Download PDF Key Points S&P 500 returns (954.5%) following the 2008 Global Financial Crisis…

Investor Memo Q2 2021

The Rise of the Unprofitables and Market Hyperopia?

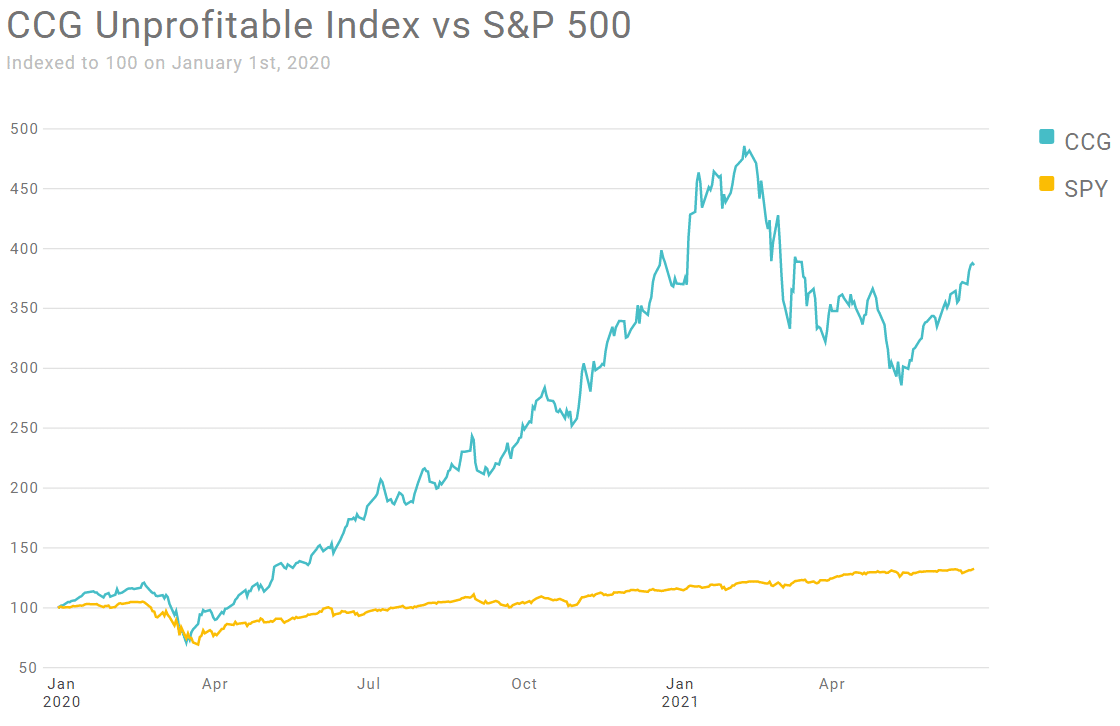

Once upon a time there was great concern about “market myopia” – the tendency of investors to be strongly focused on the short term at the expense of long-term benefits. Along with many CEOs, Nobel Prize winners Richard Thaler and Daniel Kahneman warned that such myopia was steering investors away from companies with worthwhile long-term projects but no current earnings. No more – hyperopia is the order of the day. Today investors are salivating for companies with apparent long-term promise even if they have never made a penny. To help our clients appreciate the extent of this phenomenon, Cornell Capital Group has constructed an index of significant unprofitable companies. The index consists of companies that to date have never had positive net GAAP income, have a market capitalization of at least $10 billion, and are actively traded. The graph below plots the performance of the CCG Unprofitable Index along with the S&P 500 from January 1, 2020 to the present. Whereas the market rose 32% during that period, the unprofitables rose an astonishing 298%. The market has been rewarding companies with big dreams much more than companies with current earnings. It brings to mind a clip from Silicon Valley’s Russ Hanneman.

But as Howard Marks sagely observes, markets tend to be fickle when rewarding companies for future opportunities at the expense of current earnings. Marks notes,

Fluctuations in investors’ willingness to ascribe value to possible future developments represents variation on the full-or-empty cycle. Its swings are enormously powerful and mustn’t be underestimated.

Mr. Marks viewpoint resonates with us. We believe our unprofitable index is an ideal tool for measuring market sentiment to which he refers. We suspect that if the market sentiment turns, the unprofitables will be the first to drop and will drop the farthest. For your convenience, the CCG Unprofitable Index is updated daily on our website.

Related to the unprofitable index, during the second quarter our senior adviser, Prof. Cornell, published an article with Rob Arnott and Lillian Wu entitled Big Market Delusion: Electric Vehicles. The article observes that the hallmark of a big market delusion is when all the firms in the evolving industry rise together even though they are often direct competitors. Investors become so enthusiastic that each firm is priced as if it will be a major winner in the evolving big market despite the fact this is a fallacy of composition: the sum of the parts cannot be greater than the whole. In the case of EVs, virtually every company in the space has risen dramatically – another sign of unbridled investor enthusiasm regarding the “future.”

Ever-rising stocks prices, particularly for companies with meager earnings have produced a chorus of warnings from leading investors and hedge fund managers. Jeremy Grantham stated that,

This current event is particularly dangerous because bonds, stocks and real estate are all inflated together. Even commodities have surged. That perfecta and a half has never happened before, anywhere.

In a tweet, Michael Burry went further by saying,

People always ask me what is going on in the markets. It is simple. Greatest Speculative Bubble of All Time in All Things. By two orders of magnitude.

Finally, Ray Dalio tweeted a list of six indicators of a bubble. Reading through his list, all six indicators apply to the current conditions.

In our view, warnings such as those just cited, while perhaps extreme, are worth taking seriously. Prices in relation to underlying cash flows are at virtually unprecedented levels. From this level it is hard to see how prices could rise much further in the next year, but there is a lot of room to fall.

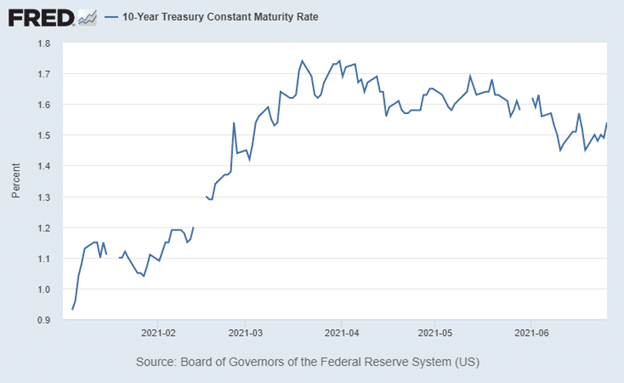

Inflation was in the news during the second quarter for good reason. We agree with Larry Summers that investors should be nervous about inflation. Economic expansion, record government deficits, and accommodative monetary policy all point in the direction of higher inflation. In our view, the best indicator to track regarding the impact of inflation on stock prices is the yield on the ten-year Treasury bond which is plotted below. Eventually rising inflation always leads to higher nominal bond yields. That effect was clear in the first quarter as rates rose significantly along with fears of rising inflation. In the second quarter, however, the increase halted and yields actually fell somewhat. In our view, that is a big reason why stocks, particularly stocks like the unprofitables, had a good quarter. We suspect that from here to the end of the year bond yields will play a central role in determining the fate of stock prices. We recommend watching the ten-year Treasury rate closely.

Putting it altogether, what is an investor to do in the current environment? At Cornell Capital Group, our primary objective is to navigate the current mania while protecting our clients’ wealth. In our estimation many stocks, such as those in the unprofitable index, have become so expensive as to be uninvestable – we will avoid them. We will continue to look for companies that have good businesses and trade at a reasonable prices, but we are aware that the pickings are slim. There is a reason why Warren Buffett is sitting on $150 billion in cash. We will also continue to make active use of options to hedge downside risk and to produce added income.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.