The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which…

Investor Memo Q3 2020

Welcome to the first of an ongoing series of Cornell Capital Group quarterly investor memos. The purpose of these memos is both to reflect on the current financial market environment and to explain our future outlook. With the impact of COVID-19 on the markets, the past few months have been a roller-coaster. We start by estimating the fair value of the S&P 500 to assess where we stand today, September 30, 2020.

Valuing the S&P 500 Pre and Post Virus

Towards the end of March, as the virus was intensifying and markets were collapsing, we created a simple valuation model for the S&P 500 to calculate the impact of the virus. In order to remove some of the fear and emotion, we conducted a long-term analysis of the virus’s impact that relied on the answers to two basic questions. The questions were 1) How much will corporate earnings drop in the calendar year ended 2020? and 2) What fraction of 2025 the projected pre-virus corporate earnings could be expected given the impact of the virus? Using the assumptions that 1) earnings would drop 40% in the first year and 2) recover to 80% of pre-virus levels by 2025, we estimated the implied level of the S&P 500 to be 2,591, which was close to the level of the index on March 27th. Using more optimistic assumptions, for example, a 1) 15% drop in earnings growth the first year and 2) recovering by 95% in year five, the intrinsic value jumps up to 3,124. (We encourage readers to download the spreadsheet model here and enter in their own assumptions)

In contrast, at the close of the third quarter the index was 3,384, and nearly touched 3,600 during the quarter, well above the 3,124 intrinsic value estimated using optimistic assumptions. What could explain this difference and the high levels of the market? One answer lies in the rate used to discount future cash flows. More on that later, but using the optimistic assumptions, and reducing the model’s discount rate of 6.70% by only 0.30% to 6.40%, we get an intrinsic value that nearly matches the current level of the index. If we drop the discount rate to 5%, the intrinsic value of the index rockets up to 4,941. Cleary, the discount rate used is of great importance.

Quarantine and Anti-Quarantine Indexes

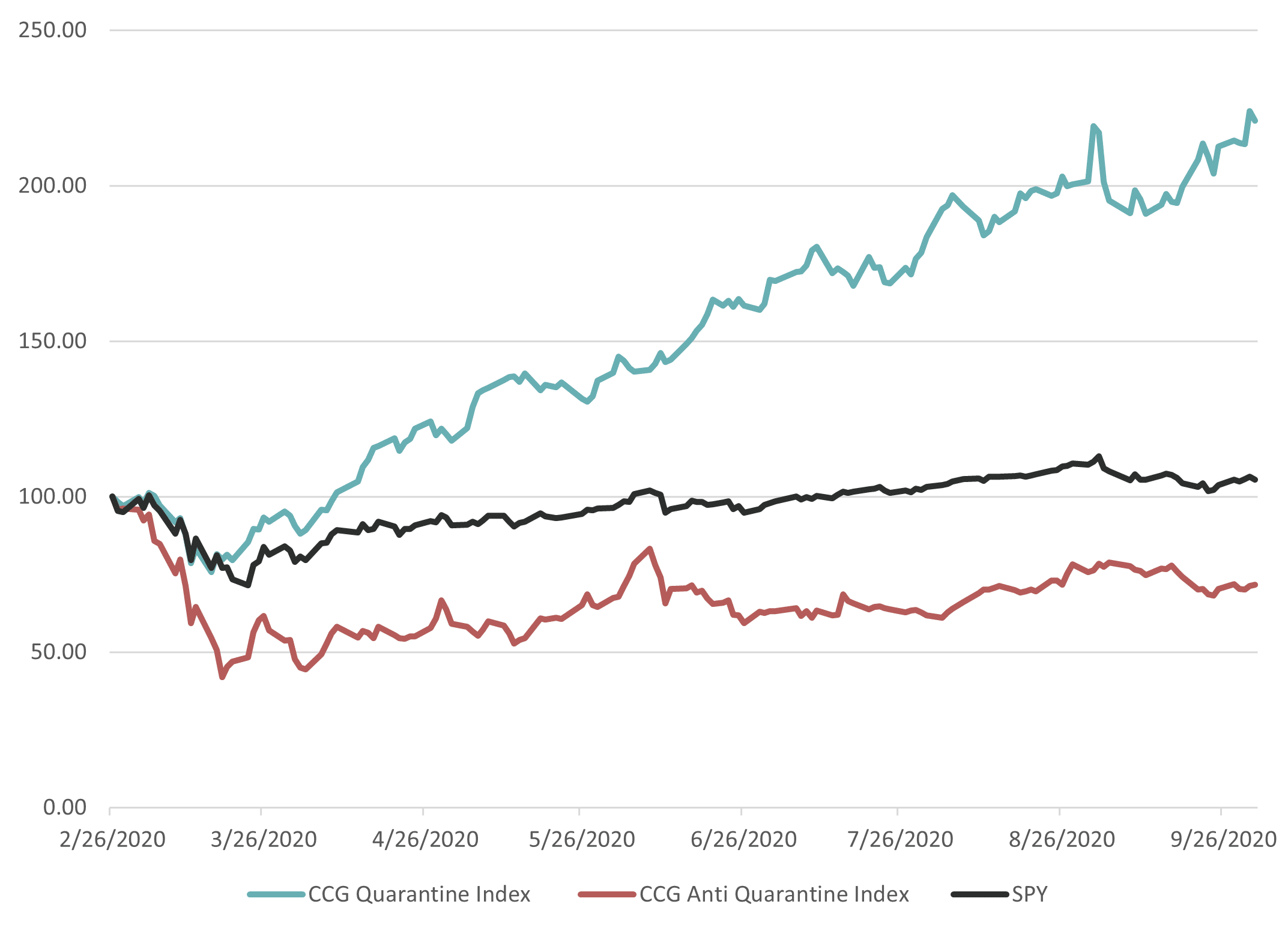

As the impact of the virus began to unfold, we developed two new performance benchmarks, the CCG Quarantine and the CCG Anti-Quarantine indexes. Both are shown in the graph below along with the S&P 500 Index. The Quarantine Index includes stocks like Amazon, Zoom, and Peloton, whereas stocks like airlines, restaurant chains and hotels are included in the Anti-Quarantine index. As the graph below shows, the divergence between the two indexes is striking. The Quarantine Index has more than doubled since late February while the Anti-Quarantine Index is down almost 40%. This is not all that surprising given the impact of the virus. However, the spread cannot widen forever. At some point, the market will have fully priced the advantages of the Quarantine Index companies and the headwinds faced by the Anti-Quarantine firms. At CCG, we think we are near that point and are taking account of it in our investment decision making.

Low Interest Rates and associated Low Discount Rates

To combat the economic effects of COVID-19, the Fed has taken unprecedented actions in the form of stimulus and its injection of liquidity. The Fed actions have produced record low interest rates. These low interest rates lead to low rates for discounting future cash flows and, thereby, are a boon for stocks. The effect tends to be particularly pronounced for growth stocks with large projected earnings in the distant future. However, with rates on government securities currently near zero, we think monetary policy is unlikely to provide another boost for stock prices going forward.

Inflation

Looking forward we think inflation could have a significant impact on stock as well as bond prices. Although the Fed has stated its desire to keep rates low even in the face of rising inflation, we are concerned that in the long run the current stimulus programs could produce an acceleration of inflation. Given the low yields on high-grade bonds, we are currently eschewing fixed income securities other than cash working balances. But inflation can affect stocks as well. By increasing nominal interest rates, inflation tends to push up the rate at which equity cash flows are discounted faster than companies can increase those cash flows by raising prices. The result is falling stock prices, particularly of those companies that are sensitive to the discount rate. This is something we will be watching closely in the quarter ahead.

Value vs Growth

The last six months have seen a second divergence related to that between the Quarantine and Anti-Quarantine Indexes. The recovery of the market from March lows has been driven by tech stocks, particularly large capitalization tech stocks such as Apple, Amazon, Tesla, Nvidia, Google and Facebook. To some this suggests that these are the stocks in which to invest because they are the winners. This thinking emulates much of life. A runner who is faster than the competition today is likely to be faster than the competition tomorrow. But there is another, we believe more compelling, way of looking at things. According to this interpretation, the stocks that have been past winners have become more expensive. Buying expensive stocks implies lower, not higher, future returns. As the quarter closes, virtually all the sexy tech companies are trading near all-time highs whereas value stocks such as Bank of America, Exxon, and Ford have remained depressed. The valuations of growth versus value stocks has never been further apart. Given these prices, to the extent we hold unhedged long positions, we tend to favor value stocks, where we define “value” using our proprietary discounted cash flow analysis rather than solely relying on traditional ratios. We also note that a combination of trader enthusiasm and market volatility has led to high implied volatilities for options on certain growth stocks. We have found that using options to set up hedge positions in these stocks can be quite attractive.

Retail/Option Trading

In our recent webinar with Dr. Jason Hsu, Jason shared some interesting statistics on the recent increasing influence of retail traders. Historically in the U,S, retail traders have accounted for around 2%-3% of trading activity compared to 85% in China. Recently, U.S. individual trading, particularly in options has jumped. It is now estimated to be close to 20% overall and even higher in options and certain high volatility stocks. It may seem as though 20% is too small to move the market, but a new paper by Xavier Gabaix and Ralph Koijen suggests otherwise. Because large institutional investors tend to reallocate their portfolios slowly, individual investors who jump into and out of stocks can have an effect out of proportion to their numbers. This is one possible explanation for why stocks they have favored such as Zoom, Wayfair, Peloton, and Tesla are up year to date 610%, 252%, 270% and 396%, respectively. But beware, those stocks have become expensive and sentiment is a two-way street. At Cornell Capital Group we are unwilling to take unhedged positions in any of these companies.

Future Outlook/What to Do

The combination of low yields on fixed income securities, sky high prices for successful technology companies, uncertain futures for traditional value companies, and political volatility, make these particularly trying times for investors. As James Mackintosh of the Wall Street Journal said in his article of October 5, 2020, “the rest of us should plan for a more volatile portfolio and lower expected returns in the future than in the past.” Although at CCG we share his concerns, we believe we have developed a strategy for coping based on four key drivers.

- A careful selection of value stocks based on thorough discounted cash flow valuation analysis.

- Using options to hedge positions, particularly for growth stocks and indexes with a large technology exposure. (The S&P 500 is now in that category).

- Employing an optimally designed diversification strategy that takes account of relative valuations.

- Careful consideration of international opportunities.