Risk Premiums And Stock Prices

_Science advances one funeral at time_ – Max Planck

Science advances one funeral at time – Max Planck

The same can be said of the equity risk premium .

Using fundamental valuation analysis to assess the level of the stock market, as measured for instance by the S&P 500 index, requires two inputs – forecasts of future cash flows and a discount rate. The discount rate, in turn, has two components, the yield on long-term government securities and the equity risk premium. The yield on government securities can be observed directly, but the risk premium is not only unobservable it is also variable. It depends on the risk perceived by investors and the extent of their risk aversion. Neither is necessarily constant. In this memo, I focus on perceived risk. If current investors believe that stock market investing is less risky than their ancestors thought, it has important implications for financial planning, valuation, and value investing. I refer to it as perceived risk because that is what matters for setting market prices, not some abstract definition of “true” risk. However, this memo is not based on an analysis of investor psychology. Quite the opposite. If investors are relatively rational, then a drop in perceived risk presumably occurs because those investors have seen evidence that the underlying market risk has also dropped. And there are a host of reasons why the risk of equity investing likely declined over the period beginning in 1926 when complete data became available. These include, but are not limited to, the following.

- Improvement in capital market regulation and oversight including the establishment of the Securities Exchange Commission.

- New mechanisms and rules to prevent market manipulation.

- Advances in economic theory and policy leading to better government stabilization of the economy.

- The willingness of the government and the Federal Reserve to respond to downturns with massive fiscal stimulus and money creation as in the cases of the 2008 financial crisis and the Covid-19 pandemic.

- Advances in asset pricing and portfolio theory, beginning with the CAPM, leading to improved risk measurement and investment management.

- The expansion of stock market participation and reduction in the cost of diversification via the invention of mutual funds, exchange traded funds, and the creation of the modern retirement savings system.

- The 20th century was a uniquely positive one for the United States, the country won both world wars and became the world’s leading economy by a large amount. Therefore, historical returns on U.S. stocks are a bias measure of future expectations.

- The collection and dispersion of data on the financial performance of equity investments leading to, among other things, investor appreciation that equities are not an exotic investment.

- Significant technological improvements in transacting and record keeping including the invention of electronic trading.

- An increase in stock market liquidity and a decline in the volatility of the return on the market portfolio.

Although all 10 points probably play a role in explaining a falling equity risk premium, in my view, points 3 and 4 are particularly critical.

While it is commonly accepted that risk premiums reflect “risk” it is far from clear what that risk is. In academic models, stock market risk is usually related to the standard deviation of stock market returns, but that is because the models require a quantitative measure. Investors we have talked to at the Cornell Capital Group in recent years do not see risk this way. They note that high volatility brings with it the potential for high returns. And if the volatility leads to a drop in prices, they view that as a buying opportunity because they believe the market will recover in relatively short order. Viewed in this light the real “risk” is that prices will drop significantly and remain depressed for many years or decades. When asked about that risk, most investors we talked to see that possibility as being so remote it can be ignored.

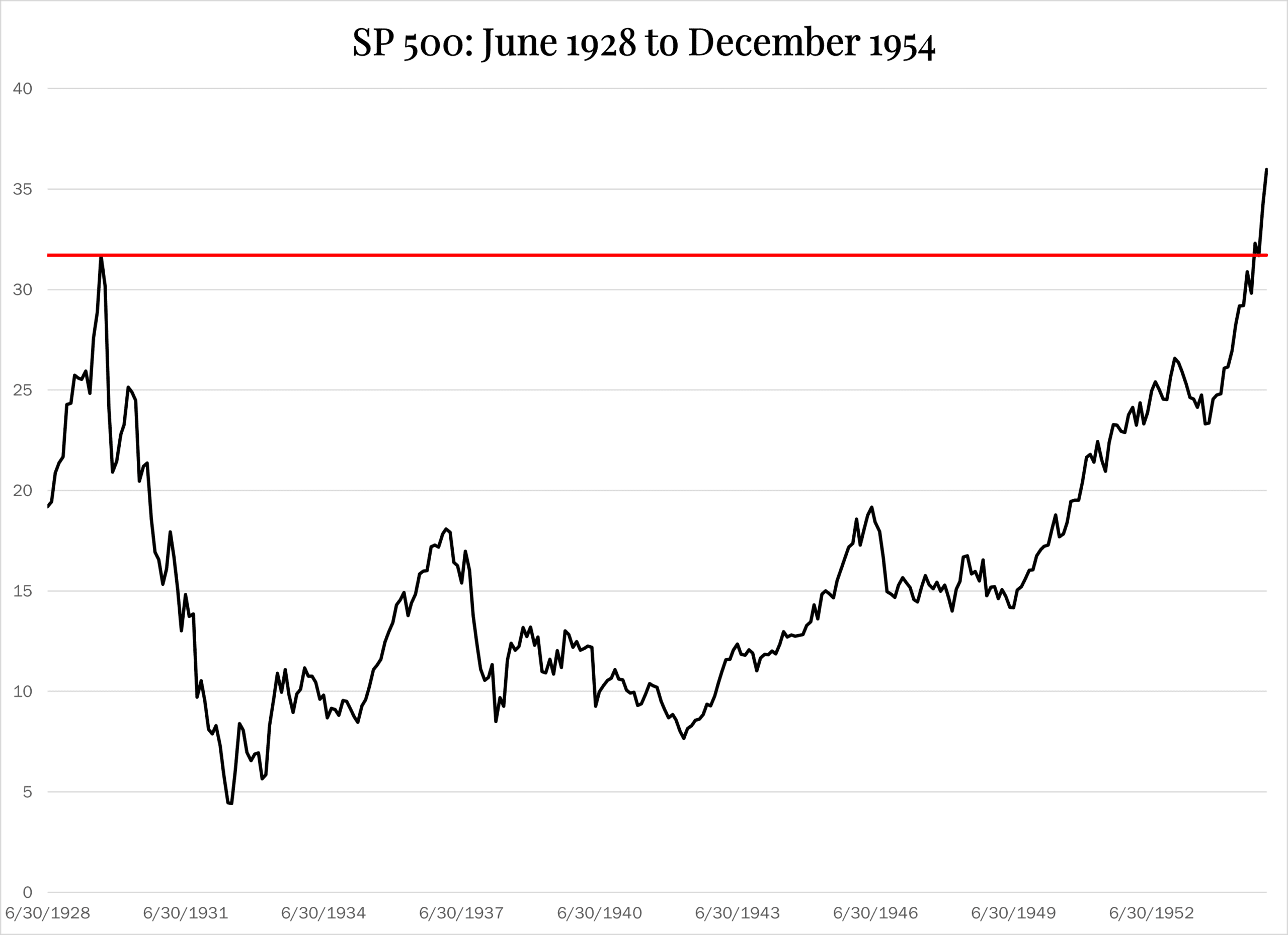

That was not always the case. As shown in the graph below, following the crash of 1929 the S&P 500 did not return to its high-water mark until 1955, almost 26 years later. But in defense of the investors’ view, things were very different in 2008 and 2019.

In 2008, both Congress and the Federal Reserve reacted strongly to the crisis. The Fed responded to the crisis with a three-pronged strategy. First, it flooded the banking sector with liquidity. Second, it invoked emergency powers granted to it during the Great Depression to lend to financial institutions other than banks. Third, it quickly cut the funds rate to zero. Congress, in turn, passed the American Recovery and Reinvestment Act of 2009, which included $800 billion to promote economic recovery. The act provided for support to troubled American companies such as General Motors. In response to these actions, the stock market began a sustained recovery that reversed all its losses by the end of 2012.

[1] Throughout this memo I use the 10-year Treasury bond yield.

In 2020, the governmental response was even more dramatic. In response to Covid, fiscal policy turned massively stimulative with the government running multi-trillion-dollar deficits. The Federal Reserve pitched in by driving short-term interest rates to zero and buying trillions of dollars of the new Treasury debt. From the standpoint of stock market investors, the government programs were a smashing success. Stock prices recovered from a 30% drop in three months and raced on to record highs in the remainder of 2020 and 2021.

Given the ability of the government to ameliorate the impact of economic shocks in 2008 and 2020, it is hardly surprising that the current generation of investors would have a very different view of risk than investors who experienced the depression. If the basic risk that investors fear is a crash in stock prices from which the market takes decades to recover, the U.S. government may have taken the risk off the table. As a result, investors are willing to accept lower risk premiums when investing in common stock. That, in turn, results in a higher equilibrium level for stock prices.

To put some numbers behind the theoretical discussion, I turn to work of my colleague, Aswath Damodaran, which is posted on his website ( https://pages.stern.nyu.edu/~adamodar/ ). Prof. Damodaran provides a spreadsheet that calculates the implied equity risk premium – the difference between the expected returns on common stock and the yield on 10-year Treasury bonds. The implied premium is that which produces a discount rate that equates the present value of future cash flows on the S&P 500 to the level of the index. I use Prof. Damodaran’s spreadsheet to calculate the implied premium for the S&P 500 as of the close on June 16, 2023, when the index was at 4410. The implied equity risk premium comes to 4.98%. This is significantly less than the historical risk premium calculated as the average difference between the return on the S&P 500 and the return on 10-year Treasury bonds of approximately 6.75%. If this higher premium is substituted into Prof. Damodaran’s spreadsheet the resulting value for the index drops to 3246, over 26% below the actual level of 4410. This illustrates the extent to which investors’ willingness to accept low risk premiums supports higher stock prices. Furthermore, it is true of every company individually, not just the aggregate market, because the risk premium affects all valuations.

The Damodaran calculations also highlight the importance of evaluating the stock market in terms of the level of prices (relative to earnings and cash flow), not the change in prices. A bull market such as experienced recently where prices rise without a commensurate increase in earnings, does not imply long-run future increases. Instead, it means that stocks have become more expensive due to a decline in the implied equity risk premium. Thinking clearly in terms of the level of the prices and the equity risk premium counterbalances the natural tendency to presume that past increases imply that future increases are more likely.

Saying the risk premiums have declined does not mean that they will be constant. Presumably, they will continue to vary with economic conditions and consumer sentiment as they always have. In fact, variation in discount rates due changes in the risk premium is an unavoidable risk of investing in common stocks because it leads to variation in price. The point here is that the variation in the risk premium will be around a new, lower, level. Because they depend on the risk premium, valuation multiples such as P/E and CAPE will also vary but around new higher levels. The good news is that those greater valuation multiples do not imply that stocks are overpriced, they are simply reflecting lower discount rates. The bad news is that those high prices do portend lower average returns on common stock going forward reflecting the lower risk premiums. Organizations, such as pension funds, that base decisions on projected returns for common stocks may have to consider changing their plans.

It is also important for appraisers and value investors who rely on discounted cash flow analysis to value companies to take account of the impact of lower risk premiums. Using historical measures of the risk premium, it becomes extraordinarily difficult to reconcile the current level of stock prices with any reasonable forecast of future cash flows.

I end with a word of warning. The world is a nonstationary place. Although both the actual and perceived risk of equity investing have declined, there is no assurance that they will remain depressed. It is possible that a fundamental change in the investment environment will cause risk premiums to rise again. For instance, a worsening of relations between China and the United States could lead to perceptions of new, henceforth underappreciated, investment risks. If that were to occur, and if premiums were to revert to their historical average, stock prices would fall by about 25%. Despite this concern, the ten points listed earlier suggest that the decline in the risk premium is permanent. This explains the richness of stock market valuations, but it implies that investors will have to be satisfied with lower expected returns.

[2] Most historical data, such as that provided by Kroll and company calculates the difference using 20-year bonds. Therefore, a slight adjustment is required if 10-year bonds are used to for the risk-free rate. The equity premium of 6.75% reflects that adjustment.