From Liberation Day Chaos to Cautious Recovery The second quarter of 2025 started with the…

Quantum Computing and Investing

At a conference on quantum computing and finance on December 10, 2020, William Zeng, head of quantum research at Goldman Sachs, told the audience that quantum computing could have a “revolutionary” impact on the bank, and on finance more broadly. In a similar vein, Marco Pistoia of JP Morgan stated that new quantum machines will boost profits by speeding up asset pricing models and digging up better-performing portfolios. While there is little dispute that quantum computing has great potential to perform certain mathematical calculations much more quickly, whether it can revolutionize investing by so doing is an altogether different matter.

The hope is that the immense power of quantum computers will allow investment managers earn superior investment returns by uncovering patterns in prices and financial data that can be exploited. The dark side is that quantum computers will open the door to finding patterns that either do not actually exist, or if they did exist at one time, no longer do. In more technical terms, quantum computing may allow for a new level of unwarranted data mining and lead to further confusion regarding the role of nonstationarity.

Quantum data mining

Any actual sequence of numbers, even one generated by a random process, will have certain statistical quirks. Physicist Richard Feynman used to make this point with reference to the first 767 digits of Pi, replicated below. Allegedly (but unconfirmed) he liked to reel off the first 761 digits, and then say 9-9-9-9-9-9 and so on. If you only look at the first 767 digits the replication of six straight nines is clearly an anomaly – a potential investment opportunity. In fact, there is no discernible pattern in the digits of Pi. Feynman was purposely making fun of data mining by focusing on the first 767 digits.

3 .1 4 1 5 9 2 6 5 3 5 8 9 7 9 3 2 3 8 4 6 2 6 4 3 3 8 3 2 7 9 5 0 2 8 8 4 1 9 7 1 6 9 3 9 9 3 7 5 1 0 5 8 2 0 9 7 4 9 4 4 5 9 2 3 0 7 8 1 6 4 0 6 2 8 6 2 0 8 9 9 8 6 2 8 0 3 4 8 2 5 3 4 2 1 1 7 0 6 7 9 8 2 1 4 8 0 8 6 5 1 3 2 8 2 3 0 6 6 4 7 0 9 3 8 4 4 6 0 9 5 5 0 5 8 2 2 3 1 7 2 5 3 5 9 4 0 8 1 2 8 4 8 1 1 1 7 4 5 0 2 8 4 1 0 2 7 0 1 9 3 8 5 2 1 1 0 5 5 5 9 6 4 4 6 2 2 9 4 8 9 5 4 9 3 0 3 8 1 9 6 4 4 2 8 8 1 0 9 7 5 6 6 5 9 3 3 4 4 6 1 2 8 4 7 5 6 4 8 2 3 3 7 8 6 7 8 3 1 6 5 2 7 1 2 0 1 9 0 9 1 4 5 6 4 8 5 6 6 9 2 3 4 6 0 3 4 8 6 1 0 4 5 4 3 2 6 6 4 8 2 1 3 3 9 3 6 0 7 2 6 0 2 4 9 1 4 1 2 7 3 7 2 4 5 8 7 0 0 6 6 0 6 3 1 5 5 8 8 1 7 4 8 8 1 5 2 0 9 2 0 9 6 2 8 2 9 2 5 4 0 9 1 7 1 5 3 6 4 3 6 7 8 9 2 5 9 0 3 6 0 0 1 1 3 3 0 5 3 0 5 4 8 8 2 0 4 6 6 5 2 1 3 8 4 1 4 6 9 5 1 9 4 1 5 1 1 6 0 9 4 3 3 0 5 7 2 7 0 3 6 5 7 5 9 5 9 1 9 5 3 0 9 2 1 8 6 1 1 7 3 8 1 9 3 2 6 1 1 7 9 3 1 0 5 1 1 8 5 4 8 0 7 4 4 6 2 3 7 9 9 6 2 7 4 9 5 6 7 3 5 1 8 8 5 7 5 2 7 2 4 8 9 1 2 2 7 9 3 8 1 8 3 0 1 1 9 4 9 1 2 9 8 3 3 6 7 3 3 6 2 4 4 0 6 5 6 6 4 3 0 8 6 0 2 1 3 9 4 9 4 6 3 9 5 2 2 4 7 3 7 1 9 0 7 0 2 1 7 9 8 6 0 9 4 3 7 0 2 7 7 0 5 3 9 2 1 7 1 7 6 2 9 3 1 7 6 7 5 2 3 8 4 6 7 4 8 1 8 4 6 7 6 6 9 4 0 5 1 3 2 0 0 0 5 6 8 1 2 7 1 4 5 2 6 3 5 6 0 8 2 7 7 8 5 7 7 1 3 4 2 7 5 7 7 8 9 6 0 9 1 7 3 6 3 7 1 7 8 7 2 1 4 6 8 4 4 0 9 0 1 2 2 4 9 5 3 4 3 0 1 4 6 5 4 9 5 8 5 3 7 1 0 5 0 7 9 2 2 7 9 6 8 9 2 5 8 9 2 3 5 4 2 0 1 9 9 5 6 1 1 2 1 2 9 0 2 1 9 6 0 8 6 4 0 3 4 4 1 8 1 5 9 8 1 3 6 2 9 7 7 4 7 7 1 3 0 9 9 6 0 5 1 8 7 0 7 2 1 1 3 4 9 9 9 9 9 9

When it comes to investing, there is only one sequence of historical returns. With sufficient computing power and with repeated torturing of the data, anomalies are certain to be detected. A good example is factor investing. The publication of a highly influential paper by Professors Eugene Fama and Kenneth French identified three systematic investment factors, which started an industry focused on searching for additional factors. Research by Arnott, Harvey, Kalesnik and Linnainmaa reports that by year-end 2018 an implausibly large 400 significant factors had been “discovered.” One wonders how many such anomalies quantum computers might find.

Factor investing is just one example among many. Richard Roll, a leading academic financial economist with in-depth knowledge of the anomalies literature has also been an active financial manager. Based on his experience Roll stated that his money management firms attempted to make money from numerous anomalies widely documented in the academic literature but “failed to make a nickel.”

The simple fact is that if you have machines that can look closely enough at any historical data set, they will find anomalies. For instance, what about the anomalous sequence 0123456789 in the expansion of Pi.? That anomaly can be found beginning at digit 17,387,594,880.

Non-stationarity and quantum computing

The digits of Pi may be random, but they are stationary. The process that generates the first million digits is the same as the one which generates the million digits beginning at one trillion. The same is not true of investing. Consider, for example, providing a computer the sequence of daily returns on Apple stock from the day the company went public to the present. The computer could sift through the returns looking for patterns, but this is almost certainly a fruitless endeavor. The company that generated those returns is far from stationary. In 1978, Apple was run by two young entrepreneurs and had total revenues of $0.0078 billion. By 2019, the company was run by a large, experienced, management team and had revenues of $274 billion, an increase of about 35,000 times. The statistical process generating those returns is almost certainly nonstationary due to fundamental changes in the company generating them. To a lesser extent, the same is true of nearly every listed company. The market is constantly in flux and the companies are constantly evolving as consumer demands, government regulation, and technology, among other things, continually change. It is hard to imagine that even if there were past patterns in stock prices that were more than data mining, they would persist for long due to nonstationarity.

In the finance arena, computers and artificial intelligence “work” by using their massive data processing skills to find patterns that humans may miss. But in a nonstationary world the ultimate financial risk is that by the time they are identified those patterns will be gone. As a result, computerized trading comes to resemble a dog chasing its tail. This leads to excessive trading and ever rising costs without delivering superior results on average. Quantum computing risks simply adding fuel. Of course, there are individual cases where specific quant funds make highly impressive returns, but that too could be an example of data mining. Given the large number of firms in the money management business, the probability that a few do extraordinarily well is essentially one.

These criticisms are not meant to imply that quantum computing has no role to play in finance. For instance, it has great potential to improve the simulation analyses involved in assessing risk. The point here is that it will not be a holy grail for improving investment performance.

Quantum marketing

Despite the drawbacks associated with data mining and nonstationarity, there is one area in which the potential for quantum computing is particularly bright – marketing quantitative investment strategies. Selling quantitative investment has always been an art. It involves convincing people that the investment manager knows something that will make them money, but which is too complicated to explain to them and, in some cases, too complicated for the manager to understand. Quantum computing takes that sales pitch to a whole new level because virtually no one will be able to understand how the machine decided that a particular investment strategy is attractive.

Fundamental investing

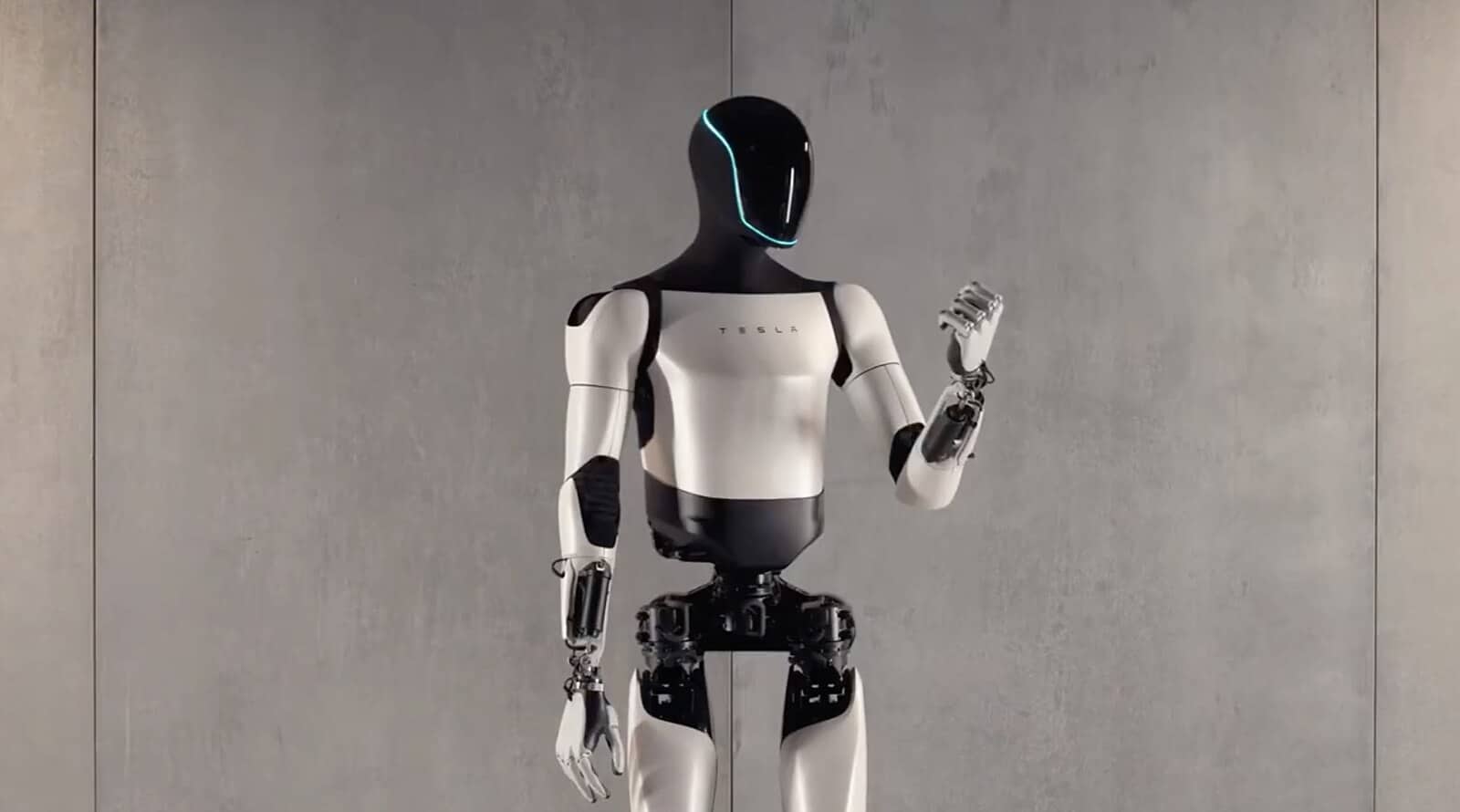

This skeptic’s take is that quantum computing will have little impact on what is ultimately the source of successful investing – allocating capital to companies that have particularly bright prospects for developing profitable business in a highly uncertain and non-stationary world. Perhaps at some future date a computer will develop the business judgment to determine whether Tesla’s business prospects justify its current stock price. Until then being able to comb through historical data in search of obscure patterns at ever increasing rates is more likely to produce profits through the generation of management fees rather than the enhancement of investor returns.