The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which…

#50 Reflections on Investing : Buy The Dips?

Is a large daily drop in the market a buying opportunity? We used 60 years of daily data to see what happens after the market drops.

Hello and welcome back to Reflections on Investing with the Cornell Capital Group.

It’s been a while since we’ve done a Reflections, but I think we have an interesting one for you today.

One thing there’s been a lot of discussion about is so-called buying the dips. Whenever the stock market falls significantly, it’s a buying opportunity because it’s going to bounce back.

And you can think for a minute: buying the dips could be a self-fulfilling prophecy. If people buy on the dips because they think they’re going to make money, their purchases will cause stock prices to rise. And if that is seen to be successful, then more people may want to try to buy the dips, and it may become—as I said—a self-fulfilling prophecy.

But is this really an effect, or is this just the financial media picking up on a few isolated examples and talking about it as a general rule?

So here at the Cornell Capital Group, we always like to go back to the data and test the idea. So, here’s what we did: We downloaded all the S&P 500 Index levels from July of 1962 until the present, so a little over 60 years of daily data.

And as you can see on the chart, it shows the total days, which is over 15,000, and the up days, which is just about half—in fact, it’s 51 percent.

And we asked: if in those 15,000-plus days there’s a big down day, is there a bounce back?

Now, you have to define that precisely. So, the way we did it was we said, “Okay, let’s call a big drop let’s start with one percent.” So, if the market drops more than one percent on a given day, is it more likely than not to be up the next day? In other words, to bounce back somewhat to have a positive return?

Now, efficient markets would say the odds are 50/50. Whether it went up yesterday, it’s still about 50/50 to go up today. But the buy the dips would say no, it’s more likely to be up.

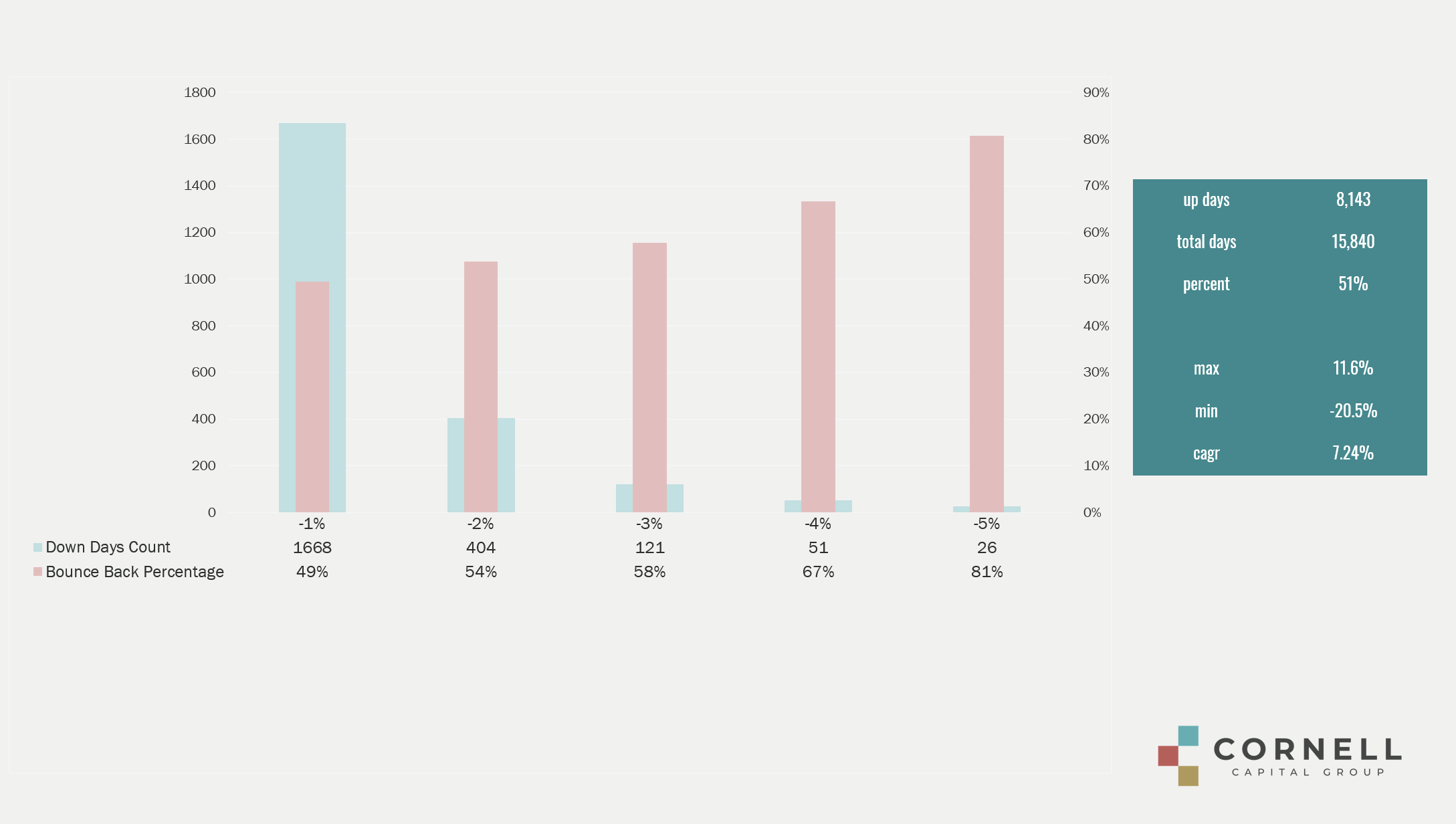

So, let’s turn to the results. And it’s showing here in the table, starting with the minus one percent drop:

Of the 15,000-plus days in our sample, there were 1,668 days where the market dropped at least one percent. And on those days, it bounced back 49.4 percent of the time—almost exactly 50 percent. Not much to write home about, consistent with efficient markets.

Well, maybe the drop wasn’t big enough.

So, what the table shows is we checked for drops of at least two percent, three percent, four percent, and five percent.

And the results are intriguing: When there’s a two percent drop, the bounce back is 54% the next day. Still awfully close to a half, but more than a half now.At three percent it’s 58.At four percent it’s 67.And we’re talking about a significant deviation from 50/50. But of course, there’s only 51 days in that 60-year-plus period where the drop was more than four percent.

And finally, when the drop was more than five percent, we’re down to 26 days, but 81 percent of the time the next day was positive.So, it does look like when there are very large drops, there is a bounce back.

Now, you can’t tell from this whether it’s enough to make trying to buy the dips a worthwhile investment strategy. That would require more work. But it is interesting that following large drops, the next day is up over two-thirds of the time.

So, we hope you enjoyed this short video. If you’re interested in this type of data or in the spreadsheet we used to produce this table, just get in touch with the Cornell Capital Group and we’ll be glad to give you the information.