From Liberation Day Chaos to Cautious Recovery

The second quarter of 2025 started with the April 2nd "Liberation Day" tariff announcement that sent shockwaves through global financial markets. What began as extreme volatility and panic selling evolved into a remarkable recovery that saw the S&P 500 not only reclaim its losses but push to a record high by quarter-end. However, beneath this surface recovery lie persistent concerns about government fiscal deterioration, slowing corporate earnings growth, and elevated valuations that suggest the market remains vulnerable to future shocks.

Stock Price Performance Through Market Turmoil

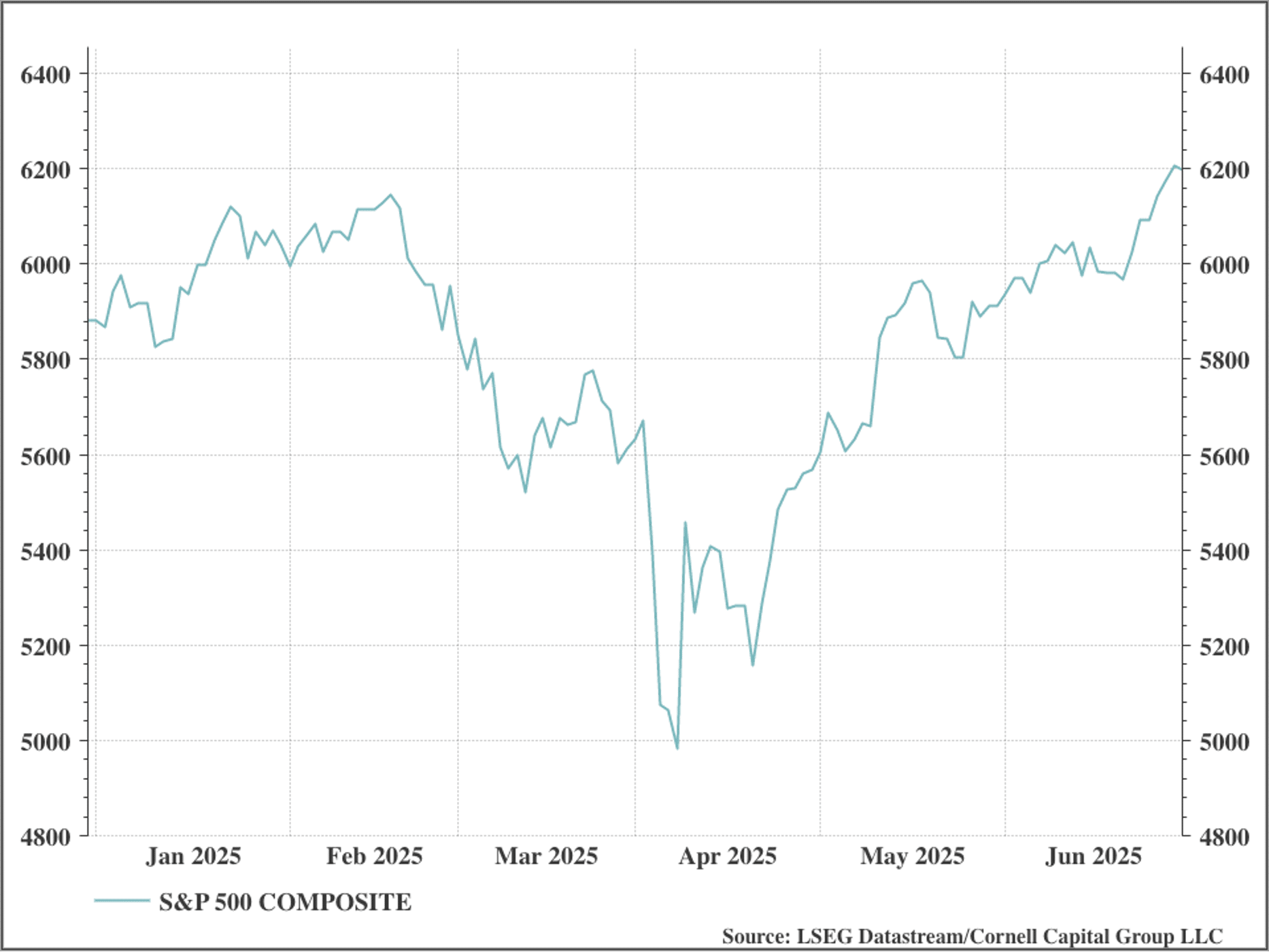

The S&P 500's journey through Q2 2025 resembled a financial roller coaster, beginning the quarter at 5,750 and experiencing one of the most severe corrections in recent memory before mounting an impressive comeback.

The market's initial reaction to President Trump’s “Liberation Day”, implementing a baseline 10% tariff on nearly all US imports and higher rates targeting specific countries, was swift and brutal. On April 3rd and 4th, the S&P 500 experienced its worst two-day decline since 2020, dropping 10.5% as panic selling engulfed global markets. The index reached an intraday low of 4,835 on April 7th, representing a decline of nearly 20% from its February peak and flirting with bear market territory. During this period, the VIX volatility index exploded from around 22 to over 60, reflecting heightened fear and uncertainty among investors.

The turning point came on April 9th when the Trump administration announced a 90-day pause on additional tariff increases, triggering one of the largest single-day rallies in market history. This policy reversal, likely motivated by the severity of the market reaction and warnings from corporate leaders about economic disruption, sparked a powerful recovery that saw the S&P 500 gain over 25% from its April lows. By May 13th, the index had turned positive for the year finishing Q2 at 6,205 for a quarterly gain of 10.6% despite the dramatic mid-quarter volatility. The recovery was further supported by trade negotiations that culminated in a preliminary deal with China announced on June 11th.

Despite this rapid recovery driven by optimism over trade deals, few comprehensive trade deals have materialized. As of now only a limited agreement with the United Kingdom has been finalized, and a preliminary deal with Vietnam was announced just days before the deadline. Talks with other major partners—including the European Union, Japan, and India—are ongoing, but no final agreements have been reached. Furthermore, the 90-day pause is set to expire on July 9th and President Trump has expressed no plans to extend it. With only a handful of agreements in place, major uncertainties remain ahead of the tariff pause expiration.

Valuation Metrics: Still Elevated

While the Liberation Day correction provided some respite from the extreme valuations that characterized early 2025, current market metrics remain well above historical averages and continue to signal potential overvaluation. The Shiller CAPE ratio, which had reached 37.7 at year-end 2024, declined to a low of 32.6 during the April correction before recovering to 36.1 by the end of June. This current level remains substantially above the historical trend line of approximately 25 that we identified in previous analyses.

The forward 12-month P/E ratio for the S&P 500 stands at 21.6, well above both the 5-year average of 19.9 and the 10-year average of 18.4. More concerning is the trailing P/E ratio of 27.99, which represents a significant premium to the long-term historical median of approximately 18. These elevated multiples suggest that despite the April correction, the market has not fully reset to levels that would be consistent with more attractive long-term return prospects.

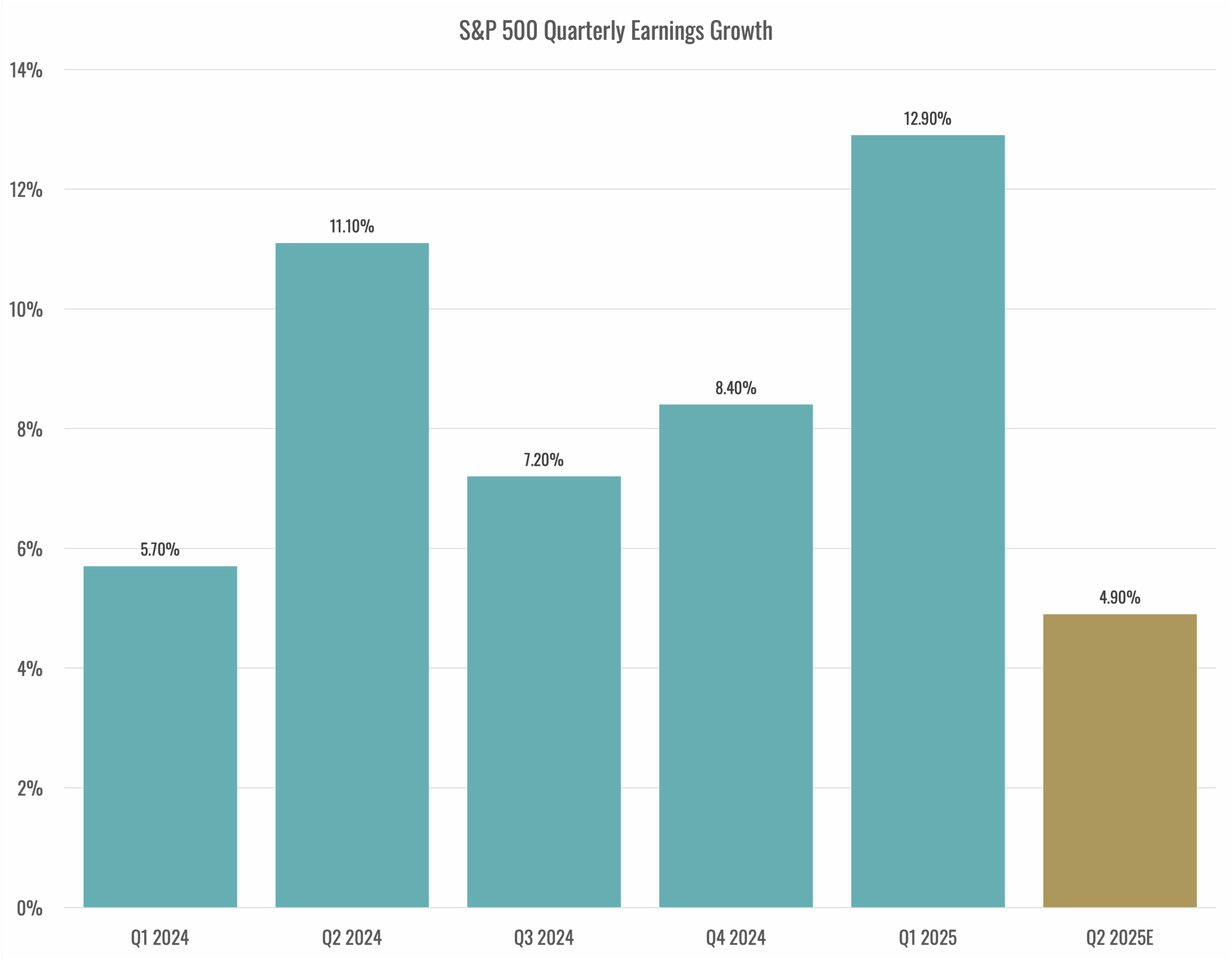

The persistence of high valuations becomes particularly noteworthy when considered alongside the current earnings growth trajectory. With Q2 2025 earnings growth estimated at just 4.9%, down sharply from Q1's 12.9%, the market is paying historically high multiples for decelerating profit growth. This combination of elevated valuations and slowing earnings represents a challenging environment for future returns.

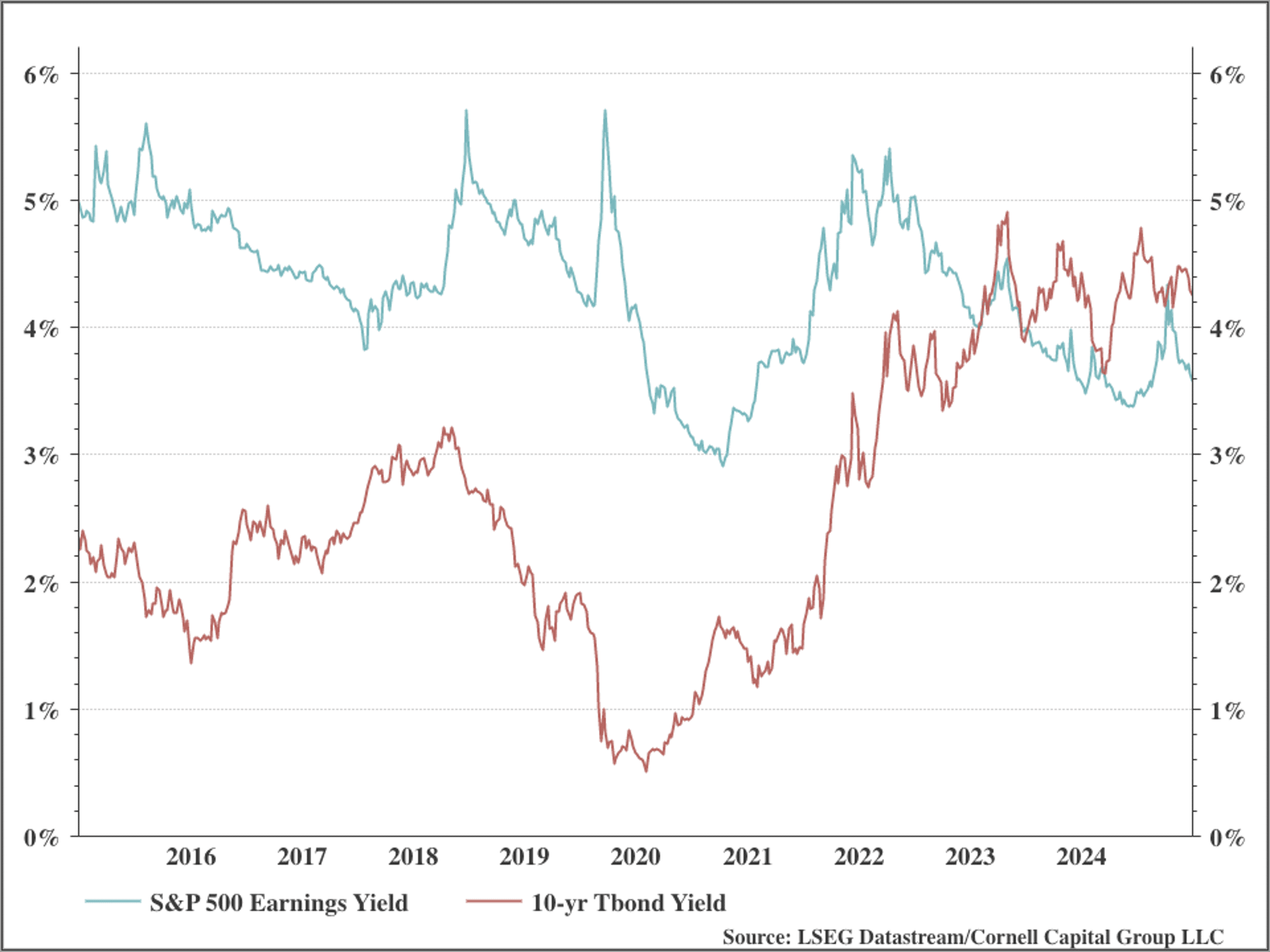

An intuitive way to appreciate the valuation issue is to compare the equity yield on the S&P 500, which is equal to equity earnings divided by the price (E/P), with the yield on 10-year Treasury bonds. Typically, the equity yield is higher than the Treasury bond yield to compensate for the greater risk. However, the chart below indicates that this is not the current situation. As the chart shows, this is markedly different from historical experience.

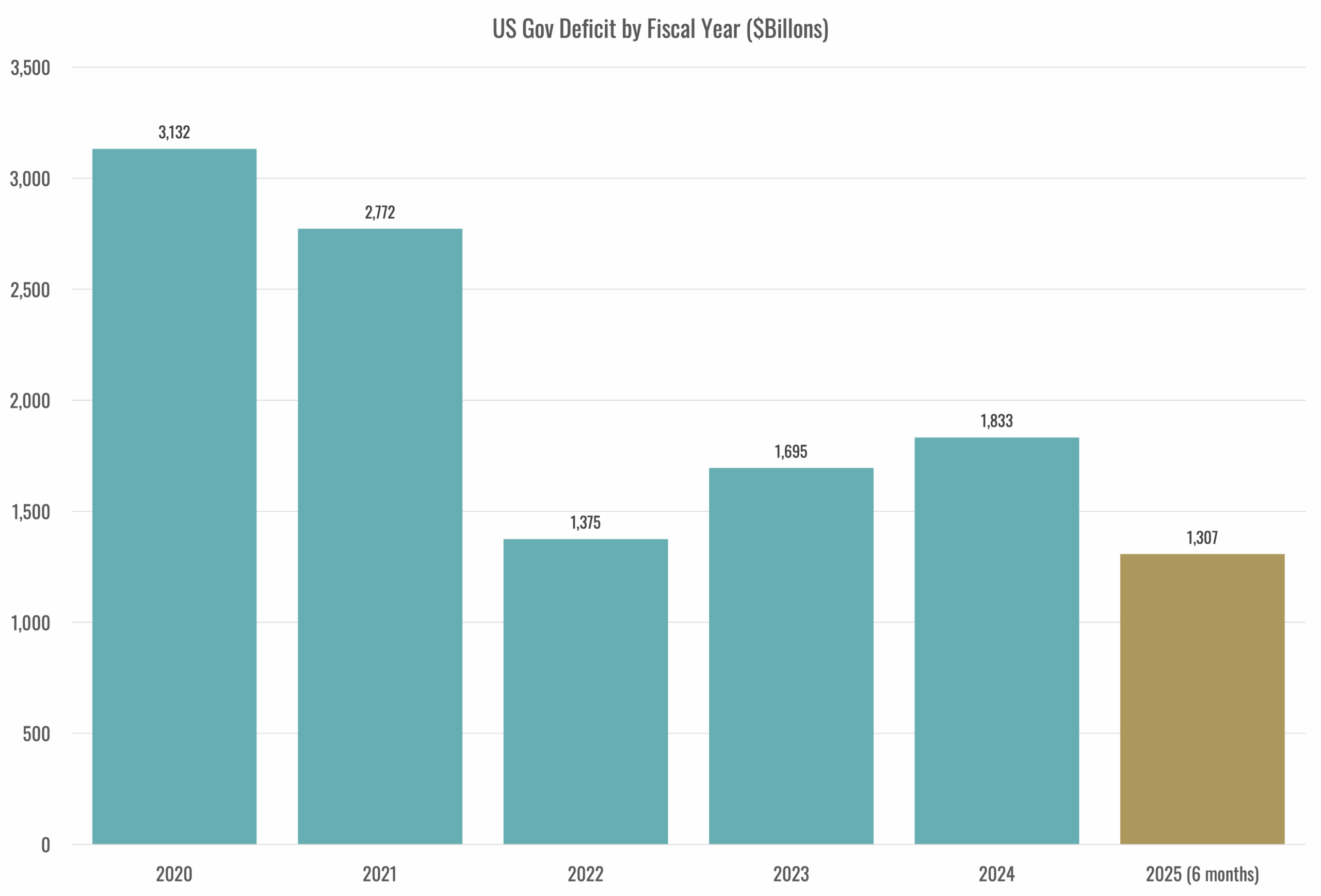

The Growing Fiscal Crisis: An Elephant That Won't Leave

The federal government's fiscal position continued to deteriorate through the first half of 2025, with the six-month deficit reaching $1.31 trillion. This represents a 13% increase over the same period in the previous year and puts the government on pace for an annual deficit exceeding $2.6 trillion. The magnitude of this fiscal deterioration cannot be overstated – at the current trajectory, the deficit would approach levels seen only during the height of the COVID 19 pandemic. The details of the “big beautiful bill” which are still being debated in Congress but none of the alternatives will have a major on the projected deficit.

Given the huge outstanding debt, Interest payments on the federal debt now exceed $80 billion per month, surpassing the entire defense budget on an annual basis. With total debt approaching 120% of GDP, the United States faces debt service costs that crowd out other government spending and constrain fiscal flexibility. The situation is compounded by the inflationary pressures from potential tariff policies, which risk pushing interest rates higher and further increasing the government's borrowing costs.

The political economy of deficit reduction remains challenging, as Americans have become accustomed to receiving government services that exceed what they pay for in taxes. The new administration's early focus on tax cuts and increased defense spending, combined with the economic disruption from trade policies, suggests that meaningful deficit reduction is unlikely in the near term. This fiscal trajectory represents a mounting systemic risk that could trigger a bond market revolt or credit crisis if investor confidence in US fiscal sustainability erodes. Such as crisis would be bad news indeed for the stock market.

Corporate Earnings: Growth Momentum Stalling

Corporate America entered Q2 2025 with significant momentum, having delivered 12.9% earnings growth in the first quarter. However, this strength proved short-lived as the effects of tariff uncertainty, supply chain disruptions, and economic policy volatility began to weigh on business confidence and performance. But, as noted above, current estimates for Q2 2025 earnings growth have declined dramatically to 4.9%, representing the lowest growth rate since Q4 2023.

The deceleration in earnings growth is particularly concerning given that it occurred despite the strong economic backdrop that characterized most of the quarter. Revenue growth has also moderated, with Q2 estimates of 4.1% representing a decline from earlier projections of 4.7%. This suggests that the earnings slowdown reflects genuine business challenges rather than temporary factors.

Looking ahead, analysts project a modest recovery in earnings growth for the second half of 2025, with Q3 and Q4 estimates of 7.2% and 6.2% respectively. However, these projections may prove optimistic given the ongoing trade policy uncertainty and the potential for further economic disruption. For the full year 2025, consensus expectations call for 9% earnings growth, but this forecast has been steadily revised downward throughout the year.

The earnings outlook is further complicated by margin pressures from tariffs and wage inflation, which are expected to challenge corporate profitability. While some companies may benefit from potential tax cuts and deregulation under the new administration, these positive factors are likely to be offset by the negative impacts of trade restrictions and economic uncertainty.

Market Outlook: Navigating Elevated Risks

As we assess the investment landscape for the remainder of 2025, several factors suggest a more challenging environment ahead. The elevated valuation environment, characterized by a CAPE ratio above 36 and P/E multiples well above historical averages, suggests limited upside potential and significant downside risk. Academic research indicates that markets trading at these valuation levels typically generate below-average returns over the subsequent decade.

The government's deteriorating fiscal position represents a growing systemic risk that could manifest through higher interest rates, currency weakness, or a loss of confidence in the US. With debt service costs already exceeding defense spending and deficits on pace to reach crisis levels, the risk of a fiscal emergency continues to mount. Such an event could trigger significant market volatility and potentially end the current bull market that began in October 2022.

The earnings growth trajectory also presents challenges for equity investors. With Q2 growth decelerating sharply and forward estimates being revised downward, the market faces the prospect of paying high multiples for mediocre profit growth.

Investment Implications and Strategy

Given the current market environment, we continue to recommend a defensive posture that emphasizes a comparison of price and value, diversification, and risk management. The combination of elevated valuations, slowing earnings growth, fiscal deterioration, and policy uncertainty creates an unfavorable risk return trade-off that argues for caution.

The fixed income market presents its own challenges, with government debt sustainability concerns potentially leading to higher long-term interest rates despite Federal Reserve policy. For this reason, we favor shorter-duration strategies or inflation-protected securities given the inflationary pressures from tariffs and fiscal expansion.

Perhaps most importantly, investors should prepare for continued volatility and maintain adequate liquidity to navigate potential market disruptions. The Liberation Day episode serves as a reminder that in an environment of policy uncertainty and elevated valuations, market conditions can change rapidly and dramatically. Maintaining investment discipline and focusing on long-term fundamentals remains paramount.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.