Economic Insights

Investor Memo Q1 2022

A Time for Caution: Cracks in the Dam As 2021 draws to a close, our primary objective at the Cornell…

#28 Reflections on Investing : Fixed Income?

Until recently fixed income has offered high risk and low return. It looks like things might be changing. We take…

Data Mining, Non-stationarity, and Entropy

By Bradford CornellIntroduction This paper provides simple intuitive explanations for three interrelated concepts that have…

#27 Reflections on Investing : The Crash of the High Fliers

The market’s incredible performance post Covid was driven largely by growth and tech. Some of these companies were up 300,…

#26 Reflections on Investing : Two Flavors of Volatility

For many investors options are associated with high leverage and high risk. However, options can be used to manage risk…

#25 Reflections on Investing : Options, Risk and Return

For many investors options are associated with high leverage and high risk. However, options can be used to manage risk…

#24 Reflections on Investing : Price To Earnings Ratio

The Price to Earnings Ratio (P/E) is one of the most frequently figures for comparing valuation. We explore the relationship…

#23 Reflections on Investing : Volatility

Volatility in the market is up once again but what does that mean for your investments?

#22 Reflections on Investing : Breaking Down Stock Prices

Prof. Bradford Cornell discusses how the book value, forecast value and speculative value contribute to the market price of a…

Cryptocurrencies and Bubble Wealth

Americans now hold over $1 trillion in cryptocurrencies. Has $1 trillion in wealth been created? From the standpoint of economic…

Investor Memo Q4 2021

A Time for Caution: Cracks in the Dam As 2021 draws to a close, our primary objective at the Cornell…

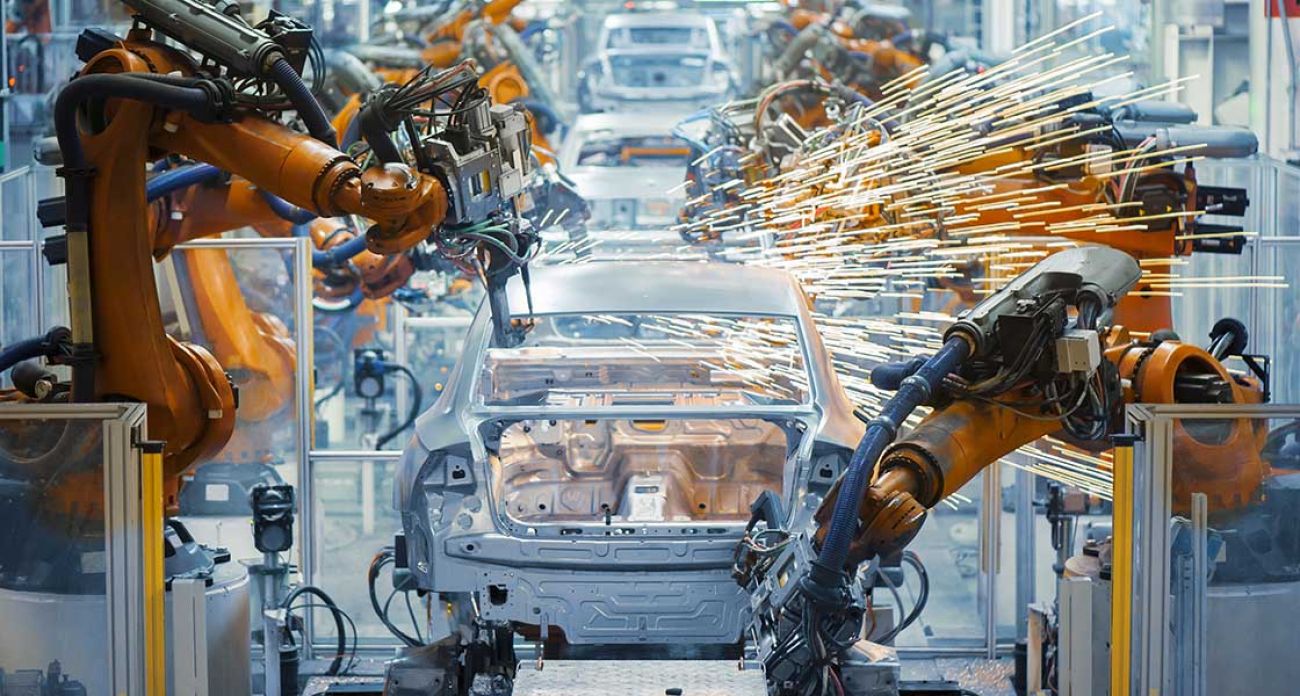

Valuing the Automotive Industry

By Bradford Cornell, Shaun Cornell, Andrew Cornell Introduction An investor would have to have been living under a rock not…