The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which…

Investor Memo Q3 2021

The Challenge Continues

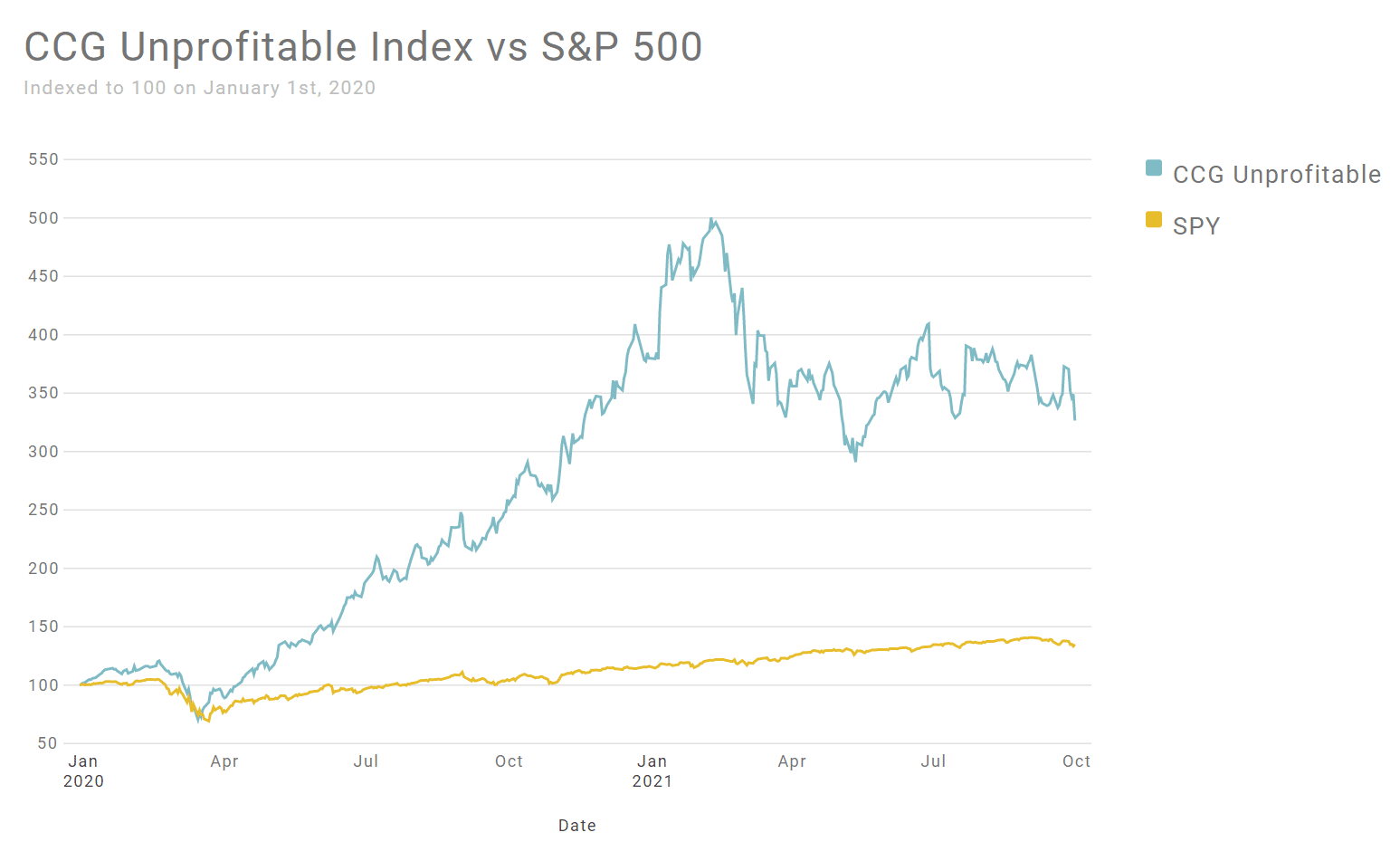

As the third quarter of 2021 draws to a close, investors face the same challenges: record high stock prices relative to any measure of earnings or revenue and record low interest rates. In this environment it is perhaps not surprising that investors have been stretching for returns anywhere they think they can be found. As one prime example, consider the Cornell Capital Group Unprofitable Index which consists of sexy, tech-oriented companies that have basically never earned a penny in their lifetimes. Starting at 100 in January 2020, the index has rocket 250% to date making the 38% rise in the S&P 500 look anemic

The combination of low interest rates and high stock prices has been due, at least in part, to the Federal Reserve continuing to pour base money into the economy via its purchase of government and mortgage-backed securities (See our video on Stock Prices and the Fed). How long this can continue without igniting persistent inflation is an actively debated question and one of great concern to us at CCG. If rising inflation is seen as permanent then interest rates would have to rise and stock prices, particularly those of the sexy tech companies whose anticipated big earnings are far in the future, are likely to fall significantly.

In a provocative article, Ross Hendricks calls the current stock market as The Most Dangerous Market Ever. The two key reasons are leverage and option trading. First, Hendricks notes that that FINRA reported a record $912 billion of debt balances in customers’ security accounts. The incentive for investors to borrow to fund new purchases was catalyzed by the two horsemen of rising stock prices and record low interest rates. Borrowing at rates near zero to invest in stocks expected to rise seemed like a no brainer to many individual investors. And if stock prices were going to rise, call option prices would rise more due to the implicit leverage in option contracts. No surprise then that individual investors began piling into options. From 2019 to 2021 option trading volume doubled. In the third quarter, the Wall Street Journal reported that for the first time option trading volume exceeded that of the stock market.

What makes the market so dangerous is that a significant decline, and we admit to not knowing exactly what significant means, could lead to a snowball effect as momentum traders, leveraged buyers, and option traders all try to get out the door at the same time. In September, there were a couple of sharp drops in the market, but it recovered each time. Could a slightly larger decline set off a wave of forced selling? We think it is a distinct possibility. The challenge for us at Cornell Capital Group is to protect our clients from the risk of such a collapse. Of course, that could be done by simply moving to cash, but that means foregoing any profit opportunity whatsoever. In addition, if the investor has capital gains achieved during the run-up moving to cash would create a tax liability. The trick is to find an appropriate middle ground. In a market characterized by rocket bottom interest rates and sky-high stock prices that is no easy task. That remains our objective.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.