In this video, we explore the history of the CAPE (Shiller PE) ratio, how it’s…

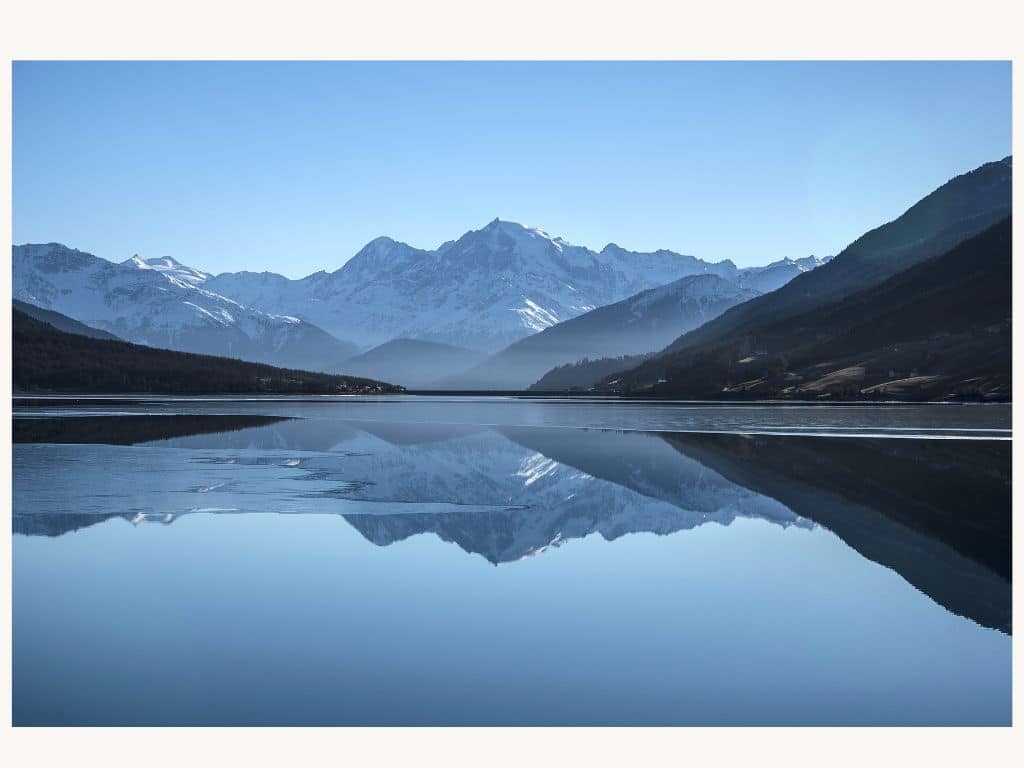

#55 Reflections on Investing : Stock Prices – For Every Buyer There is a Seller

When attempting to explain movements in stock prices the media often overlook the key facts that for every buyer there is a seller and every outstanding share must be held continuously.

As we record this, the S&P 500 has surpassed 5,000, and it leads a lot of people to ask, ‘How could the market be so high? What is the process by which the level of market prices is determined?’ It’s easy to get confused about that, so today, I’ll try to set the record straight. So, let’s go over to the iPad.

Let this circle here represent all the stocks in the S&P 500. Every single one of all 500, every single share, has to be held at all times, and that’s what determines the level of prices. The price must be such that every single outstanding share is held. Well, suppose that someone then wants to buy. Suppose ‘Ms. A’ here decides she wants to buy an S&P 500 stock. So, she’s going to go into the pool as an owner. How does she do that? The only way for her to do that is to convince someone else, let’s say Mr. B here, to come out because every share has to remain held at every second. As a result, Ms. A may have to pay a little bit more to get Mr. B to sell, because Mr. B was willing to hold a minute ago, and now he’s willing to sell to Ms. A, maybe because the stock price is up a few cents. And that’s how the prices move. People who want to move in one direction have to convince someone else to move in the other direction.

And to give you an example of how this is often misunderstood, there’s been a recent academic paper published saying that investors should hold more stock, that they should be 100% invested in stock rather than holding stocks and bonds. Let’s say that people read that paper and they said, ‘Yes, I want to hold more stocks.’ What exactly would happen? Well, there’d be a lot of people like Ms. A then, all wanting to go in. But you can’t ‘go into the market’ unless someone else comes out. So, the only impact of a big surge in interest in investing in the market is going to be a change in price. There can’t be more investment in the market in terms of the number of shares, because those are fixed. There can be more dollars invested in the market, more dollars because prices are higher, but as prices go higher, assuming that corporate profits remain about the same, then future returns have to go down. And that’s why future returns and current prices are negatively correlated.

So, when you start thinking about the market, remember that basic fact that every share has to be held all the time, and if you want to understand movements in prices, you have to take that into account.

Just to close, here at the Cornell Capital Group, for example, we think that prices are high. What do we mean by that? That investors have bid prices up to the level where expected future returns appear to be meager. This has been Reflections on Investing with the Cornell Capital Group. Thanks for joining us.”