Download PDF Key Points S&P 500 returns (954.5%) following the 2008 Global Financial Crisis…

Investor Memo Q1 2021

Is it still the year of not good enough?

We concluded our year-end 2020 investor memo by saying that 2021 will be “the year of not good enough.” This does not mean we are expecting an economic downturn. What it does mean is that the current expectations built into stock prices will be extraordinarily difficult to fulfill. If companies, particularly high-flying companies like Tesla, fail to live up to expectations the result is likely to be significant declines in stock prices.

Now that the first quarter is history, we still feel the same way. To begin, our belief that many high-flying companies would fail to live up to expectations leading to falling stock prices has largely been realized. On March 29, 2021, the Wall Street Journal ran a story reporting on the turbulence hit by highflyers and noted that relative to 2020 highs, Tesla was down 32%, Plug Power 55%, Peloton 38%, Shopify 30%, and Square 25%.

We also suggested that value stocks were likely to outperform growth. That too has come to pass. During the first quarter, the Russell 1000 Value Index rose over 10%, whereas the Russell 1000 Growth Index fell slightly. However, the strength of the overall market surprised us. The table below shows that during the first quarter the Dow rose 7.76% and the S&P 500 rose 5.77%. The more heavily tech weighted NASDAQ index rose only 2.78%. Given the level of stock prices at the start of the year that is an impressive performance. One we think the market will be hard pressed to repeat in the second quarter.

|

Dow Jones Index |

S&P 500 Index |

NASDAQ Index |

|

|

Year end 2020 |

30,606.48 |

3,756.07 |

12,888.28 |

|

First quarter end 2021 |

32,981.55 |

3,972.89 |

13,246.87 |

|

Percent change |

7.76% |

5.77% |

2.78% |

Interest rates and inflation

Another theme of our year-end memo was that investors should pay close attention to interest rates and inflation. We noted that there is a dark side to the current low interest rates. Given a 10-year Treasury rate of about 1% at year end, we said that it was hard to see rates going much lower. Consequently, falling rates would no longer be a force driving stock prices higher. That turned out to be correct. Rates did rise to about 1.75%, but the stock market shook off the increase and rose anyway.

We also worried about inflation fears pushing interest rates higher. We are now more concerned about that than ever. We agree with Larry Summers, the ex-Treasury Secretary and Harvard University President, who stated that current macroeconomic policy is the least responsible it has been in 40 years. Summers believes that the combination of massive stimulus, big deficits, and exceptionally easy monetary policy are likely to ignite inflation.

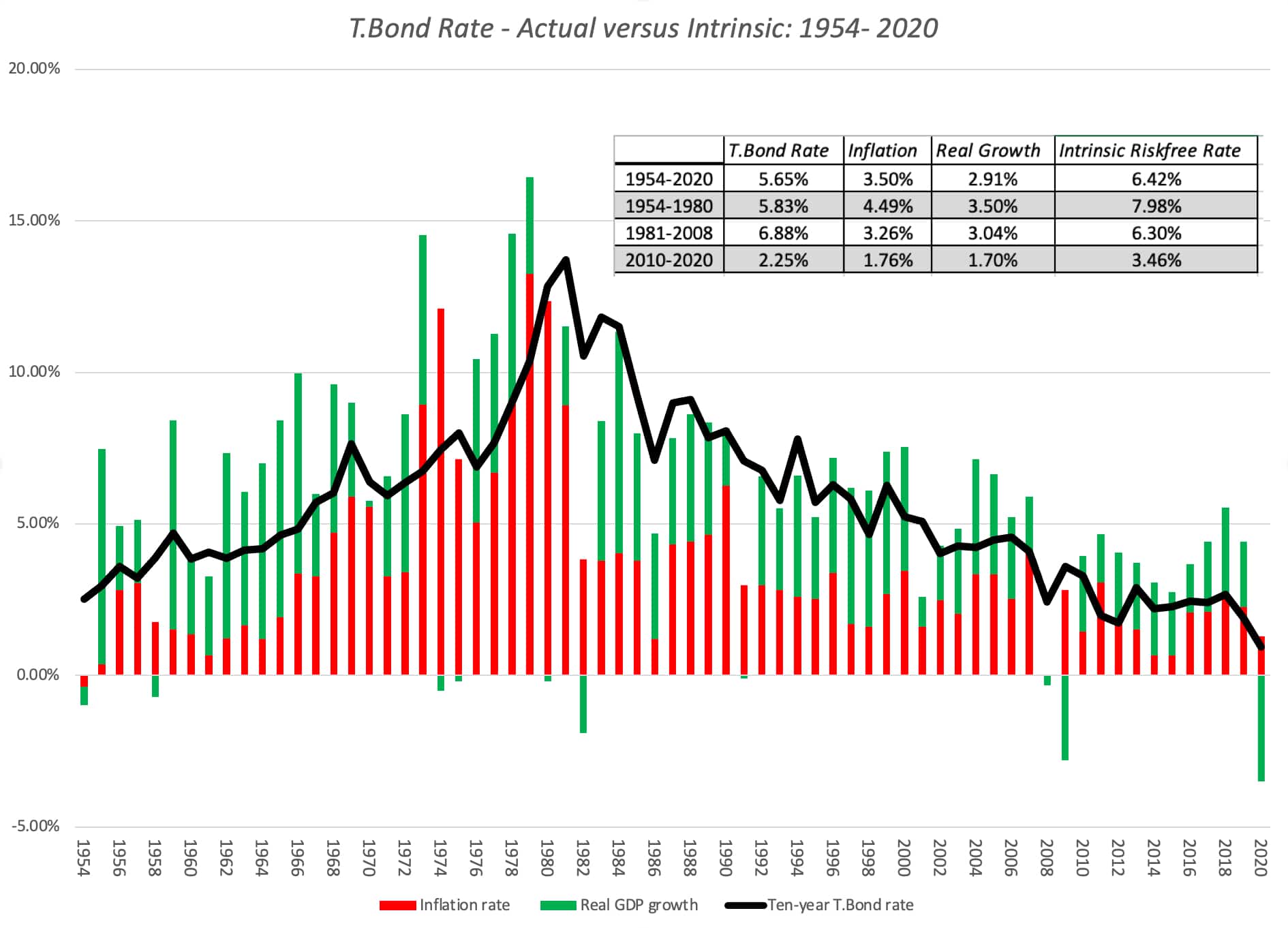

Many commentators seem to believe that if the 10-year Treasury rate starts to rise, the Fed can come racing to the rescue and push the rate back down. We agree with our colleague, Aswath Damodaran, that the financial media significantly exaggerates the ability of the Fed to affect long-terms rates by any means other than controlling inflation. The chart below, taken from Prof. Damodaran’s website, compares what he calls the intrinsic 10-year Treasury rate, the sum of real growth and inflation, to the observed 10-year rate. Notice that over the long-run the two track quite well indicating that the two primary determinants of the 10-year Treasury rate are real growth and inflation.

The two determinants have markedly different implications for stock prices. Although accelerating real growth produces higher interest rates, and thereby higher discount rates, the downward pressure is likely to be more than offset by the benefits of greater real growth on both revenues and margins. If rising rates are primarily due to inflation, the effects are far more likely to be negative. Consequently, investors need to pay close attention not only to the 10-year rate itself, but also the reason for its variation.

The CCG Indexes in Q1

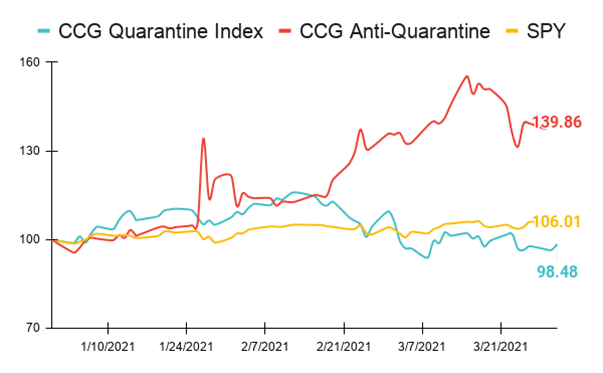

Last year we created several new indexes. The first was the CCG Quarantine Index, which consists of companies we felt would benefit most of Covid restrictions. Then was the CCG Anti-Quarantine Index consisting of companies that we believed would benefit from a reopening of the economy. It is no surprise the Quarantine Index greatly outperformed the Anti-Quarantine index in 2020. The first quarter 2021 however has been a much different story. Whereas the Quarantine index was largely flat, the Anti-Quarantine Index jumped by almost 40%. The market was clearly anticipating a reopening of the economy during the first quarter.

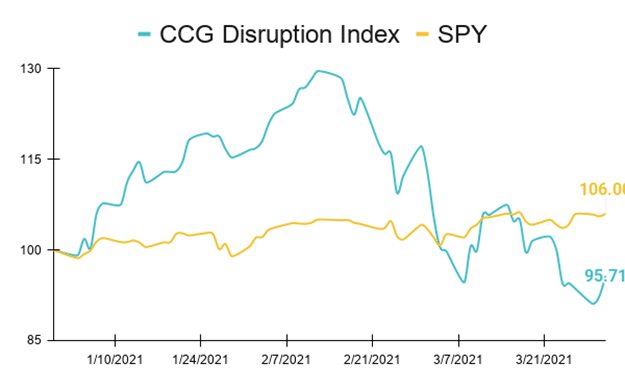

Our newest index the CCG Disruption Index which is composed of companies widely characterized as “disrupters.” The Disruption Index much like the Quarantine Index has had an eventful and volatile start to the year. After being up as much as 30% in February, it dropped sharply to end the quarter down despite a rise in the overall market as measured by the S&P 500. In our view, the subsequent poor performance can be attributed largely to the sky-high prices being paid for the stock of the disrupters early in the year. Even after the drop, the valuations of many disrupters still look frothy to us, due in part to what we call the big market delusion.

Q1 Research: Big Market Delusion – EVs

In Q1 Cornell-Capital completed a research paper, Big Market Delusion – EVs, in conjunction with Research Affiliates. The paper was widely covered by media worldwide. It made a simple point. A change in the light vehicle manufacturing market from gas to electric propulsion will not change the competitive, capital intensive nature of the business. Like any competitive business, margins will be compressed and there will be many losers and some big winners. As the paper went to press, all EV makers were priced as if they would be winners. The paper concludes that investors should be aware that such an outcome does not make sense. The sum of the parts cannot be worth more than the whole.

Conclusion and Outlook

We concluded our annual letter by saying to the extent we hold unhedged long positions we will focus on value stocks. However, we do not rely solely on traditional metrics such as Price/Book or Price/Earnings to define a “value” stock. Instead, we define “a value stock” in its most fundamental form, a security that is trading below our estimate of the present value of the future cash flows it will provide. Regarding growth stocks and popular tech stocks, we will use options to provide hedges and to take advantage of opportunities to harvest attractive premiums. All in all, the markets have behaved in much the way we expected during the first quarter. In addition, other than rising concerns about inflation, we see conditions as largely unchanged. Consequently, we plan to stick with our strategy in the second quarter.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.