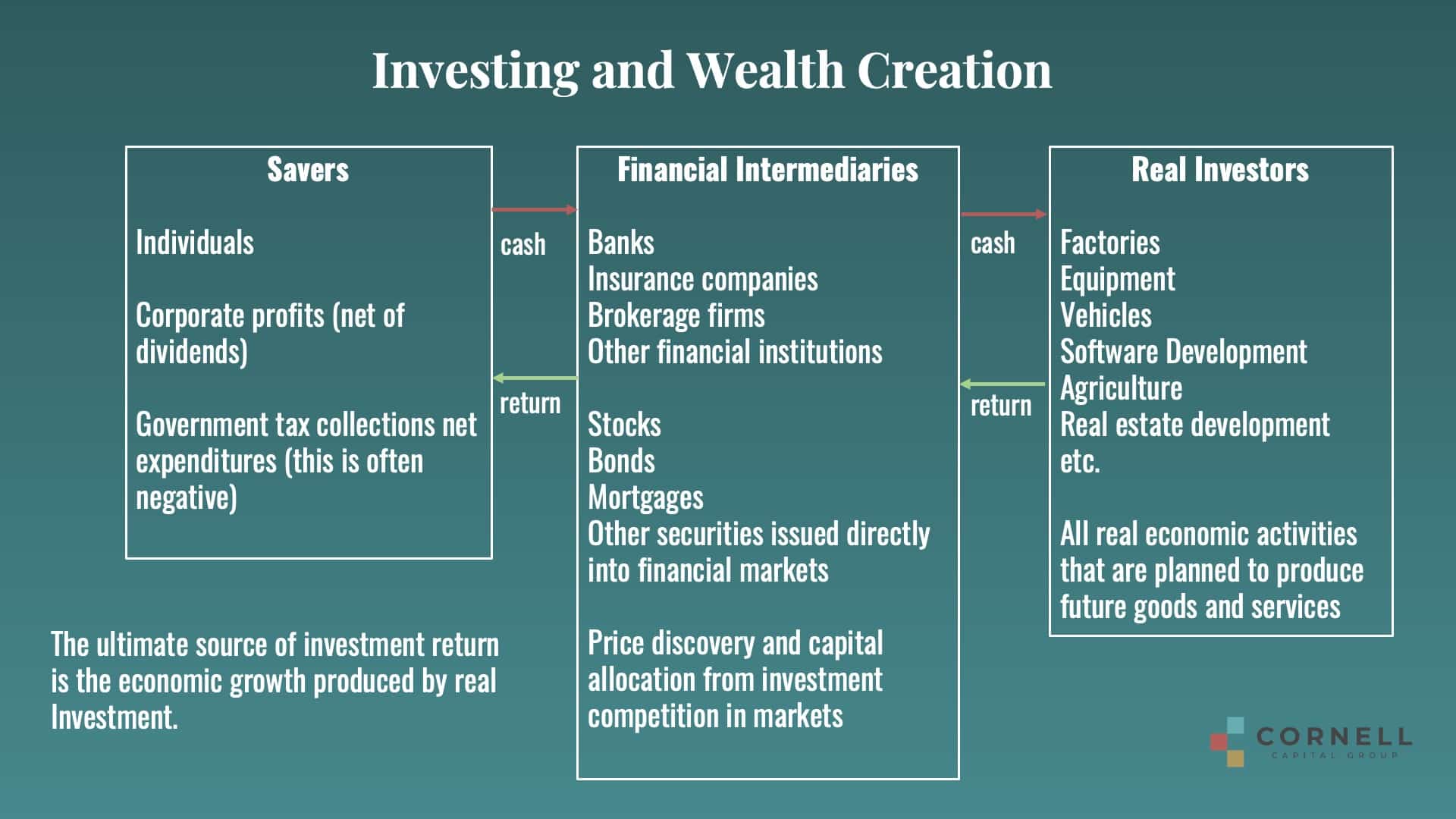

#63 Reflections on Investing : Are Investors Creating Wealth or Transferring It?

The ultimate source of wealth from financial investments comes from the transfer of funds to entities that invest in the…

The Implied Equity Risk Premium and Stock Market Bubbles

The implied equity risk premium (IERP) and theories of stock market bubbles both offer explanations for the current elevated level…

#62 Reflections on Investing : Government Debt and Investing

As Herb Stein “if something cannot go on forever, it will stop”. The current growth of government debt is unsustainable…