Download PDF Key Points S&P 500 returns (954.5%) following the 2008 Global Financial Crisis…

Investor Memo Q4 2021

A Time for Caution: Cracks in the Dam

As 2021 draws to a close, our primary objective at the Cornell Capital Group remains protecting our client’s capital. In a market where valuations remain frothy this means a strategy of carefully comparing price and fundamental value and selective hedging.

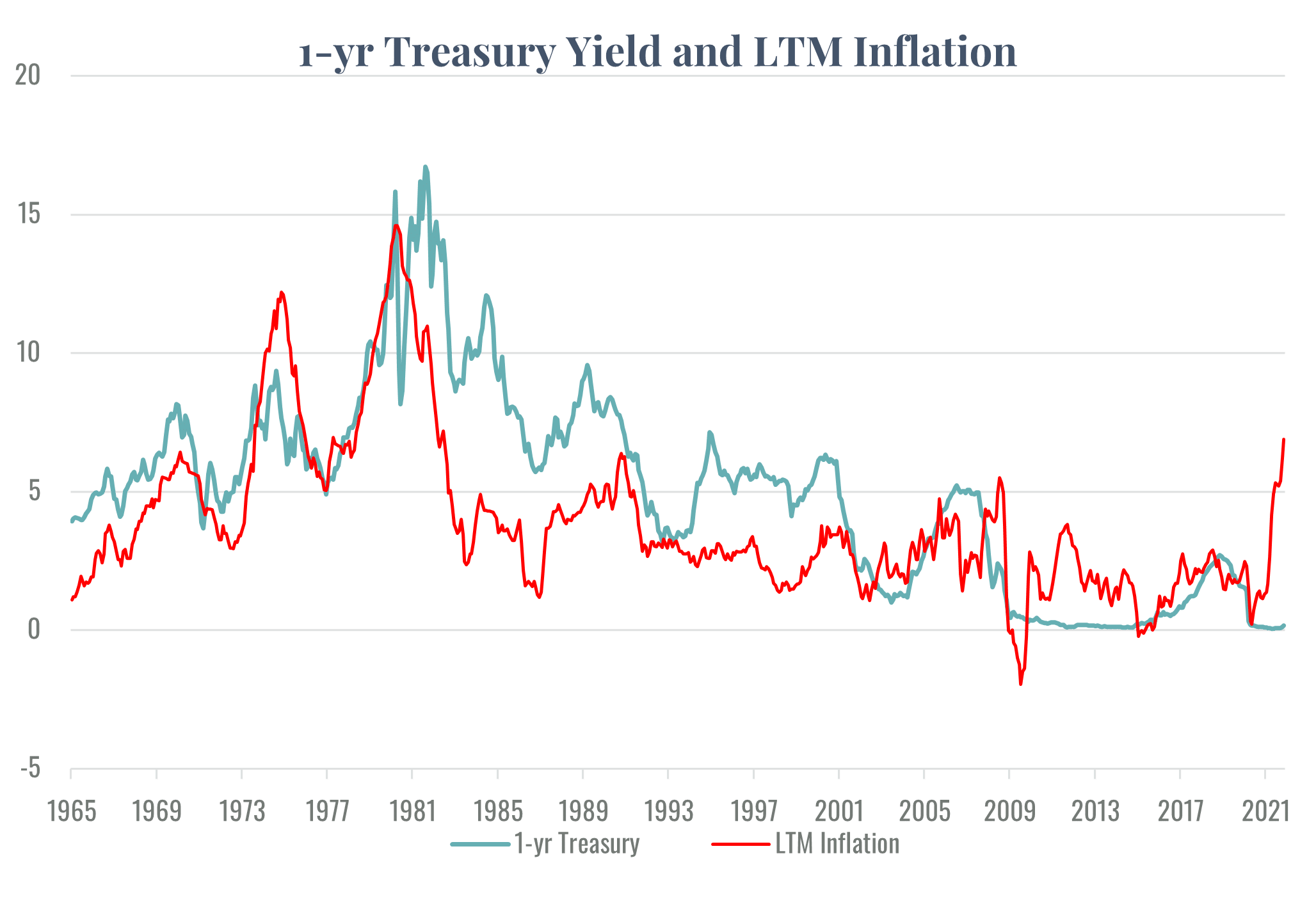

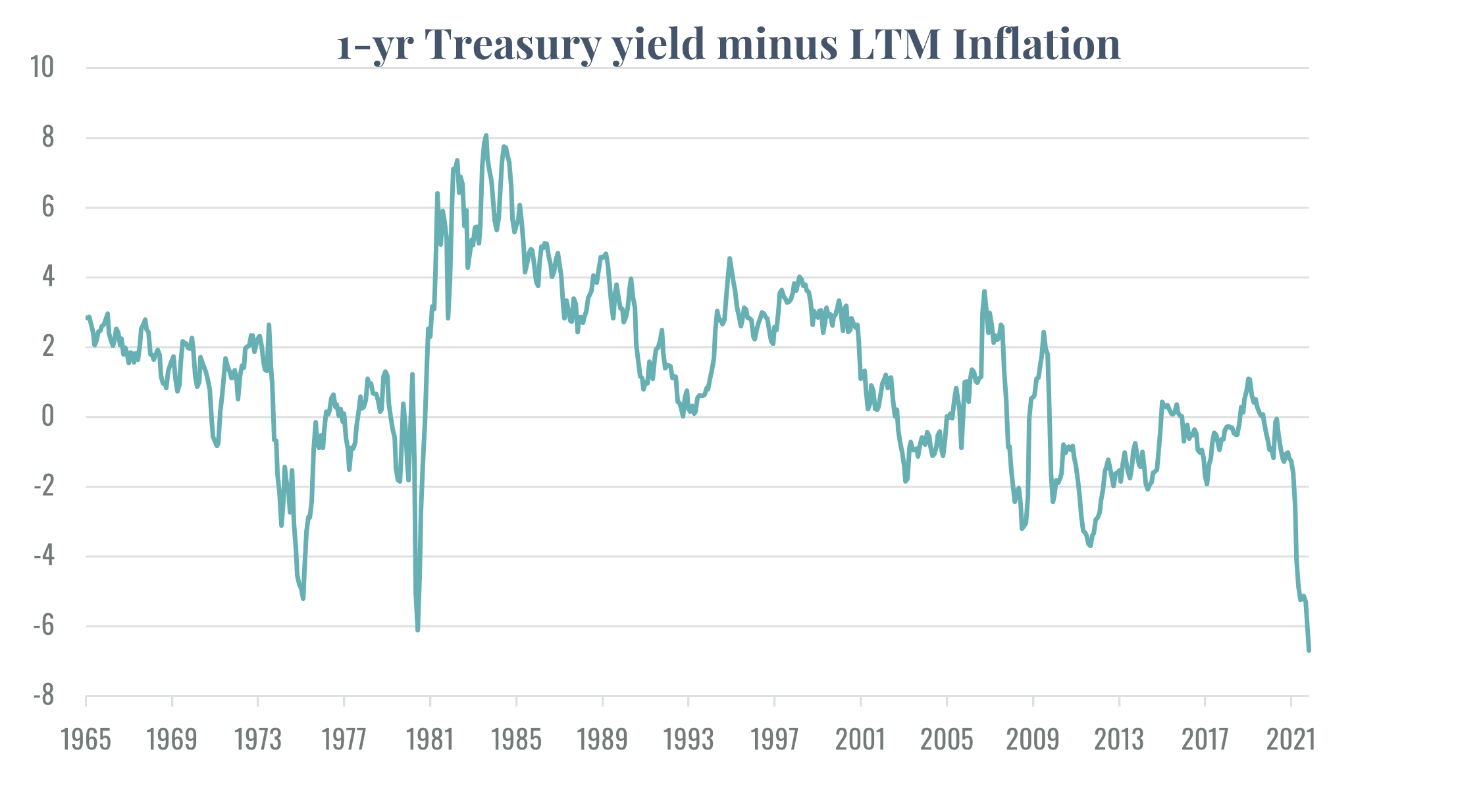

One of the key issues for investors in 2021 was the behavior of interest rates. We think they will have an even bigger impact in 2022. Our senior advisor, Prof. Cornell, observes: “I have been following the relation between inflation and interest rates since I wrote my PhD dissertation on the subject back in the 1970s. I have never seen a more anomalous situation. But don’t take my word for it, look at the two charts below. The first plots the yield on one-year Treasury securities against the inflation rate observed over the prior twelve months. The second plots the real interest rate, defined as the difference between the Treasury yield and the inflation rate. The charts clearly show that a Treasury yield near zero combined with an inflation rate of 6.8%, resulting in a negative real rate of 6.7%, is something that has never been observed.”

In our view, the current situation is not an equilibrium. With real rates on government debt at minus 6%, we can see why many investors feel there are no alternatives to equities or junk debt. If inflation stays at this level, rates will have to rise, either because of a change in fed policy or because investors will no longer accept nominal yields of 1.5%. When rates do move, the impact on the market is likely to be significant.

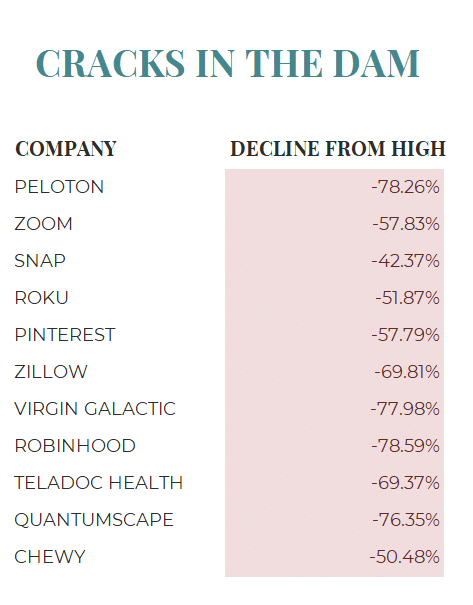

Although stock indexes ended 2021 near record levels, as the year came to an end, warning signs were beginning to appear. During the Tech Bubble ending in 2000, before the general markets collapsed, the first cracks in the dam appeared when the sexiest highfliers without a history of earnings dropped. There is similar evidence now. The chart below shows how much some of the most famous current highfliers have dropped from their 2021 highs.

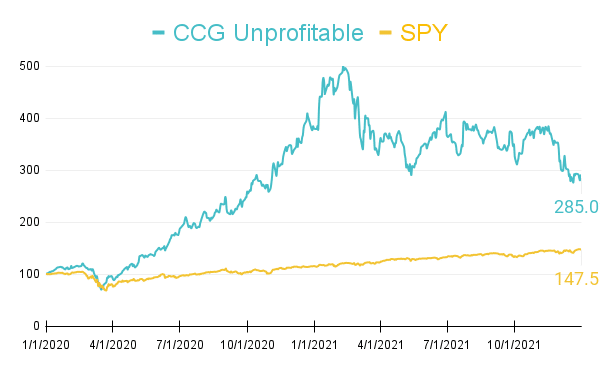

The story is similar in the case of the Cornell Capital Group Unprofitable Index. The index tracks a group of disruptive companies that have yet to make any meaningful GAAP earnings. From the Covid low in March 2020, the CCG Index rocketed up an astonishing 650 percent to reach its high point in February. But more recently, the tide has turned, and the index has dropped more than 40 percent.

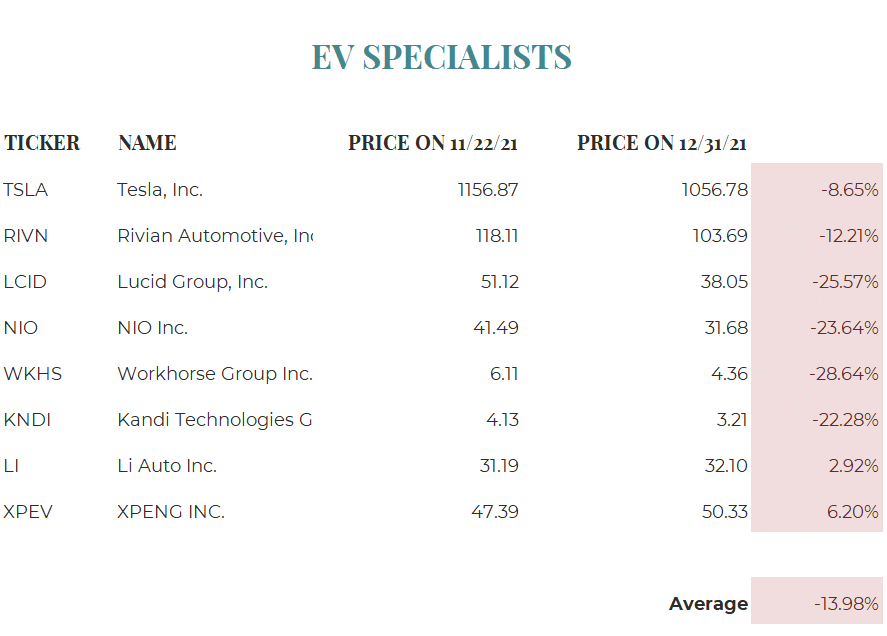

On November 22, 2021, we released a report on the valuation of the automotive industry. We concluded that “Because we believe that the competitive structure of the market will remain unchanged, it is our view that in the long run EV/IC ratios will regress toward their historical average of about 1.10, primarily due to the stagnation or outright decline in the stock prices of auto manufacturers. The higher the current EV/IC ratio, the more likely the stagnation or decline. Over the next decade, it will be difficult for investors in auto manufacturers to earn meaningfully positive stock returns with the outlook for investment in electric vehicle specialists being particularly bleak.” Since then, the prices of EV specialists have declined more than 13% on average as shown in the following chart. Despite the drop, however, EV specialists still trade at EV/IC ratios much greater than 1.0. In our view, these companies remain unattractive long-term investments.

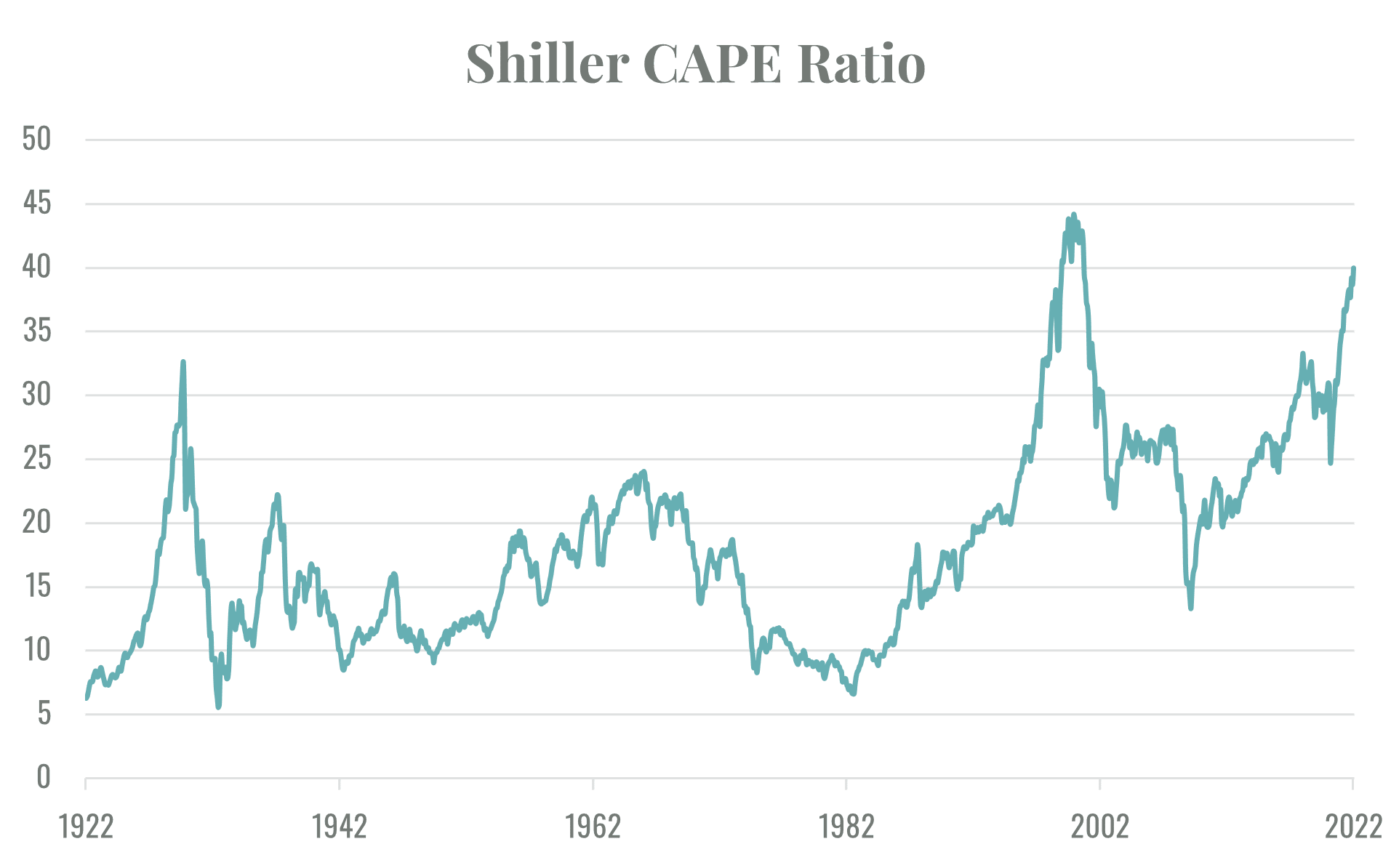

Despite the cracks, as 2021 ends, the S&P 500 is near a record level both in absolute terms and relative to any reasonable measure of earnings or cash flow and the NASDAQ is not far behind. A good example of this is the Shiller CAPE ratio which compares the price of the S&P 500 to its average earnings over the last ten years. It ended the year reaching a level only exceeded at the pinnacle of the Tech Bubble. Furthermore, the S&P 500 hit a record high 71 times during 2021.

Putting all the pieces together, our bywords for 2022 are caution, value, and risk management. Any stock we hold outright must offer value, as measured by our proprietary discounted flow analysis, that at least equals its price. To the extent we purchase higher risk stocks, we will generally hedge with options to achieve what we feel is an attractive risk return tradeoff. 2021 rewarded investors with what was a largely smooth increase in stock prices. In our view, 2022 will not be so kind.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.