Download PDF Key Points S&P 500 returns (954.5%) following the 2008 Global Financial Crisis…

Investor Memo Q2 2022 : Taking Stock

Looking Back

Too often financial market analysis is focused on the issue de jour – jumping from hot topic to hot topic with little reference to what was said in the past. Breaking from this tradition, this quarterly memo takes stock of what we have said in the past to provide perspective before turning to current conditions.

Over the past 18 months, we have distributed 32 videos through our “Reflections on Investing” series and authored several reports. Here is what we had to say on key issues with links to related videos and reports.

Crypto currencies

In our April 2021 video, Valuing Bitcoin, we concluded that cryptocurrencies have virtually no fundamental economic value. Consequently, the only support for their prices are expectations regarding what they can be sold for in the future. That is not a sound foundation on which to base an investment and in the long run collapse is likely. To further explain the basis for this conclusion we authored a short paper entitled Bubble Wealth.

Is the stock market overvalued?

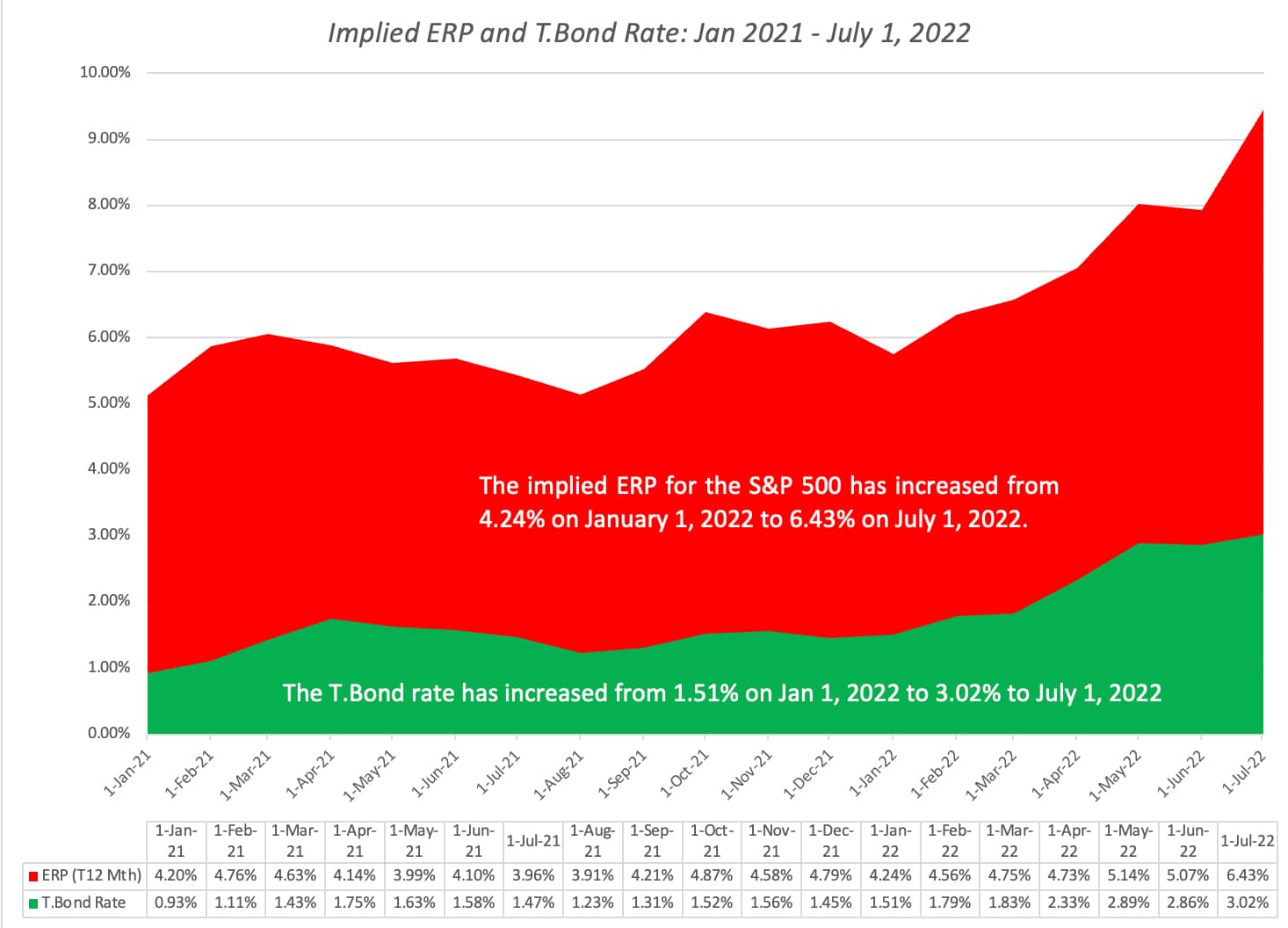

In two videos streamed in May 2021, we addressed the question of Is the Market Overvalued? At the time, the S&P 500 was at 4,175. We noted that the answer to that question depends on the risk premium investors require for holding common stocks. At sufficiently low risk premiums even higher stock prices can be rationalized. If, however, risk premiums were to rise to levels more consistent with historical experience, the result would be a sharp contraction in stock prices. That is what has occurred. As can be seen in the attached chart from Aswath Damodaran’s blog, the Russian invasion of the Ukraine, the rise of inflation, and the risk of recession have combined to push risk premiums up. The implied equity risk premium jumped from 4.24% on January 1, 2022 to 6.43% on June 23, 2022. The bad news is that such higher risk premiums lead directly to lower prices. The good news is they also imply greater returns on stocks going forward.

The Critical Role of Expectations

If the value of a stock is the present value of expected future cash flows, then expectations will be front and center in affecting market prices. But unlike actual corporate performance, expectations are subject to swings in investor sentiment. As we discussed in our video on Expectations and Valuation, there is no better example than Netflix. Today Netflix trades at about the same price it did five years ago, but the company is earning more than ten times what it did back then. Why have investors failed to make a penny over those five years? Because back then sentiment was sky high and now it is much more muted. This serves as a warning for investing in companies for which great things are expected. They must achieve great things just to keep the stock price from falling. The stock price will rise significantly only if they do something even greater than the lofty expectations. In the case of Netflix that proved to be a bridge too far.

Competition and stock prices

One of the fundamental precepts of financial economics is that for a company to be worth more than the amount invested in it, the return on its equity must exceed the cost of equity capital. This requires barriers to entry. Without such barriers as soon as returns on equity exceed the cost of capital competitors will enter and compete away the excess profit. In a report on Valuing the Automotive Industry issued in November, we argued that the prices of most all electrical vehicles company were unstainable because they traded at prices far in excess of invested capital despite the fact that the industry was highly competitive. Today the average price of EV specialists is down about 40% from November 22, 2021 when our report was published.

Beware Bear Market Rallies

When have stock prices had their sharpest rallies? During the worst of times! In our video, Best of Times, Worst of Times, we show that large stock price increases were far more common during the market collapses associated with the bursting of the dot.com bubble and the financial crisis than during normal times. The warning is clear. Don’t assume that bad times are over just because there has been a sharp rally in the stock market.

Looking ahead

For the past 18 months we have been warning about the combined effects of sky-high equity prices and low risk premiums. For that reason, we have pursued an option hedging strategy at CCG which has provided protection from the market carnage. For the same reason, we avoided high-risk growth stocks and alternative investments such as crypto currencies which we believe traded at prices well in excess of fundamental value.

Now, investors are facing heightened geo-political tensions, rapidly shifting expectations, crypto market failures, record inflation, and a rising risk of recession. This uncertainty brings with it heightened market volatility. Although stock prices are not as frothy as they were in the beginning of the year, they remain high relative to earnings and cash flow. At CCG, our strategy for navigating these uncertain times remains two-fold. First, we will maintain our focus on fundamental valuation analysis. In uncertain times, careful valuation analysis provides a solid foundation for investment decision making. Second, we still like our approach of using options to hedge equity positions (guided by fundamental valuation) particularly considering the greater option premiums resulting from the increased market volatility. In these market conditions, we believe our strategies for protecting investor capital become even more important.

To close on a positive note, as discussed above, the lower stock prices are associated with greater risk premiums and accordingly higher expected returns on stocks. This is not surprising; when times turn bad investment opportunities emerge. We will be watching closely to take advantage of those opportunities if risk premiums continue to rise, and prices continue to fall.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.