The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which…

#51 Reflections on Investing : The Apple Stock Bond Paradox

In August of 2020 Apple issued a 40 year, 2.55% bond, two years later that bond is down nearly 40%. Apple’s stock on the other hand is up over 50% in that same period. Why is that and what does it imply?

Hello and welcome back to Reflections on Investing with the Cornell Capital Group.

Today we wanted to spend a little time talking about discount rates. If you’ve been following our Reflections, this topic has appeared repeatedly in various Reflections, but we’ve never really taken a deep dive into it. So, let’s start first with the basic equation for the discount rate:

Discount rate = Risk-free rate + Risk premium

The risk-free rate measures the time value of money, and the risk premium measures the risk value of money. The sum is what the marginal investor requires to hold a common stock.

You might look at this formula and say, “Well, where’s the beta?” Beta would enter through the risk premium, but it only enters when you use a specific model, namely, the Capital Asset Pricing Model (CAPM). That’s a specific model. The equation that I’ve written here is more general; it just says “risk premium.” The reason for that is that many scholars, led by probably Nobel Laureate Eugene Fama, don’t believe that the CAPM is right, and that you need a more sophisticated model for the risk premium.

We’re not going to delve into that dispute here, but the point is that when we say “risk premium,” it does not necessarily mean any specific model. But we’re going to show you something quite interesting with respect to Apple, which is the most valuable company in the world and one of the ones that is followed by virtually every investor.

So let’s start with Apple bonds. In 2020, Apple issued a 40-year bond that matured in 2060 with an interest rate of 2.55%. At that time, that was the market interest rate on very long-maturity, very low-risk bonds. And Apple’s bonds are virtually risk-free. Some would say even less risky than US government bonds because of Apple’s huge equity base and the continuing demand for all their products.

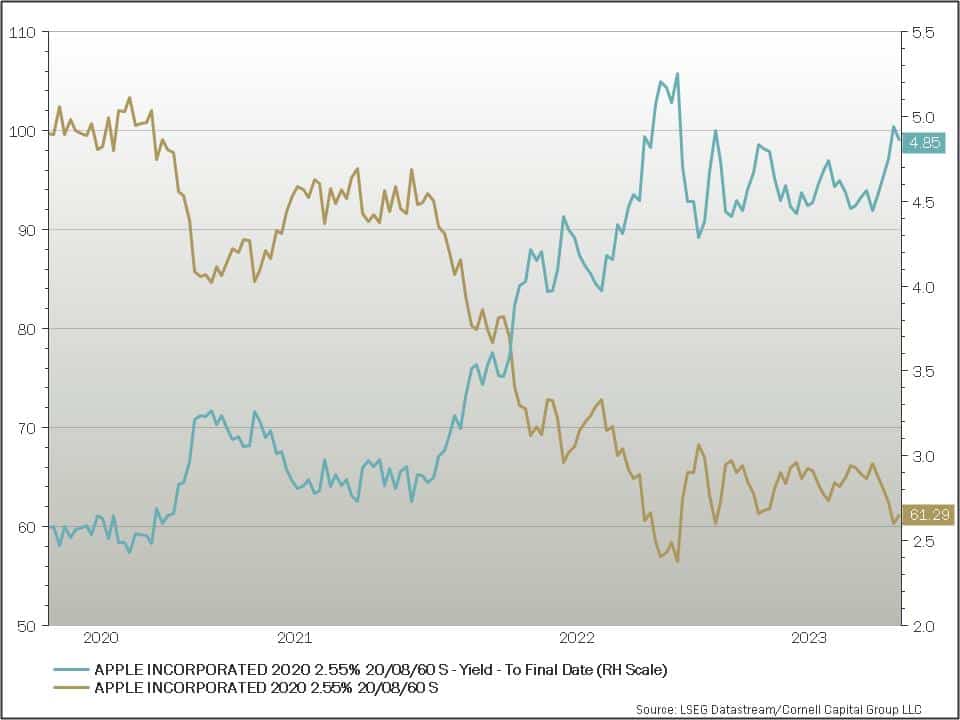

So that was the interest rate they had to pay at the time, but things have changed. Federal Reserve policies have changed, inflation has accelerated, and if you look at the first graph that we have here, it plots the yield on these 40-year, very low-risk bonds. You can see in the blue line that it’s risen from 2.55% at the time the bonds were issued

That interest rate is the discount rate for the bond. In the case of the bond, the cash flows are known. Apple has promised to pay a certain amount every six months, so there’s no risk to the cash flows unless Apple defaults, which we’re assuming here has virtually zero probability.

But as the discount rate rises (because the risk-free rate is rising), the bond price falls. And you see that in the sort of gold line here. The bond started at par value of $100, but last week it was trading well below that, down almost 40% to $61.29.

So, because of the rising discount rate (the RF term in the equation that I showed earlier), as the discount rate rises the price falls. And you can see in this chart that it’s basically a mirror image: Every time the discount rate rises, the bond price falls.

So, what about stocks? Well, stocks are more difficult because if we stick with Apple, the discount rate for Apple stock is going to be greater than for its bonds. For the bonds, it was basically the long-term risk-free rate, but for the stock there’s going to be a risk premium because those cash flows earned by Apple’s equity investors are not promised like the way the bond payments are.

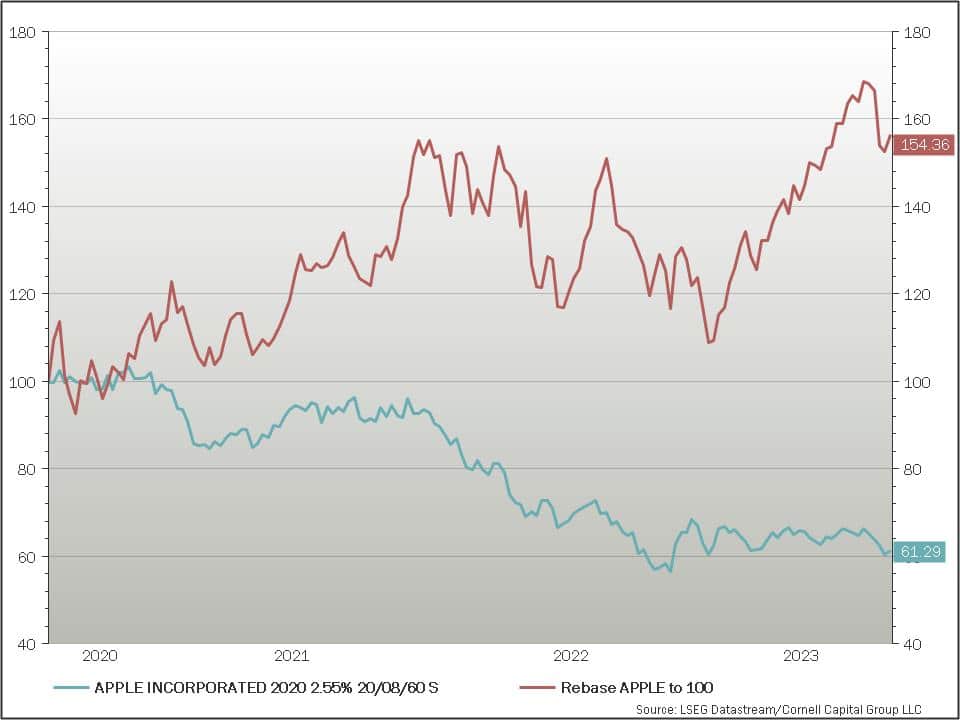

So, if we look at a second graph, you see something interesting. This plots Apple’s bond price in blue (the same bond price we saw in the previous chart) against Apple’s stock price in red.

Now we already know that the RF part of the discount rate went up significantly. That would cause the stock price to fall along with the bond price, but you can see the stock price hasn’t fallen; it’s risen. How could that be? There are only two explanations in a rational market: Of course, it could be that investors are irrational, but if you say that, you can explain anything. So, in a rational market, how could the stock price be going up where the bond price drops so much?

**One possibility is that the cash flows that are being discounted—the cash flows to equity investors—have risen, or the expectations (I should say) of future cash flows have risen. So, you’re discounting a bigger number, and that overwhelms the rising discount rate. The problem is that at least since 2021, it’s pretty hard to say that Apple’s expected cash flows have risen. The enthusiasm of the pandemic days is gone, and Apple is facing a more competitive world. So, what else could explain the rise in the stock price?

One possibility is that the risk premium has fallen, and that has offset the rise in the risk-free rate. The problem with that is, why would Apple be seen as less risky today than it was in 2020, 2021, or 2022?

So, bottom line, if you’re an Apple investor or thinking of becoming one, this is a bit of a mystery.

The falling bond price shows that the risk-free rate part of the discount rate is definitely higher—enough higher that the bonds have dropped 40%. But over the same time that the bonds dropped 40%, the stock rose 54%.

So, either expectations for Apple’s future cash flow rose dramatically enough to offset the rising discount rate due to the risk-free rate, or the risk premium declined offsetting the rising risk-free rate, or some combination of the two.

The problem we face here at the Cornell Capital Group is that we don’t see either the rising expected cash flow or the falling equity risk premium as being reasonable explanations. This makes us concerned about Apple’s current valuation. Perhaps you feel differently, but even if you do, you want to think very carefully in terms of the impact of changing discount rates on valuation, and this Apple example is a perfect one to consider.

This has been Reflections on Investing. Thanks for joining us.