The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which…

Investor Memo Q4 2020

Expectations and Investment Returns

To provide perspective on investing in 2021, at Cornell Capital Group we start with a fundamental concept from finance theory. The theory states that if a company performs according to the cash flow expectations reflected in the current market price of the stock investors will earn a “normal” or “fair” rate of return. Our senior adviser, Professor Cornell, and his colleague, Professor Aswath Damodaran, currently estimate that normal rate of return to be approximately 5.5% for a typical stock. If the company subsequently does better than expected the investor earns a return greater than 5.5%. If the company fails to live up to expectations the return will be less than 5.5%. The key thing to recognize is not how well the company does in some absolute sense, but how well it does compared to the expectations on which the current market price is based. And that in our view is the rub.

To illustrate the issue, we quote at length from a recent Overheard column in the Wall Street Journal. “Peloton Interactive is now worth more than 100 times what it agreed to pay for fitness-equipment manufacturer Precor earlier this week. Earlier this month Airbnb finished it first day as a public company worth more than the combined market value of Marriott International, Hilton Worldwide Holdings, and Hyatt Hotels. The current market suggests that before long, streets will be jammed with Teslas delivering DoorDash meals. . . Investors might want to pause this holiday to rethink the fantastical future they are already pricing in.”

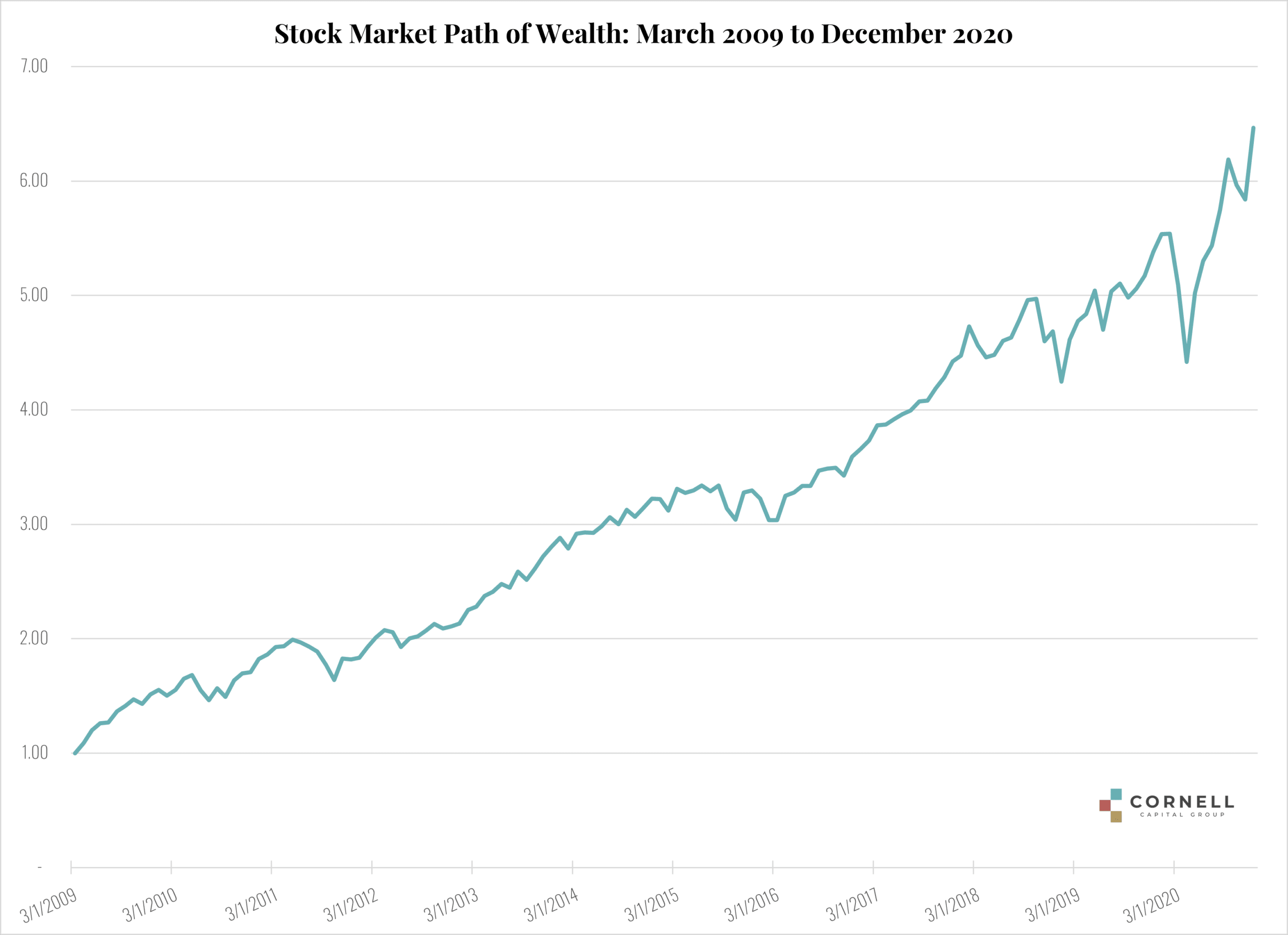

Although focused on high profile tech companies like Tesla, Airbnb and DoorDash, the market’s optimism is by no means limited to such firms. The entire market has been on a relentless tear since the end of the financial crisis in March 2009. As shown on the graph below between March 2009 and the end of December 2020, the total return on the U.S. stock market was approximately 675% or an annual compound growth rate of about 17.39% per year. The enthusiasm of investors is reflected in what we see as a particularly dangerous indicator. On December 28, 2020, the Wall Street Journal reported that margin borrowing at reached an all-time record. If the market were to start to fall, there could be significant forced sales, particularly of high-flying stocks.

Pricing and Politics

In our view, politics will also be a market threat in 2021. The Biden administration faces a daunting financial challenge. The pandemic and related stimulus has left the government with record levels of debt. Dealing with that debt is likely to mean higher taxes, greater inflation, or both. Neither is a good sign for the stock market. In addition, there are limits to how much liquidity the Fed can inject without eventually stoking inflation. Although the debt will need to be dealt with at some point, the big question is when. In 2020, Fed policy was highly beneficial for the stock market. 2021 may not be so kind.

Interest rates and Inflation

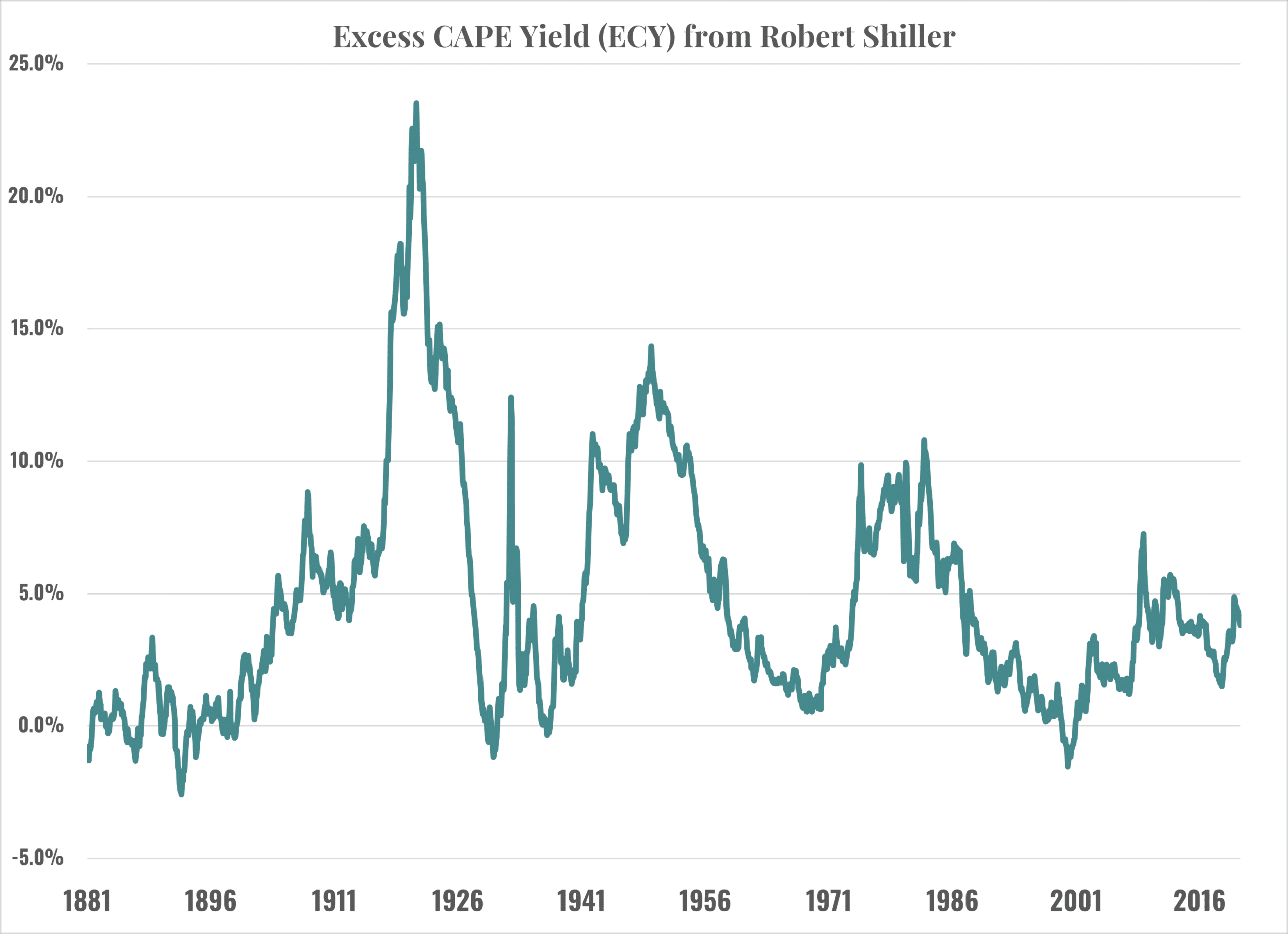

The strongest support for the market comes from the level of interest rates. With the yield on ten-year Treasury bonds stuck below 1%, high-grade fixed income securities do not provide stocks with much competition. The low level of interest rates also implies a low discount rate for future cash flows which pushes up the fundamental values of equities. In support of this viewpoint, Nobel Prize winner Robert Shiller has developed a new excess CAPE yield. He begins with the inverse of the CAPE ratio which is essentially an earnings yield. He then deducts the real interest rate on risk-free bonds. The chart shows that the current excess CAPE yield is about 5%. The excess CAPE yield is buoyed by current negative real interest rates. At 5%, the CAPE excess yield is slightly above the post-war average, and well above level seen during the dot.com bubble. For these reasons, Prof. Shiller concludes that stock prices are high, but they are not overly frothy.

But there is a dark side to the current low interest rates as well. It is hard to see rates going much lower from here. Consequently, falling rates will no longer be a force driving stock prices higher. Although the Fed has stated a desire to keep rates low, if inflation were to rise things could change for two reasons. First, inflation directly puts upward pressure on nominal interest rates. Second, rising inflation could cause the Fed to reverse course and abandon the effort to keep rates constant. In either case, as noted above, stock prices would likely drop.

Virus, Vaccines, and Value

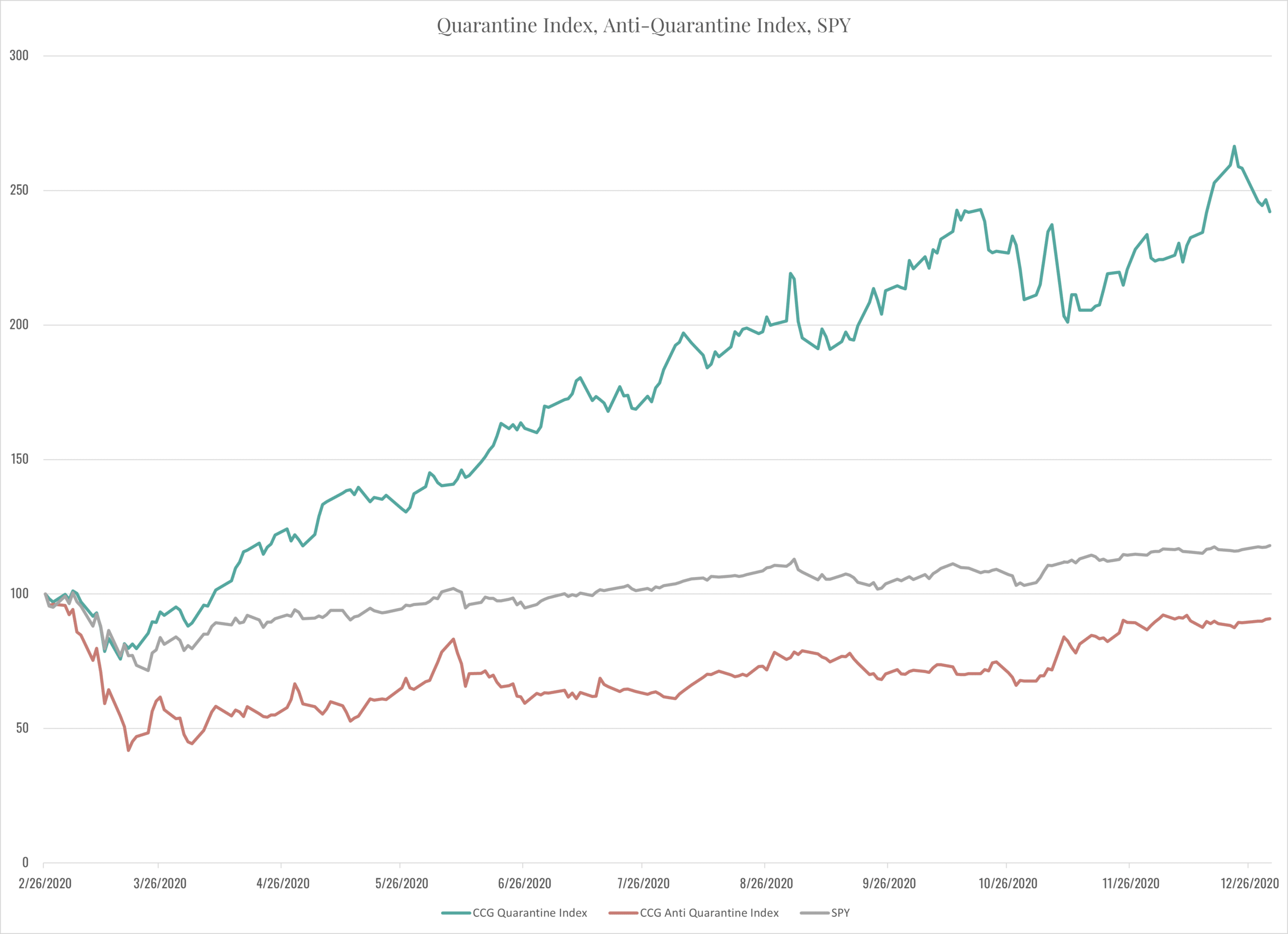

At Cornell Capital Group, in 2020 we developed two indexes to help track the impact of the pandemic on stock prices: the CCG Quarantine Index and the CCG Anti-Quarantine Index both of which are plotted below. Since the pandemic hit in late February 2020, there as been a dramatic divergence between the indexes. As the chart shows, the Quarantine Index was up over 158% through the end of 2020, whereas the Anti-Quarantine Index actually dropped 11%. It is difficult for us to imagine that the rubber band could be stretched much further, particularly with vaccines now being distributed. We think that traditional value stocks in the Anti-Quarantine Index are likely to outperform the tech stocks in the Quarantine Index in 2021. However, that outperformance could well be due to both indexes falling, but with the Anti-Quarantine falling less.

As a follow up to the Quarantine and Anti-Quarantine indexes, we recently developed the “CCG Disruption Index” which tracks the performance of companies allegedly changing the way business is done in various industries. Examples include Tesla, NextEra, Zoom, Peloton, Roku, Square, and Uber, among others. This index allows us to track the performance of companies which have lofty expectations impounded in their stock prices.

Conclusion and Outlook

To conclude, our view is that 2021 will be “the year of not good enough.” This does not mean we are expecting an economic downturn. What it does mean is that the current expectations built into stock prices will be extraordinarily difficult to fulfill. If companies, particularly high-flying companies like Tesla, fail to live up to expectations the result is likely to be significant declines in stock prices. For this reason, we are taking a two-pronged approach in 2021. To the extent we hold unhedged long positions we will focus on value stocks. However, we do not rely solely on traditional metrics such as Price/Book or Price/Earnings to define a “value” stock. Instead, we define “a value stock” in its most fundamental form, a security that is trading below our estimate of the present value of the future cash flows it will provide. In this context, we have developed our own discounted cash flow valuation model and spend a great deal of time and effort estimating future cash flows to put into the model. Finally, with regard to both growth stocks and popular tech stocks, we will use options to provide hedges and to take advantage of opportunities to harvest attractive premiums.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.