Economic Insights

#38 Reflections on Investing : Forecasting Returns

Building off our previous episode, we dig into the relationship between current price ratios, future expected earnings growth, and future…

#37 Reflections on Investing : The Discount Rate and the Future of the Stock Market

Finance theory in recent years has stressed the importance of changes in the discount rate for explaining movements in stock…

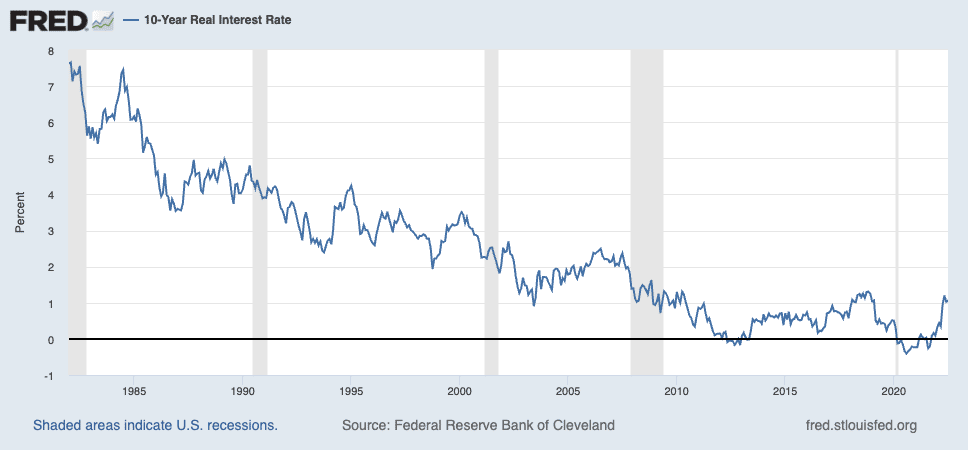

#36 Reflections on Investing : The “Real” Interest Rate

As former US Secretary of Treasury Larry Summers has stressed, the real interest is an important indicator of the impact…

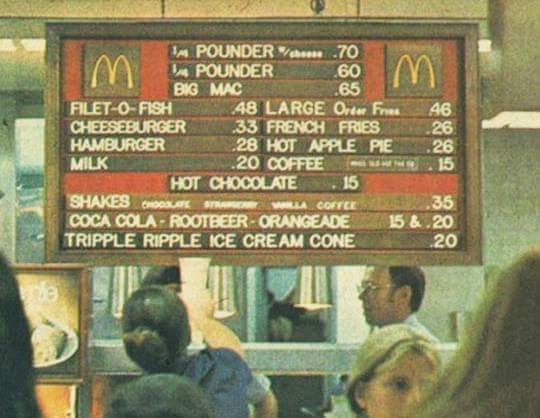

#35 Reflections on Investing : Inflation and Relative Prices

Relative price changes, changes in the price of one good or service relative to others, are often confused with inflation…

#34 Reflections on Investing : The Shiller CAPE Ratio

The Shiller CAPE Ratio is often referenced yet at times not fully understood. In this latest installment, Prof. Bradford Cornell…

#33 Reflections on Investing : Interpreting the Market P/E Ratio

From the pandemic lows of March 2020 to the end of 2021, stocks had an incredible run. Earnings were up…

Investor Memo Q2 2022 : Taking Stock

Looking BackToo often financial market analysis is focused on the issue de jour – jumping from hot topic to hot…

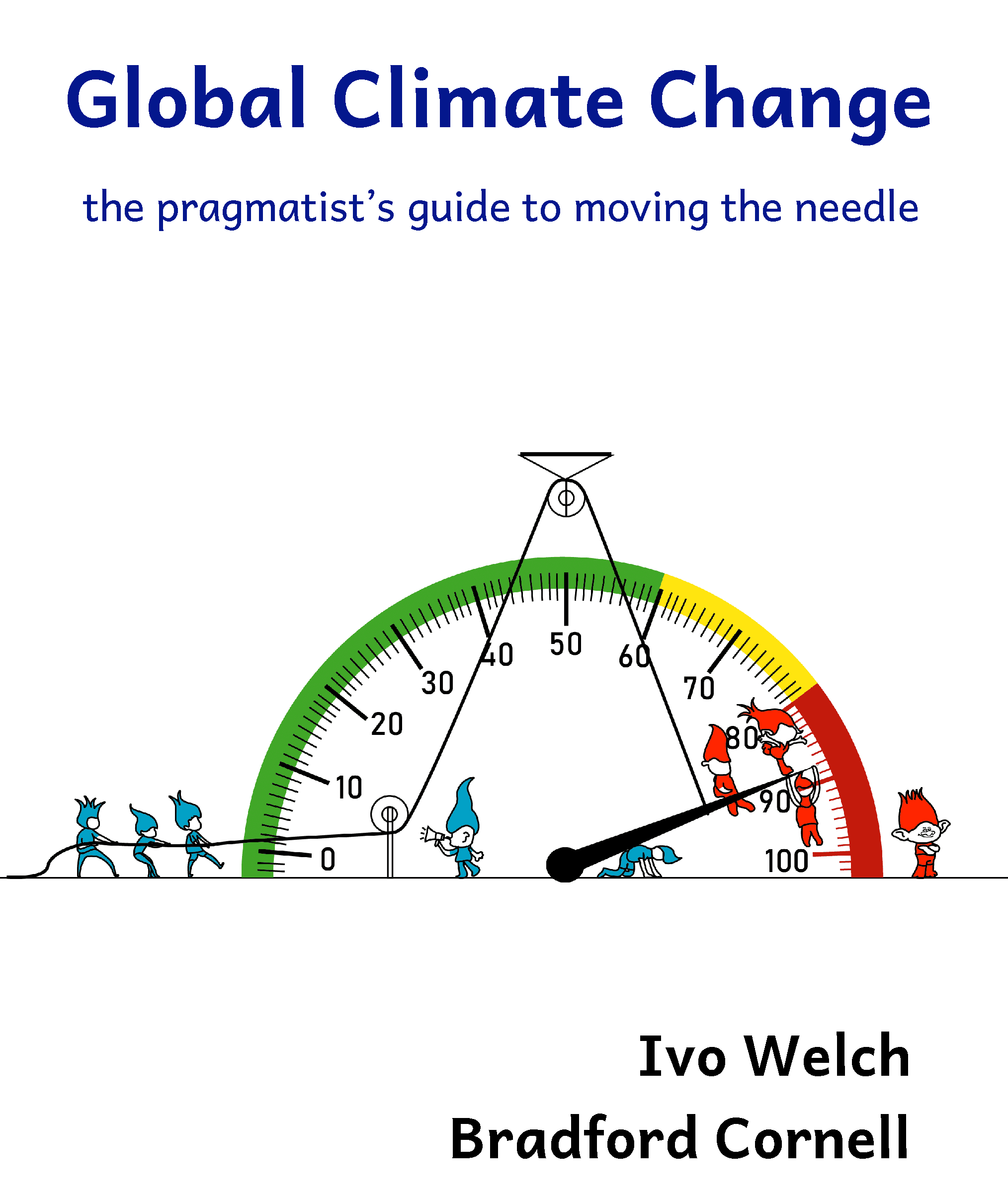

#32 Reflections on Investing : ESG and Investment Returns

There has been an explosion of interest in ESG investing, in part because many investors believe it leads to superior…

#31 Reflections on Investing : Will Elon Musk Buy Twitter? What Does the Market Think?

Elon Musk recently proposed a buyout of Twitter at 54.20 per share. Twitter stock traded over 50 following the news…

#30 Reflections on Investing : The Best of Times, The Worst of Times

Recent times have been dreadful for investors especially for holders of growth and tech stocks (See “The Crash of the…

#29 Reflections on Investing : Expectations and Valuations

Growth in earnings doesn’t necessarily equate to growth in a stock’s price. A company’s growth must meet or exceed the…