Download PDF Key Points S&P 500 returns (954.5%) following the 2008 Global Financial Crisis…

Investor Memo Q1 2023: Banks, Interest Rates, and Debt

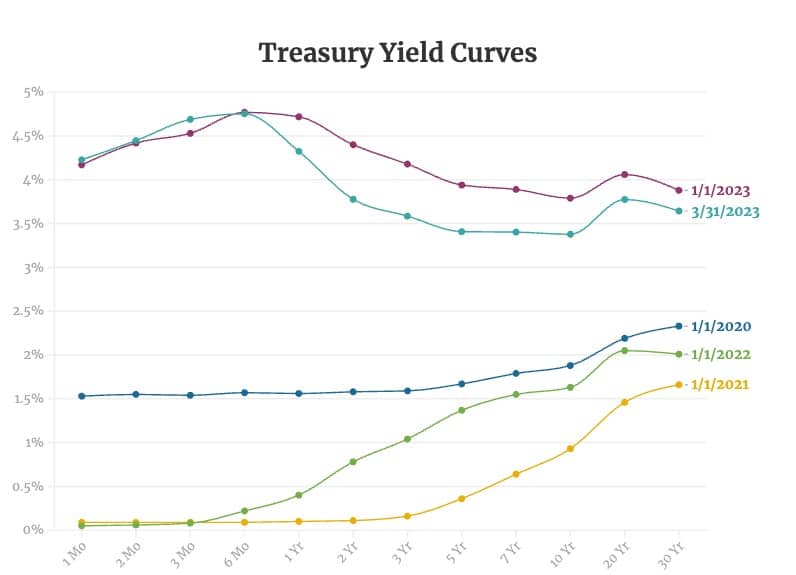

During the first quarter the story of both the fixed income and stock market revolved around the ongoing evolution of the yield curve. To review, the yield curve plots the yield on Treasury securities as a function of their maturity. The graph below plots the yield curves at the start of the year for the last three years along with the current yield curve.

The key starting points are the curves for 2021 and 2022. Notice that in both years the interest rate on short-term Treasury bills was nearly zero. At a maturity of ten years, the yield on Treasury bonds is about 1% in 2021 and 1.5% in 2022. By 2023 Federal Reserve policy had led to a dramatic change in the yield curve. Short-term rates had jumped from zero to 4.5% – 5% and the return on ten-year Treasury bonds had risen to approximately 3.75% depending on the day on which the curve was observed.

The dramatic shift in the yield curve had two critical impacts on banks, particularly banks that held large amounts of long-term government securities. First, they faced a choice of paying about 4.5% on deposits or risk losing them. Second, the value of their long-term government bonds, whether recognized for accounting purposes or not, dropped by about 20% on average. This put banks that held large amounts of such bonds at risk. For example, Silicon Valley Bank (SVB) reported in December 2022 that deposits represented 82% of the bank’s liabilities and over 60% of those deposits were invested in cash or government securities.

Aware of the decline in the value of SVB’s government bonds, sophisticated investors rushed to withdraw their money quickly, whether or not the bank paid a competitive rate on deposits, for fear that the market value of the assets was insufficient to cover all of the deposits. Because those investors were correct, the drop in the value of bonds rendered the bank insolvent on a mark to market basis and the regulators were forced to seize the bank. The resulting fear that such problems could be more widespread led to a sharp drop in the stock prices of most banks and a collapse in the stock prices of banks deemed most at risk such as SVB and First Republic. The bank panic, in turn, led to a decline in the overall stock market.

It is hard not to lay much of the blame for this fiasco at the foot of the Federal Reserve and the Federal Government. In 2020 and 2021, the government ran deficits averaging close to $3 trillion. Prior to that the largest deficit ever recorded was less than $1.5 trillion. The Fed responded to the deficits with record purchases of government securities. Between the end of 2019 and the end of 2022, the Fed’s holdings of securities increased by $4.4 trillion. With such government borrowing and monetary excess, it seemed hard to believe that inflation was not just around the corner and that fighting that inflation would require a dramatic shift in Federal Reserve policy toward higher short-term interest rates and tighter monetary policy.

Nonetheless, the banks that are in trouble played a major role in their own demise. As we repeated, beginning in 2020 and continuing through 2022, investing in long-term government securities offered low returns and entailed significant risk in the form of rising inflation and the Federal Reserve response to that inflation. For instance, in August 2021 our Reflections on Investing focused on the Ten-year Treasury Bond and warned that the yield was too meager to justify the risk. We reiterated that theme in a more general Reflections on Fixed Income. And we were hardly alone. Larry Summers was beating the drum about the risk of rising inflation throughout much of the period. We stress that these were risks, not certain outcomes. No one knew what was going to happen. For instance, during much of the period, the Fed was claiming that inflation was transitory. But it is precisely such risks that banks must manage. While the Federal Reserve and the Treasury may have lit the fire, the fact that the house burned down at some banks was due to the lack of a fire department.

Options Trading

In the first quarter, retail trading of options continued to rise. Option volume has more than doubled since 2018. Furthermore, the Economist reported that retail investors now account for about half of U.S. option trading. In addition, retail investors have tended to focus on trading short dated, even so-called zero-day-to-expiration (0DTE) options which mature at the end of the trading day. These are speculative “lottery-like” securities with the lure of a big percentage payday in a short period of time, much like a casino. How does this affect the Cornell Capital Group given our use of options to manage risk and increase income? Basically, not at all. We are not option “traders”, we are hedgers. We do not trade zero-day options. We take our positions based on long-term fundamental analysis and hold them until we feel conditions have changed or the options mature. If anything, we might get a slight benefit from the growing options trading mania because it increases the liquidity of the market allowing us to get better spreads when we do trade. In rare cases, it may also allow us to get better prices if short-term options trading, based on sentiment and momentum, drives prices away from long term fundamental value.

Assessing the Level of the Stock Market

Recall that when assessing the level of the stock market, our starting point is the approach we described in our video on Valuing the S&P 500. In our year-end 2022 memo, we noted that our estimate of the fundamental value for the S&P 500 index at year end came to approximately 3800, not far from the closing market price of 3839.50. In the first quarter of 2023, the index rose to 4109.31, an increase of 7.0%. In our view, little has changed from a fundamental perspective during the first quarter with the possible exception of new risks to the banking system. It is hard for us to rationalize the run-up in prices. As a result, we believe that the market is slightly overpriced but within the range of reasonable estimation error. It is not a time for taking speculative positions. However, this does not mean there are no stocks that offer attractive opportunities. Using our proprietary discounted cash flow valuation models, we are evaluating a number of companies that appear promising. But it does mean we will continue to proceed with caution.

Concentration

Periodically, stock market concentration has attracted the attention of investors. Now should be one of those times. Exhibit 3 presents both the market capitalization of the five largest companies in the S&P 500 and their fraction of the total capitalization of the index. The exhibit shows that the market is significantly more concentrated than it was at the height of the dot.com bubble. Since 2010 the concentration ratio for the top 5 companies has more than doubled.

In addition, the company with the highest market cap in 2023, Apple, had an equity value more than 7.5 times higher the Exxon Mobil had in 2010 when it was the index leader. Together Apple and Microsoft had a market cap in excess of $4.5 trillion and accounted for 13.69% of the index at the start of 2023. Their combined market cap exceeded the total market cap of the last 266 companies in the index.

The market concentration is not necessarily a bad thing (especially when the market is going up). Apple, Microsoft, Alphabet, and Amazon are remarkable companies. However, they are not infallible or immune to competition. If market dynamics change and these companies face increased economic headwinds, they could have an outsized negative influence on the entire market. With many investors “crowded” into a handful of companies, if they all wanted to get out at the same time the drop could be sharp and fast. Furthermore, for passive investors invested in the market index, they might be less diversified than they think, especially when the concentration is based on one particular sector.

As investors, there is another thing that bothers us about the valuations of leading American tech companies. They are priced as if they are world leaders and thus far, they have been. But there may be cracks in the armor. As one example, on March 27, 2023, the Wall Street Journal reported that the top four hottest apps in the United States were developed in China. Seven-month-old Temu was the most downloaded app across U.S. app stores during the first three weeks of March. It was followed by CapCut, TikTok and Shein. Chinese venture capital investor Fang Lu offered an explanation for China’s emerging dominance noting that in China, “Everybody works on improving their craft, stich by stich.” The companies are backed by China’s vast pool of tech talent – more than half of Temu’s work force are engineers striving to improve the product. We are concerned that American tech companies will be facing increasingly stiff competition. We will be taking that into consideration in our investment decision making.

Conclusion

We ended our Q4 2022 memo by citing Warren Buffett’s first rule of investing – Don’t lose money. The rule is just as applicable today. In our view valuations remain on the high side, so we will have to look carefully to find companies trading below their fundamental value. We also plan to make continued use of options both to hedge and to increase income in situations where our analysis implies it improves the risk/return tradeoff.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.