The Continuing Market Melt-up The third quarter sustained the upward momentum in the market, which…

Investor Memo Q2 2023: What Downturn?

Stock Market Review for the First Half Year

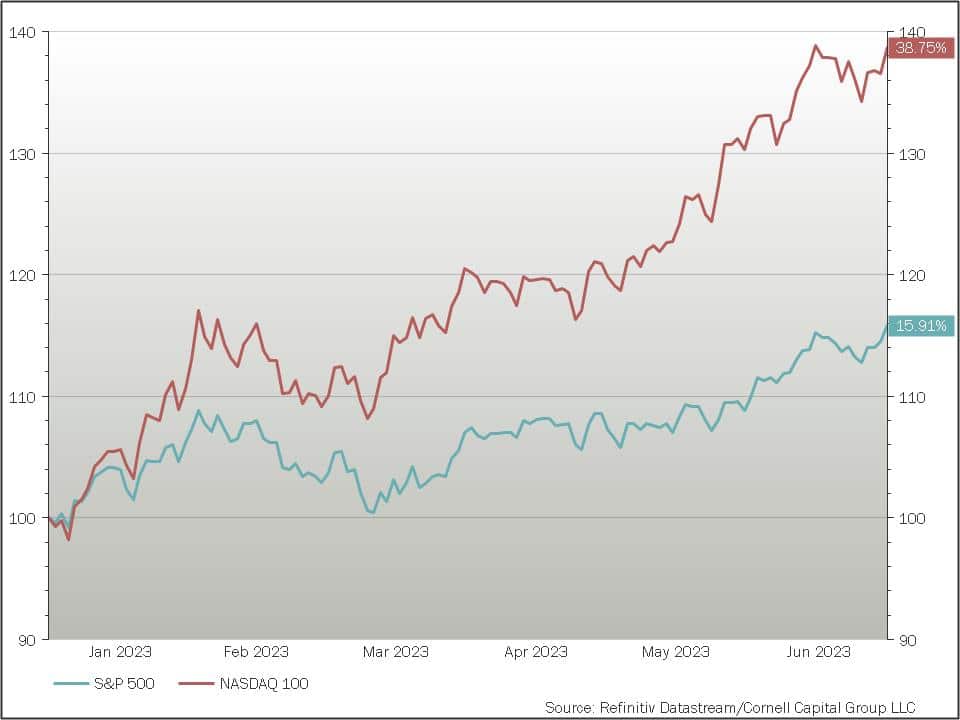

The market performance in the first half of 2023 was a surprise, to say the least. Whereas the year began with concerns about an impending recession, the market shrugged off those fears and moved dramatically upward as shown in chart below. The first half year increase in the S&P 500 was 15.9%, while the increase in the NASDAQ 100 was an astonishing 38.7%, matching half-year increases not seen since the 1980s.

The dramatic rise was fueled primarily by largely unprecedented increases in the prices of big tech stocks. For example, Apple rose 50% to surpass $3 trillion in market capitalization, Tesla jumped 113%, and Nvidia soared 190% to join the trillion-dollar market cap club. The performance of the big tech stocks led to a record concentration of market value which we discussed in a May episode of our Reflections on Investing.

And all of this happened without much increase in earnings. Virtually the entire rise in the NASDAQ stocks, and S&P 500 stocks for that matter, was due to multiple expansion. An increase in prices without a commensurate rise in earnings implies a decline in discount rates. For instance, in a memo to our clients Prof. Cornell explains that for Apple to be worth more than $3 trillion and Tesla more than $850 billion, investors holding those shares must believe that despite the company’s size it will still grow sharply or be willing to accept low future returns over the long run.

For value investors who base decisions on a comparison of market price with a discounted cash flow estimate of fundamental value, these are trying times. The market rally has pushed prices to a level that exceeds reasonable estimates of fundamental value in many cases. As one example, our colleague, Prof. Aswath Damodaran, recently posted a sophisticated DCF valuation of Nvidia. He estimated that that market price on Nvidia vastly exceeded fundamental value and concluded that, “The runup has been just so astonishing that I cannot in good conscience hold on to it and call myself a value investor.” Prof. Damodaran’s conclusion points to a confrontation between valuation and momentum that value investors must take account of.

Value Investing and Momentum

Momentum refers to the tendency of a stock that has risen to continue rising and one that has fallen to continue falling. Prof. Damodaran’s experience with Nvidia illustrates how momentum and value investing are often at loggerheads. Large run-ups in price, relative to underlying fundamentals, will often lead a value investor to conclude the stock is overpriced and sell it. However, that run-up is evidence of positive momentum so to a momentum investor Nvidia was a screaming buy. The question is what to do.

Prof. Damodaran’s experience is typical. Valuation and momentum often give conflicting signals. The reason is the valuation depends on the level of prices compared to fundamental value while momentum is based on the change in prices. If the change in prices has been positive for some time (strong momentum), the resulting rise in price is likely to make the stock appear expensive to a value investor. The reverse is true on the downside.

So how is an investor to reconcile the confrontation between valuation and momentum? At the Cornell Capital Group, we take a middle position. Our core investment strategy remains comparing price with fundamental value as estimated by our proprietary DCF models. However, we use momentum as a caution flag. If the valuation analysis implies that a company is overpriced, but the momentum is strong, then it may be wise to wait until momentum has ebbed before selling. The reverse is true on the buy side for stocks that have been falling and for which DCF models indicate they are now underpriced.

Is AI a Big Market Delusion?

Prices of U.S. tech stocks have risen to a level where many sophisticated value investors such as Cliff Asness of AQR Capital Management are beginning to talk about the possibility of a bubble. Whether it represents a bubble or not, there is evidence that AI may be the basis for a big market delusion. Admittedly, we may begin to sound like a broken record, but the story keeps repeating. First, social media, then electric vehicles, and now AI. The problem with all these new technologies is that even if they change the world that does not necessarily justify an acceleration in valuations across the board. As we stated in our report on Valuing the Automotive Industry, “a new technology does not translate into value creation for a company that adopts it unless it produces returns on invested capital (ROIC) in excess of the cost of capital. To earn excess returns, there must be barriers to entry that prevent competitors from adopting the technology, entering the business and driving down the ROIC to the cost of capital.” The same is true of AI over which an intense competitive battle is brewing. Firms like Nvidia that have the early lead are priced to perfection. Prof. Aswath Damodaran observes, “Nvidia needs to dominate the AI market to justify its price point.”

As wonderful as AI might turn out to be, we view it as a potential trap for investors. As we explained in our report, AI and Stock Market Valuation, because it is not that difficult for companies to adopt AI, competition is likely to prevent many of those companies from producing future cash flow sufficient to justify their valuations. In our view, it is more important than ever to apply discounted cash flow valuation to determine whether the current market price of a stock we are thinking of buying is justified by reasonable estimates of future cash flow. Following Michael Mauboussin, another way to look at it is to “start with what we know, the stock price, and ask whether the expectations for the company’s financial performance implied by the stock price are justified.”

Contrarian Investing/International Diversification

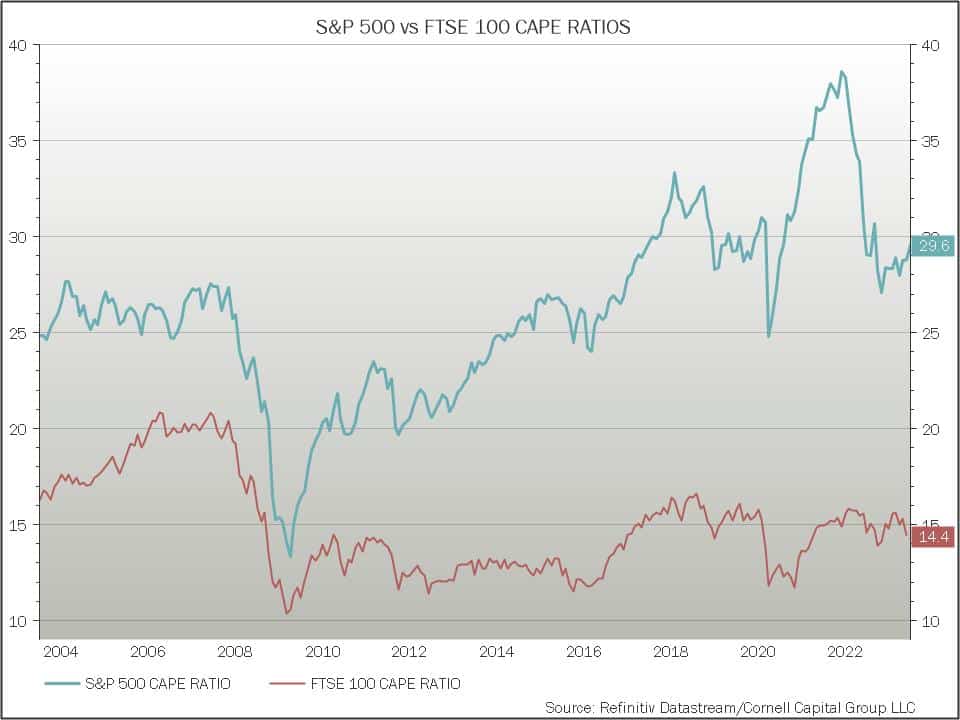

The run-up in U.S. stocks during the first half of the year has further expanded the gap between their valuation and the valuation of stocks in the rest of the world. For example, the chart below compares the CAPE ratios for the S&P 500 against the same measure for the UK’s FTSE 100.

The chart shows that the gap is both large and growing. The growing gap brings to mind a famous quip by Herbert Stein, “If something cannot go on forever, it will stop.” But the question is when? Rob Arnott, the Chairman of Research Affiliates has noted that, “There are quarters, there are years, there are even cycles when contrarian investing doesn’t work particularly well, but over long periods of time, it’s relentless,” But Mr. Arnott has been saying that for years as a reason for investing in emerging market value stocks while U.S. tech companies continued to dramatically outperform both value stocks and the stocks of other international markets. Despite this track record, however, Arnott’s viewpoint has much to recommend it. From a valuation perspective, the gap between the American stock market and other markets around the world has grown to a point where continued divergence seems unlikely. Even Warren Buffett has focused more on international companies during the past year.

Conclusion

In our view, the extent of the run-up in U.S. stock prices, without a corresponding improvement in fundamentals, in the first half of 2023 is a cause for concern. Despite the positive momentum, we feel that it is time to reduce exposure to the American stock market, particularly with respect to companies that have seen their stock prices rise to levels are difficult to justify using a reasonable assessment of future cash flows. In addition, we are looking abroad for more attractive valuation opportunities. Of course, this means that if the American tech companies continue to charge upward, a valuation-based strategy is likely to underperform, but we believe that is a risk worth taking in order to protect investor capital.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction.