In this video, we explore the history of the CAPE (Shiller PE) ratio, how it’s…

#46 Reflections on Investing : Don’t Forget The Debt

Hello and welcome back to Reflections on Investing with the Cornell Capital Group, and today we’re going to talk about something that’s been somewhat forgotten in recent years, corporate debt. We think it’s going to play a much more important role in the markets in the months and years ahead.

But to get started, remember if you go back to one of our very first reflections, we made a point which is easy to forget but which is absolutely critical. That is that the value of a company to investors as a group must come from the free cash flows that are generated and the rate at which those are discounted. That determines what is called the operating value of the company.

So let’s look at a schematic for how evaluation is done and I urge you to go back and look at the early Reflections if you’re not particularly familiar with discounted cash flow valuation. Or you could also go over to my colleague Aswath Damodaran’s site Musing on Markets and look at one of his valuations. But if we turn here to a very simple schematic, the top line is the present value of the cash flows and the terminal value and that determines the operating value of a business. To get the total value you have to add in the non-operating Assets in cash, that however gives you the value of the business, not the value of the equity. And the difference for the most part is the value of the debt.

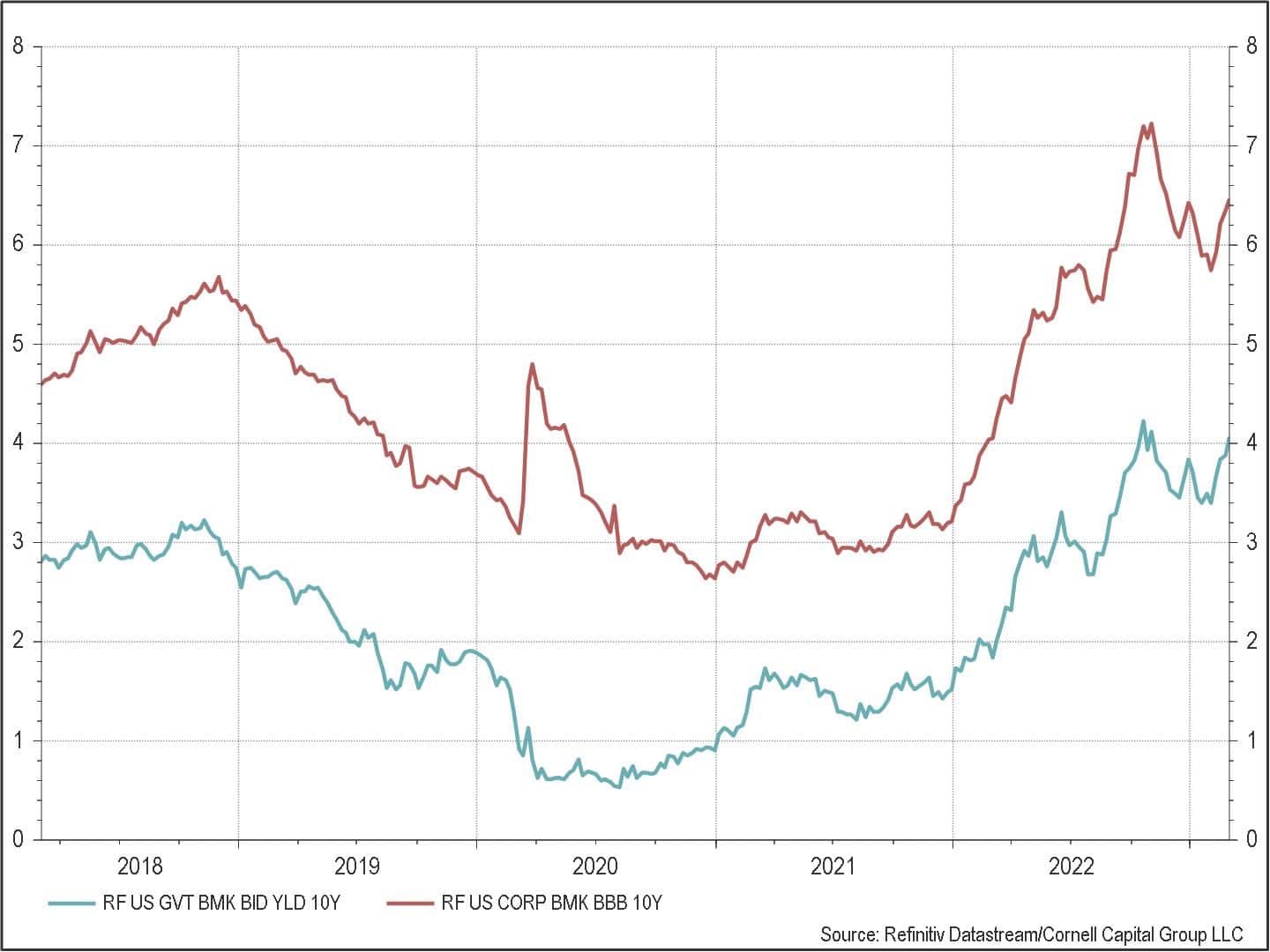

For some companies, debt has become a far more important element. And the reason that debt is becoming more important is the the increase in the rate of interest. So if we look at our next chart here, it shows two key interest rates, the 10-year treasury rate is in blue at the bottom and you can see that has risen from less than two percent to approximately four percent today. The reddish orange line is the rate on BBB corporate bonds. The BBB bond is the lowest investment grade and is often used as a bellwether to measure the cost of corporate borrowing and you can see that that’s more than doubled from three percent to more than six percent.

What that means is that companies that have a lot of debt that they took on during the period of low interest rates, may have a problem as that debt matures and they have to refinance it at rates more than twice as high.

So one thing that investors ought tokeep an eye on is the level of debt that companies have because not only is it a big number to be subtracted off, in some cases, from the value of operating assets, but the risk of the company is also magnified by the debt, particularly in an environment of rising interest rates.

And what we did here at Cornell Capital was just put together a list of companies that we follow that have at least 20 billion dollars in debt. And that debt is a significant fraction of the value of their operating business so let’s take a look at just some some key ones here and I’ll explain why they fit into this.

Dell Technologies has been involved in a lot of deal making. That deal making requires taking on debt. So Dell’s net debt is debt minus cash, so we’ve already given them credit for the cash. The net debt is 40 percent of the value of the operating business.

For American Airlines, it’s 76 percent. For a AT&T, it’s nearly 50 percent with a total debt of 132 billion dollars. For Edison International which is very typical of utilities, it’s about 52 percent of the operating value and over 30 billion dollars.

Finally, there’s Carnival Corporation, which is typical of companies that had a very difficult time during the pandemic. Their businesses were disrupted, they weren’t making money anymore so to stay alive they started taking on more and more debt and you can see in Carnival’s case, it’s risen to 71 percent of the value of the operating business.

So the bottom line is that investors should pay careful attention to debt, particularly at companies where it’s a big fraction of their operating value. Rising interest rates could make that leverage a significant risk for investors in the months and years ahead.