The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which…

#49 Reflections on Investing : Value Investing and Momentum

One of the most difficult problems for fundamental value investors is reconcliling value and momemtum.

Welcome back to Reflections on Investing with the Cornell Capital Group.

As we sit here now, the first half of the year is over, and the stock market has been far stronger than anyone expected. And that leads to a problem for value investors like us at the Cornell Capital Group.

To review, as defined by Professor Damodaran and myself in our published work, a value investor is someone who estimates the fundamental value of a company using discounted cash flow analysis (and we have our own proprietary version of that here at CCG), and then compares that with price. Companies for which value exceeds price are potential purchases, and companies for which price exceeds value are earmarked for sale or maybe even taking short positions by, for example, writing options.

All sounds good, but there’s a hitch.And the hitch is momentum.

Momentum is the tendency of stock prices that have been going up tend to continue going up, or that have been falling tend to continue falling. And you wouldn’t think that would exist because it’s too easy to take advantage of.

Well, two things: first of all, it’s not that easy to take advantage of because there’s a lot you have to define. When I say prices have been going up, well, going up how much? Going up for how long? You have to answer those questions to really use a momentum strategy.

But once you agree on a definition, there is evidence both over time and around the world that momentum is a pervasive strategy that tends to work. And for those of you who are interested, I heard you can look up the name Cliff Asness as someone who’s written extensively about momentum. Dr. Asness was a student of Nobel Prize winner Gene Fama at the University of Chicago, where he received his PhD, and then left academia to found AQR, where he now manages $143 billion trying to combine value and momentum strategies.

What makes them hard to combine? Why the two are often at loggerheads is the following:Momentum is based on the change in prices. A high momentum means that prices have been going up—the changes have been positive. Valuation is based on the level of prices—comparing price with estimated value.

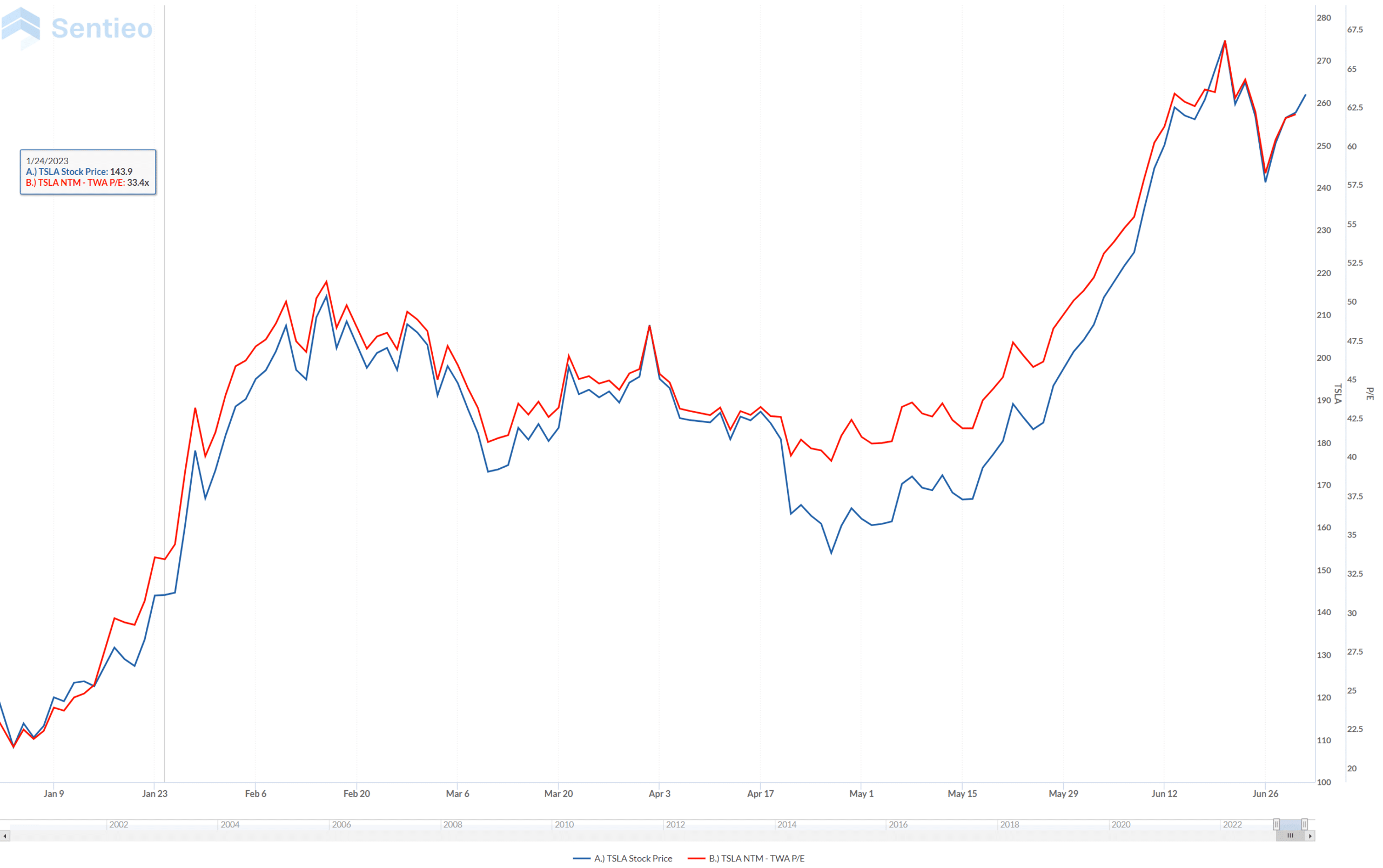

Now take a situation where prices have been rising without fundamentals changing very much. That’s a lot of what happened in the first half of 2023.For instance, let’s look at Tesla. Here’s a chart plotting both Tesla’s stock price and the price-earnings multiple.

And notice the two lines are almost on top of each other. That means that almost all the increase in Tesla’s stock price was due to expansion of the price-earnings multiple—that is, the fundamentals didn’t change much. But either people’s expectations for the future or their discount rate changed a good deal.

But a fundamental investor is likely to look at that and say, “Hey, the fundamentals haven’t improved very much. The stock price is way up. This must be a situation primed for sale or even an effective short position.”

But that runs head on into momentum, which says, “This is a company that’s primed for purchase.”

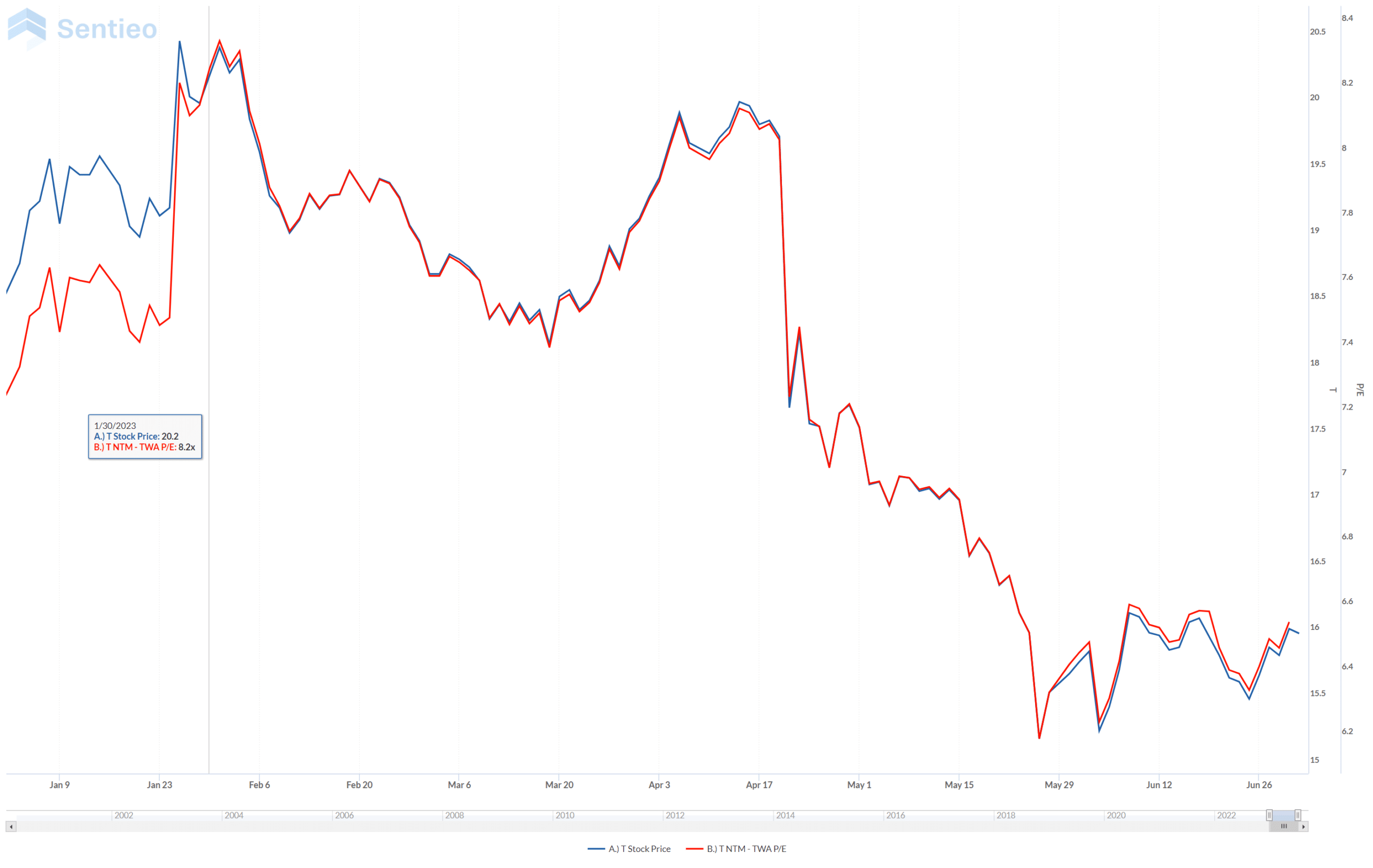

This second example is AT&T, which is shown here. AT&T has been declining—actually been declining for probably over five years, but you can see in this year-to-date chart that it’s been dropping recently.

At the Cornell Capital Group, when we value AT&T, it suggests to us that those declines are overdone—that this looks like a good purchase opportunity. Prices have been falling but fundamentals haven’t been declining.

Once again, that’s at loggerheads with momentum. Value says buy. Momentum says sell.

So, what’s one to do? And that’s what Mr. Asness tries to do in his firm to bring these two together.

At the Cornell Capital Group, we take a pretty simple approach to this. We remain fundamental investors—value investors. Our basic strategy remains comparing price with value estimated by our proprietary models. But we use momentum as a caution flag, as a timing flag if you like.

If you’ve decided to, let’s say, purchase AT&T, you don’t have to purchase it tomorrow. You can wait a while.

And you can track momentum. And it may make sense to not make your value-based purchase until the negative momentum has disappeared.

In the same way with Tesla on the other side, if it looks overvalued, you don’t have to sell it or short it. You can wait a while and see if the momentum subsides, and then make that decision.But it’s not easy.

Reconciling value and momentum is one of the more difficult aspects of investing. And we hope that this short video has helped you appreciate some of the issues involved.