Economic Insights

Valuing Exxon

Most stock valuation chatter on the internet focuses on companies with great growth opportunities like Zoom, Wayfair and Peloton or…

Investor Memo Q3 2020

Welcome to the first of an ongoing series of Cornell Capital Group quarterly investor memos. The purpose of these memos…

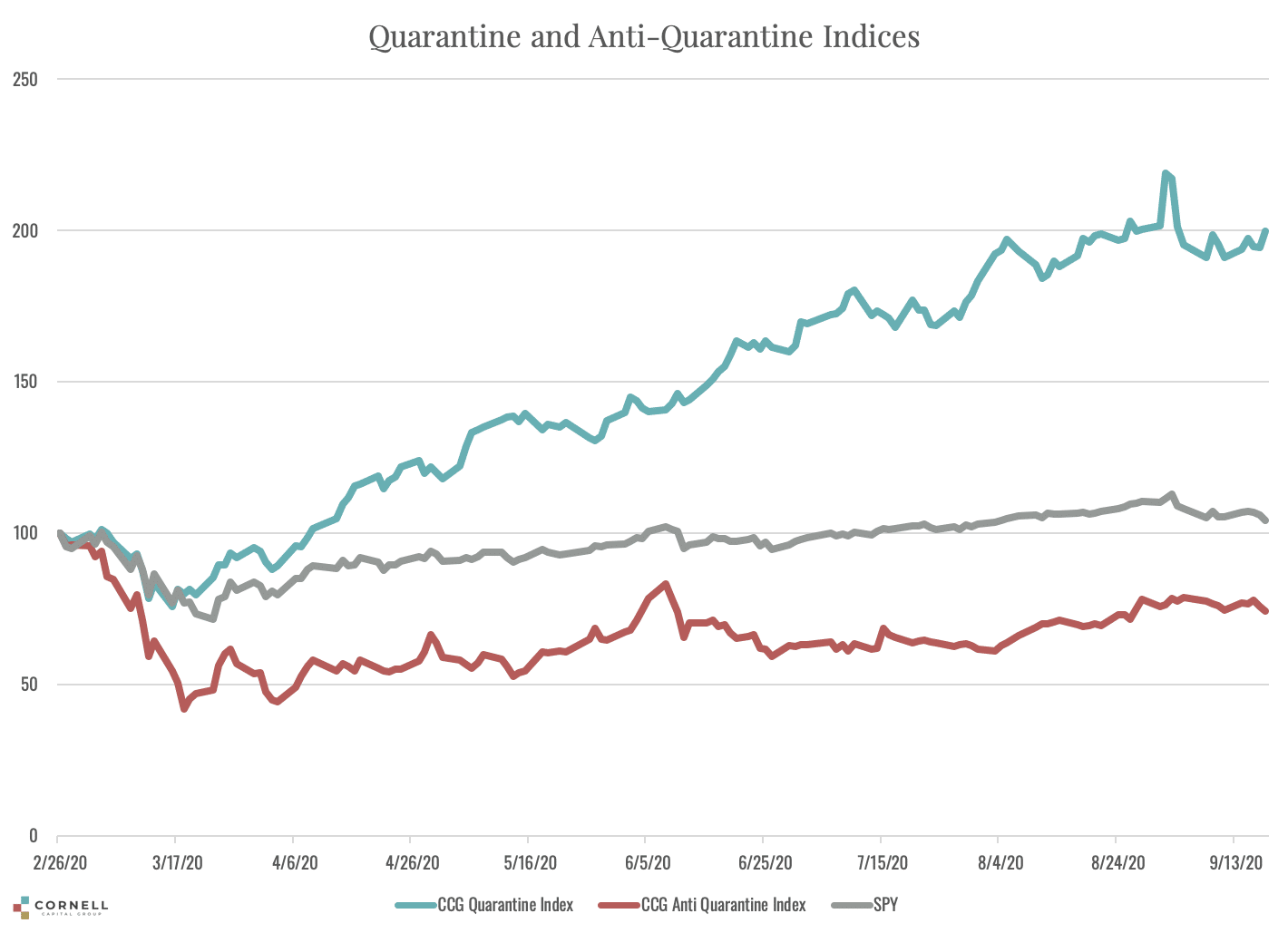

Revisiting the CCG Quarantine Indexes

Back in April 2020, we introduced two new indexes – the Cornell Capital Group (CCG) Quarantine Index and the CCG…

What Does it Take to be Worth $500 billion?

On August 31st Tesla’s latest bull run ended when the stock closed at an all-time of $498.50 per share. At…

Are the Tech Giants Trading Like Bonds?

The tech giants are trading at valuation ratios that are close to unprecedented for such…

The Big Market Delusion Everywhere:Electric Trucks

It is often said that once you have a hammer, everything looks like a nail. So be it with the…

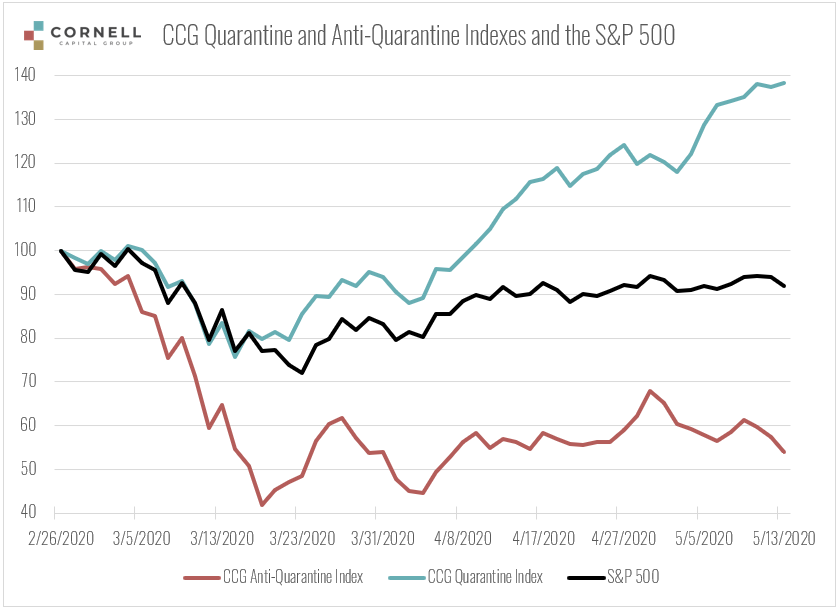

The Cornell Capital Group Anti-Quarantine Index

In a previous post, I described a new index introduced by the Cornell Capital Group called the CCG Quarantine Index. …

Value Stocks Long Winter

Up through the end of 2006, one of the most widely reported results in empirical studies of investing was the…

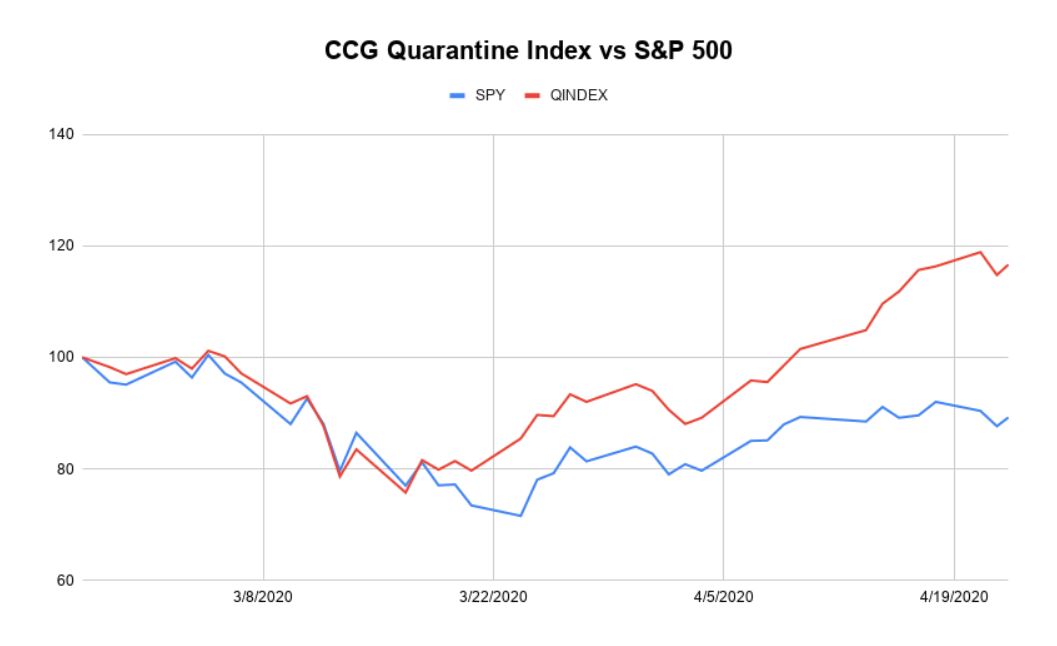

The Cornell Capital Group Quarantine Index

Interpreting movements in the stock market is difficult enough in normal times. The Covid-19 crisis has made it all the…

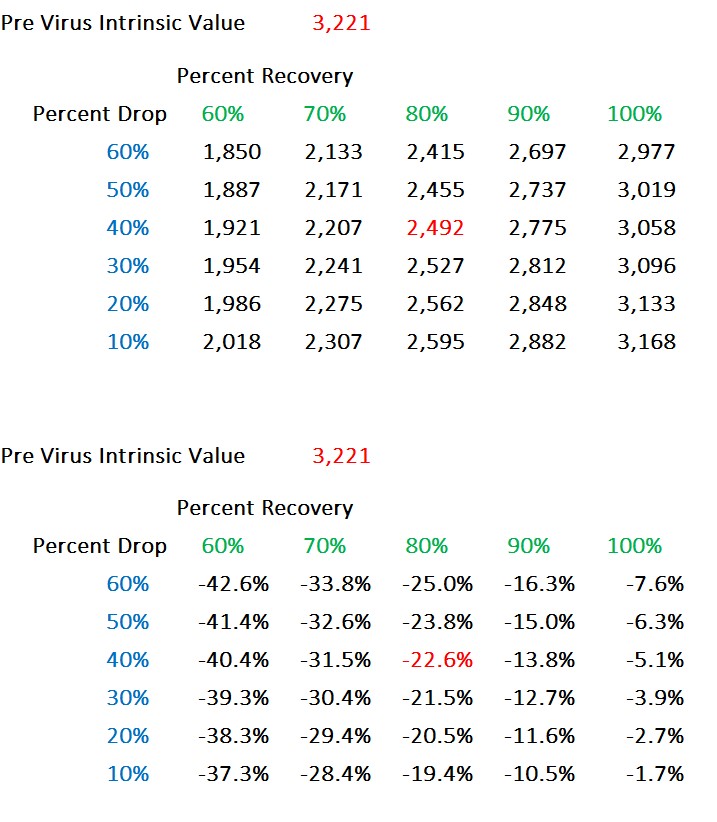

Valuing the S&P500 : One More Time

I have written about the problem of valuing the S&P 500 in previous columns, but the issue is so important…

Dissecting Volatility

It is one thing to say that the market is volatile. It is quite another to appreciate fully what that…

Medallion Fund: The Ultimate Counterexample?

Abstract: The performance of Renaissance Technologies’ Medallion fund provides the ultimate counterexample to the hypothesis of market efficiency. Over the…